Trump-endorsed $ABTC, like a well-pressed riddle in a linen suit, has dashed into the public eye with its inaugural earnings report. This company, resplendent in its boast of being “not just a miner, not just a treasury,” has strung together a hope of 50 EH/s to fan the flames of its BTC-flavored growth stratagem.

While much of the Bitcoin mining sector has taken to pirouetting around AI and HPC infrastructure like a string of overly eager debutantes, American Bitcoin (Nasdaq: ABTC) seems to be cutting a different rug entirely. It is bravely aiming to burgeon into a premier Bitcoin miner, nurturing a sizeable BTC treasury, all while preserving its steely-eyed claim of not being just one thing. The conundrum that hangs in the stately parlour, however, is whether the economic tea leaves justify this grand play when so many of their peers have twirled away from Bitcoin mining altogether.

Let’s saunter through their first quarterly results since prancing onto the Nasdaq stage.

Current Bitcoin Mining Status

The company only made its grand entrance on 31 March 2025 and trotted onto Nasdaq on 3 September. In this breathtakingly brisk passage of time, it has plowed forward with commendable alacrity.

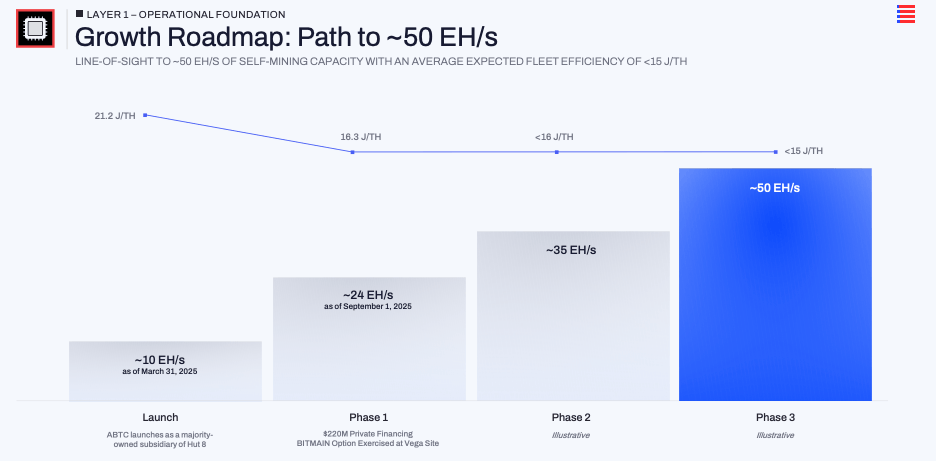

By the curtain drop on the third quarter, it boasted ~25 EH/s of installed plumage, with an average fleet efficiency strikingly listed at 16.3 J/TH. A significant feather in its cap is a purchase agreement for roughly 14.8 EH/s of spanking new miners at the Vega site in Texas. Subtle hints from management suggest a promising road to ~50 EH/s.

