Tuesday, Feb. 17, 2026: The tale of XRP, like a stubborn mule, remains obstinately wedged below its $1.49794 daily Bollinger midband after a brief Sunday escapade to $1.6711. Meanwhile, the illustrious Cardano Foundation, in a fit of governance enthusiasm, has joyously declared a YES vote on the first DeFi Liquidity Budget withdrawal. Let us not forget Robert Kiyosaki, who, with all the wisdom of a self-proclaimed financial oracle, informs his followers that he intends to bolster his Bitcoin holdings as BTC lingers near the esteemed $67,777-above the fabled $60,000 support level, like a cat perched upon a fence, neither here nor there.

TL;DR

- XRP is unable to charm the Bollinger Bands into allowing it above $1.50.

- In a historic moment, Cardano governance votes “Yes” for a DeFi liquidity withdrawal worth 500,000 ADA.

- “Rich Dad Poor Dad” author Robert Kiyosaki maintains his bullish stance on Bitcoin, which is valiantly holding above $60,000 after a recent liquidity sweep.

XRP news: Bollinger Bands signal weakness for XRP price at $1.50

XRP’s weekend rally to $1.6711 had briefly ignited the flames of hope, yet like a mirage in the desert, the buying momentum vanished almost as swiftly as it appeared. By the time Tuesday dawned, our reluctant hero was still sulking below the daily Bollinger midband, a veritable wallflower at the party of crypto prices, having been rejected three days running.

As the price languishes beneath this pivotal threshold, all eyes are now on the lower Bollinger Band at $1.2311, the next potential hiding spot for XRP if its current malaise continues.

This predicament is particularly poignant because Sunday’s spike was widely heralded as the herald of a breakout. Yet, alas, by Tuesday’s light, that breakout seems as elusive as happiness in a tax audit.

Cardano news: Foundation votes “yes” on treasury withdrawal for DeFi Liquidity Budget

In a separate episode of the ongoing soap opera that is DeFi, the Cardano Foundation has triumphantly confirmed via their digital oracle, X, that it has voted “Yes” on Withdrawal 1 under the Cardano DeFi Liquidity Budget framework. The sum of this withdrawal, a whopping 500,000 ADA, was filed with all the pomp and circumstance befitting a royal decree on Jan. 15, 2026.

And lo! This vote is publicly verifiable on-chain through Cardanoscan, reinforcing the network’s governance transparency like a clear window in a well-kept house.

In their infinite wisdom, the Cardano Foundation praised the team’s risk management policies, although they graciously suggested that before further withdrawals are approved, stronger reporting standards should be instituted. Their recommendations? They are nothing short of a financial buffet:

- Public dashboards tracking liquidity deployment.

- Expanded conflict-of-interest disclosures.

- Clearer operational rules for fund management.

- More accurate ADA price assumptions in budget modeling.

We have voted YES on the Cardano DeFi Liquidity Budget: Withdrawal 1. ✅

We commend the team’s disclosure of their risk management policies and recommend further refinements in transparency and reporting before subsequent withdrawals.

On-chain vote:

– Cardano Foundation (@Cardano_CF) February 17, 2026

The internal vote distribution revealed a shining example of democracy in action, with four votes in favor, none against, and one brave soul abstaining, perhaps contemplating the deeper meaning of liquidity.

This approval ushers in treasury-backed DeFi liquidity for Cardano while simultaneously enforcing accountability measures, akin to a parent asking for the receipts after a shopping spree.

Bitcoin news: “Rich Dad Poor Dad” author Kiyosaki reaffirms BTC accumulation plan

