Ah, what a world we live in! While the legal titans at Ripple duel endlessly with the mighty SEC in the U.S. courtrooms, Canada has already sprinted ahead, leaving its southern neighbor in the dust. It seems Canada has not only figured out how to make poutine but also how to make crypto innovation happen with ease. Behold: the first-ever spot XRP exchange-traded fund (ETF) in North America, a delightful gift to investors—who, let’s be honest, could use some excitement that doesn’t involve lawyers!

This little moment isn’t just a win for XRP in Canada—it’s a much-needed reminder that, while the U.S. twiddles its thumbs and engages in a never-ending courtroom spectacle, there are countries out there that actually *do* things. Yes, we’re talking about regulation that moves crypto forward, not just in circles.

Canada Steals the Show with First Spot XRP ETF

And so, Canadian regulators have made history, perhaps with a sense of pride and maple syrup in their hearts, by giving the green light to the very first spot XRP ETF. Purpose Investments, based in Toronto (no surprise there), is behind this shining achievement. As of June 18, the Purpose XRP ETF (ticker: XRPP) is now officially trading on the Toronto Stock Exchange. 🎉

This fund promises a neat and tidy way for investors to dip their toes into XRP waters, without all the pesky wallet or private key nonsense. They offer three options: CAD-hedged (XRPP), CAD non-hedged (XRPP.B), and, for those who prefer something a bit more international, USD (XRPP.U). And yes, it’s eligible for your beloved TFSAs and RRSPs, because we know how much Canadians love their tax-advantaged accounts.

“We’re proud to keep pushing the boundaries of what’s possible in the space,” said Vlad Tasevski, Purpose’s Chief Innovation Officer, in a tone that surely was accompanied by a celebratory fist pump. We get it, Vlad—innovation, blockchain, and possibly some Tim Hortons coffee after a job well done.