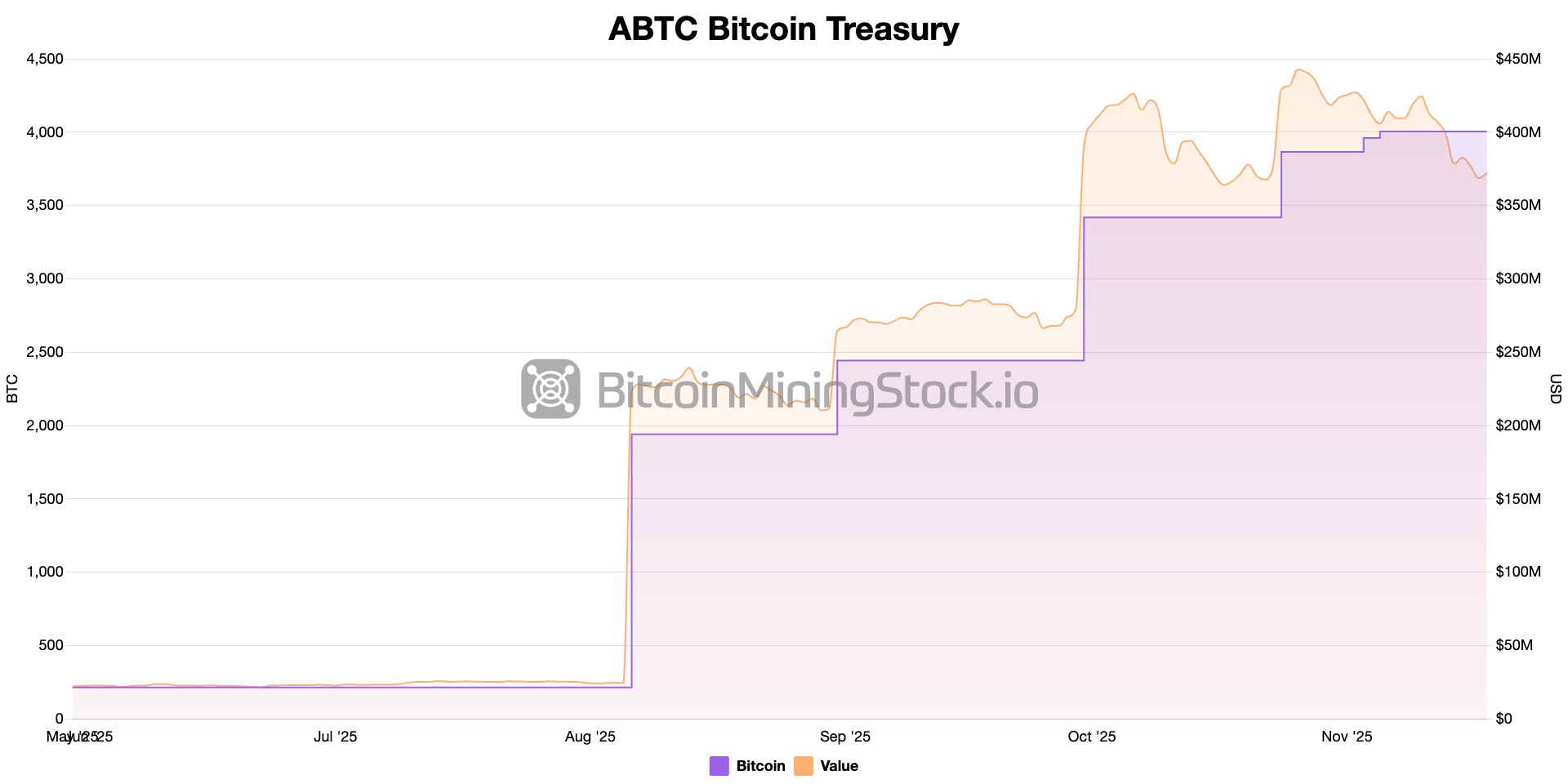

Over this exhilaratingly brief chapter, it has hoisted its Bitcoin reserves from nil on 1st April to a plush 3,418 BTC as of 30th September. The latest knick-knacks suggest that number has inflated towards 4,000 BTC+. Management graces us with the whimsical translation that this equates to 371 satoshis per share, illuminating an increase in BTC per share by a splendid 50% since its debut. They seem earnestly keen for the market to gaze keenly upon the Bitcoin per share metric rather than merely the shortcomings or show of its hash rate.

Thus, grand as a peacock, American Bitcoin audaciously places its wagers on scaling Bitcoin mining and BTC holdings, without a single backward glance.