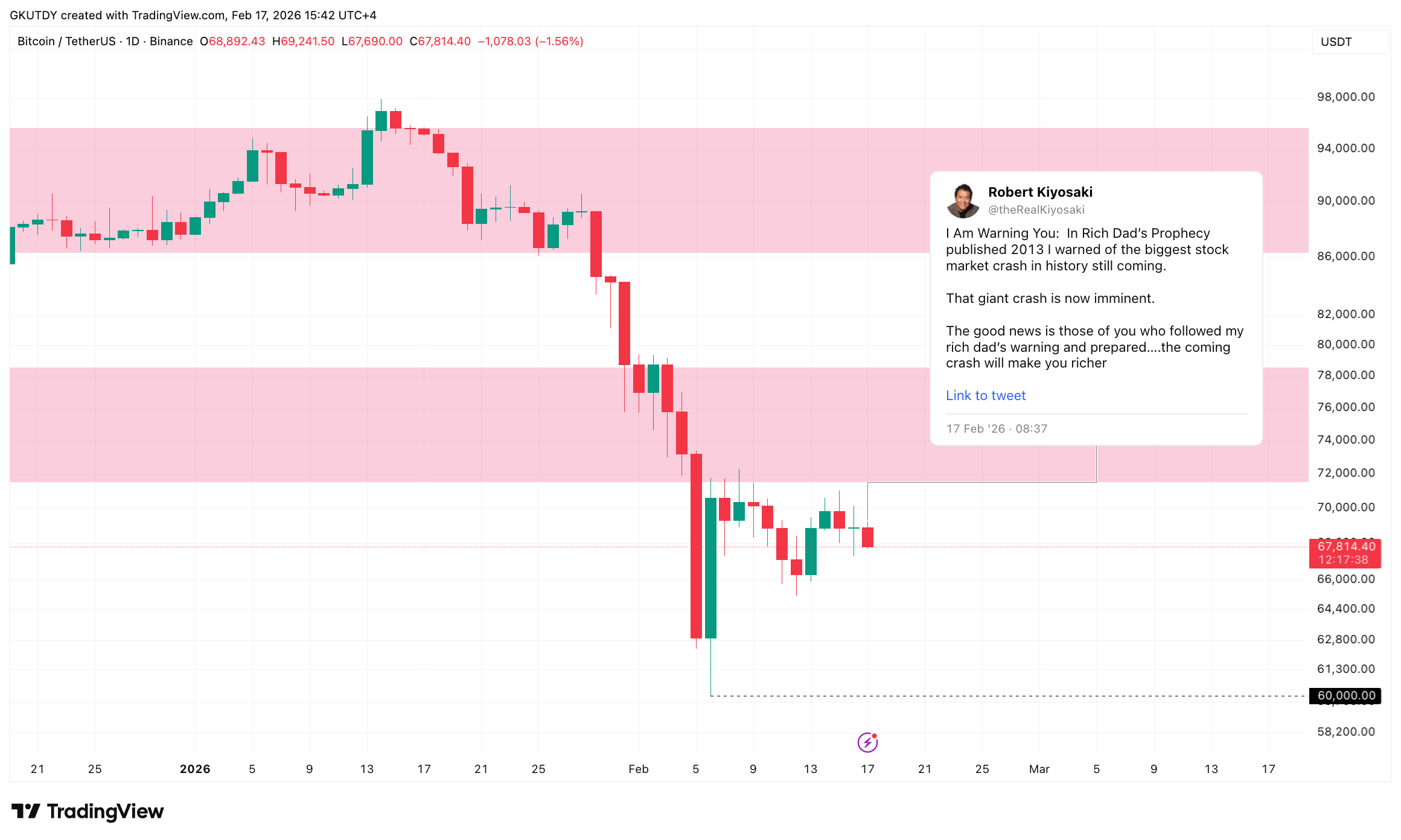

In a Tuesday missive on X, our financial sage, Robert Kiyosaki, forewarned of a looming stock market crash. He reiterated his strategy of purchasing more Bitcoin during price pullbacks, a tactic that makes one wonder if he sleeps with his Bitcoin under his pillow.

Kiyosaki cited Bitcoin’s supply cap of 21 million coins, claiming that nearly all are already in circulation, supporting his long-held argument for scarcity as the ultimate treasure map. He proudly declares his holdings of gold, silver, Ethereum, and Bitcoin, all while preparing to accumulate even more BTC. It’s as if he’s assembling the Avengers of investment.

His wise observations come as Bitcoin consolidates near $67,777, following a prior foray toward the mystical $60,000 mark. That number, now serving as structural support, makes one ponder if it has become the new favorite resting place for Bitcoin.

Importantly, Kiyosaki’s stance is not a new revelation but rather a consistent refrain from his financial symphony. What changes, however, is the context: current price compressions and volatility expansions mean that his accumulation strategies occur against a backdrop of heightened risk sensitivity, much like a tightrope walker in a windstorm.

What to watch next for XRP, ADA, BTC

- XRP: A daily close above $1.49794 is required to confirm a recovery above $1.50. Continued rejection keeps $1.2311 in play.

- Cardano (ADA): Testing the $0.27-$0.29 support zone as market focus shifts to transparency execution following Treasury Withdrawal 1 approval.

- Bitcoin (BTC): $60,000 remains key structural support. A break above $73,000 would mark a renewed expansion phase. Until then, a sideways chop in the $60,000-$70,000 range seems the most probable scenario, like a hamster on a wheel.

Read More

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- eFootball 2026 is bringing the v5.3.1 update: What to expect and what’s coming

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- Call the Midwife season 16 is confirmed – but what happens next, after that end-of-an-era finale?

- Country star Thomas Rhett welcomes FIFTH child with wife Lauren and reveals newborn’s VERY unique name

- Denis Villeneuve’s Dune Trilogy Is Skipping Children of Dune

- Decoding Life’s Patterns: How AI Learns Protein Sequences

- Mobile Legends: Bang Bang 2026 Legend Skins: Complete list and how to get them

- Taimanin Squad coupon codes and how to use them (March 2026)

- Are Halstead & Upton Back Together After The 2026 One Chicago Corssover? Jay & Hailey’s Future Explained

2026-02-17 15:19