The U.S. Continues Its Legal Ballet While Canada Dances Ahead

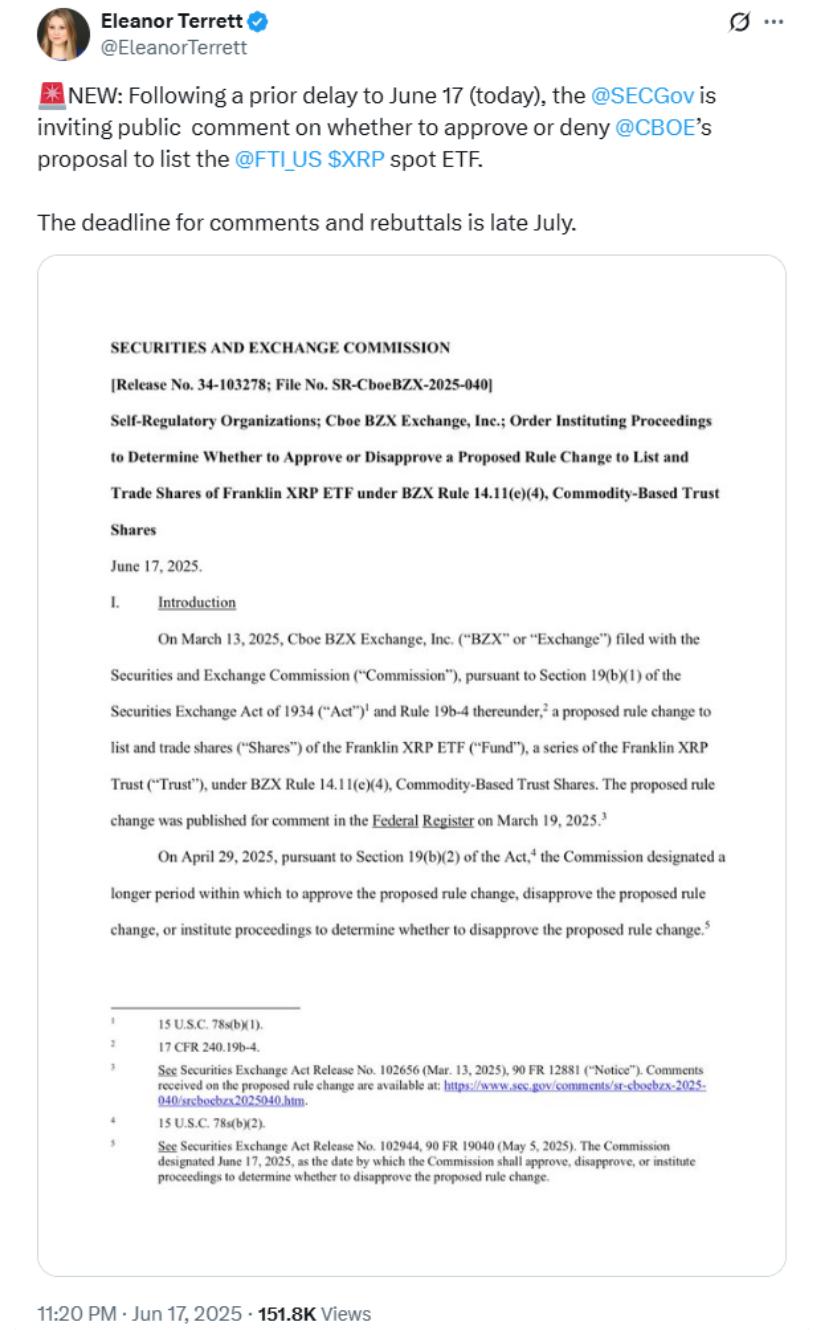

Meanwhile, in the U.S., well, let’s just say the courtroom drama continues. The Ripple-SEC battle isn’t exactly gripping audiences like a summer blockbuster. No, this one has all the thrills of watching paint dry. On June 16, both Ripple and the SEC managed to agree on something: let’s just extend the suspension of the SEC’s appeal. The appeal? It’s just the SEC’s desperate attempt to overturn a court ruling that mostly favored Ripple. But who needs to win when you can keep fighting for years, right?

As this legal tug-of-war rages on, U.S. XRP ETF applications are stuck in a state of eternal limbo. Investors continue to wait, tapping their fingers, trying to stay optimistic amidst the constant delays. The SEC’s status update, conveniently scheduled for August 15, 2025, will surely be the highlight of that summer. 💼

Canadians Stay Cool While U.S. Investors Wait for a Sign

But wait—there’s hope! Canada’s approval of the XRP ETF sent XRP’s price soaring by nearly 8%. Yes, it briefly outperformed Bitcoin and other big players, like an underdog story in a sports movie. Since then, it’s settled at a respectable $2.15, which is a nice reminder that the market doesn’t just move based on legal drama—it’s about progress too!

“The OSC’s approval reinforces Canada’s global leadership in digital assets,” Tasevski said, once again talking up the nation’s progressive stance on crypto, probably feeling a bit like a proud parent. They’re not wrong, though; Canada is officially the cool kid at the crypto party now. 🥳

And so, as we wait for the U.S. to catch up, let’s stay optimistic. If the U.S. ever decides to approve its own spot ETF, there could be a rush of momentum. According to Polymarket, there’s an 88% chance of that happening in 2025. We’ll see if that turns into another thrilling courtroom drama or a real ETF launch.

Purpose and Evolve Lead the Charge in Canada

Purpose Investments isn’t the only one having a good day. Evolve ETFs is also rolling out its own XRP ETF, set to launch on June 18. With two major ETFs launching simultaneously, it’s clear that institutional investors are taking a serious interest in Ripple. Looks like the Ripple market is getting more than just a passing glance.

These spot ETFs are a smooth, accessible way for both retail and institutional investors to get a slice of the Ripple pie. With the world’s banks paying more attention to Ripple, including some juicy collaborations with Bank of America, it seems like this digital asset is more than just a passing trend.

Final Thoughts: U.S. Falling Behind?

And so, as Canada proudly waves its crypto flag, launching regulated products like the XRP ETF, the U.S. remains tangled in legal red tape. The future of Ripple in the U.S.? Well, that’s still anyone’s guess, but right now, it’s all about the courts—not innovation.

Canada’s first-mover advantage is crystal clear. It proves that when you set a clear regulatory path for digital assets, they can become part of the mainstream finance world. Whether the U.S. will catch up remains to be seen, but Canada is undeniably ahead in this race. 📈

So, stay tuned, folks. More Ripple news and lawsuit updates are surely just around the corner as the global crypto landscape continues to evolve.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Wuthering Waves Mornye Build Guide

- ATHENA: Blood Twins Hero Tier List

2025-06-18 20:11