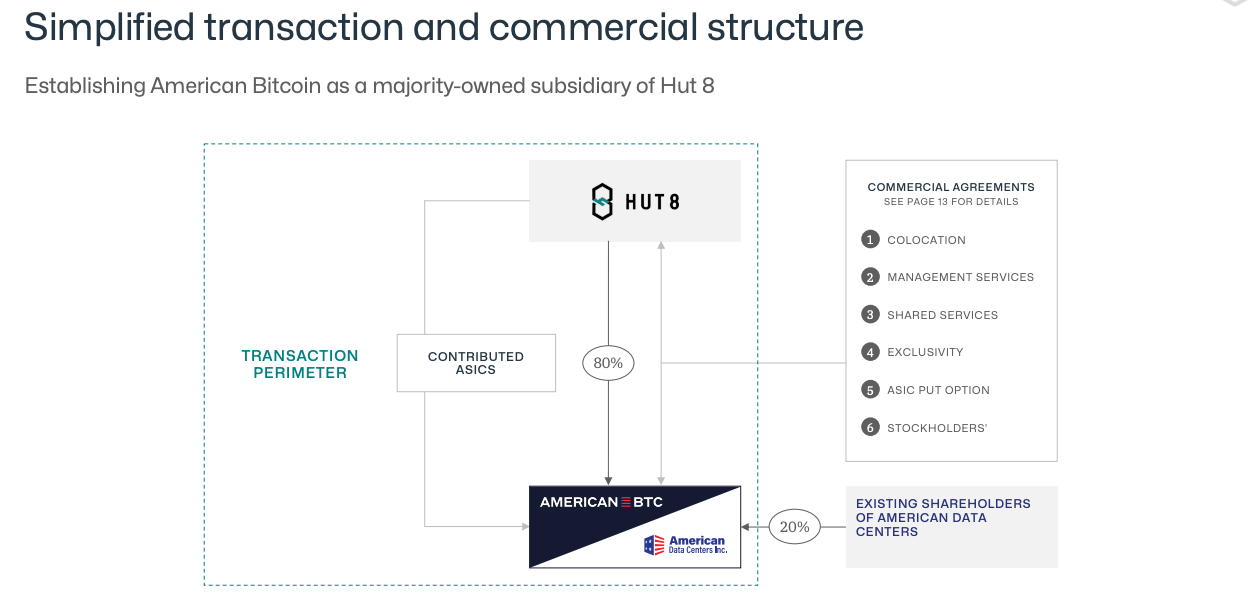

Asset-Light Model: The Secret Concoction

Uniquely, American Bitcoin’s Bitcoin mining operations waltz hand in glove with its partnership with Hut 8. The company lavishes no ownership over the mainstays of infrastructure. Hut 8 provides the venues, liaises with utility billions, and offers miners a fitting physical environment. American Bitcoin takes on the role of financier and buyer of the ASIC fleet, while handling hosting and service fees, and whipping its resources into play for miners and Bitcoin, rather than infrastructure edifices. In the third quarter, management declared their SG&A was a mere 13% of total revenue. A snugly efficient cost base, they’d say, further asserting the claim that shedding infrastructure overhead keeps their purse strings firmly in check.

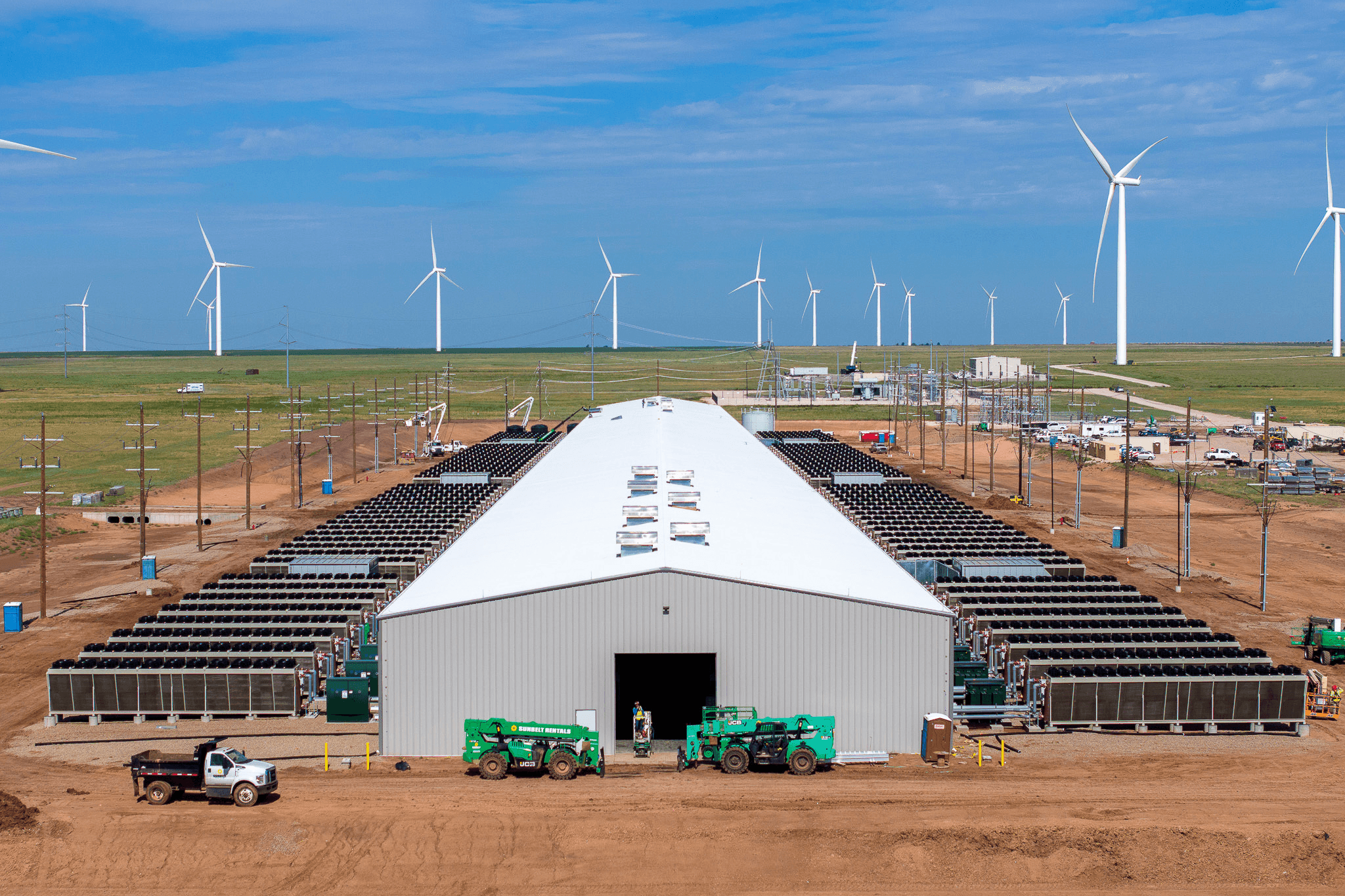

The Vega site in Amarillo serves as the showpiece. On the Q3 earnings call, Asher Genoot illuminated that American Bitcoin accounted for more than 95% of the local co-op’s load and operates as a fully adaptable, subservient customer at a wind farm. When the grid demands a breather during peak events, the mine can retire swiftly. The management adroitly argues that AI and HPC data centres can’t pivot without inconveniencing their clientele, gifting Bitcoin mining a blue-ribbon niche: it can sip cheap, breezy power and bow out gracefully when the grid shows signs of stress.

Perched atop the venture is a clever financial stunt. Rather than doling out miners in cold, hard cash, American Bitcoin has masterminded the Bitmain deal in such a way that a sizeable block of its Bitcoin stands as collateral against new ASIC acquisitions.

The odd marriage of outsourced infrastructure, flexible power, and BTC-backed financing is the secret potion fueling the aspiration for 50 EH/s.

What Q3 Unveils About the Model’s Economic Fortitude

The premiere quarter as a public company offers a snug peek at their core thesis.

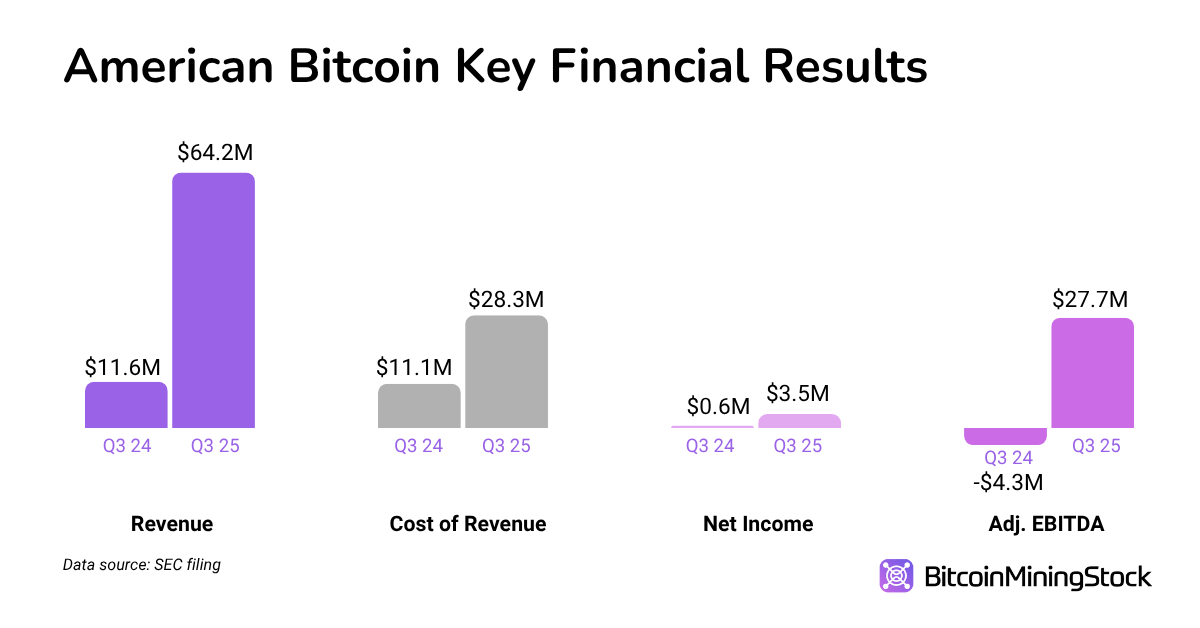

For Q3 2025, American Bitcoin held forth with $64.2 million in revenue. The cost of revenue struck $28.3 million, weaving a 56% gross margin. This figure already entwines both power and Hut 8’s colocation fees. During the call, management hinted that if you isolated mere real-time energy costs against the value mined of Bitcoin, the effective margin would nudge towards 69%. While non-GAAP, it lends credence to their narrative, claiming to harvest Bitcoin at nearly half the cost of open market purchases.

Profitability metrics stood proud amidst Bitcoin price tumult. The company tallied a $5.5 million mark-to-market loss on BTC holdings, yet net income still arched up to $3.5 million. Adjusted EBITDA practically doubled to $27.7 million. For an entity barely ripe for its nameplate a mere twelve months ago, this performance carries undeniable weight.

On the balance sheet, a clear blueprint for capital unfolds. To broaden its hash rate, American Bitcoin has employed a BTC-pledged structure for miners at Vega, rather than solely thrashing cash. As of quarter-end, 2,385 BTC out of 3,418 BTC were pledged collateral for such arrangements. In sum, the very Bitcoin that undergirds its “accumulation” yarn doubles as a springboard for continued hash rate ascension.

These figures may not be the bedrock proof of perpetual robustness. Yet presently, they do illuminate how an asset-light structure can yield hearty margins while fanning the flames of both hash rate and BTC holdings.

Concluding Deliberations

The first toddling steps of American Bitcoin on the public stage boast blistering execution and sparkling early economics. The asset-light construct has whisked in tidy margins while scaling rapidly, devoid of the burdensome infrastructure often shackling traditional miners. The impending crucible will be whether this “not just a miner, not just a treasury” model can stand firm, especially should Bitcoin prices surrender.

To those who perch keenly to see the narrative woven, paying heed to strides towards 50 EH/s and continued sats-per-share prosperity holds merit. Yet, it would be wise to court answers to a few pressing queries: How will the company ball its risk if a downturn arises with a lion’s share of its Bitcoin tethered as collateral? What if Hut 8’s development ambitions wane? And to what extent will the allure of equity issuance and BTC-backed finances persist under shifting market skies…? These answers shall cast light upon a more definitive personal theory.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Brawl Stars Steampunk Brawl Pass brings Steampunk Stu and Steampunk Gale skins, along with chromas

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-11-21 10:00