- Ethereum whales appear to be playing a “buy-the-fear” game as ETH stumbles past support levels.

- Is a rebound just around the corner, or should we brace for more chaos?

Ah, the “buy-the-fear” strategy – where big, powerful creatures (known as whales) wade into the market during a dip, hoping to scoop up discounted assets like they’re at an exclusive sale on Black Friday. And, dear reader, it seems that Ethereum (ETH) whales are doing just that. The question, however, is: will their gamble pay off, or are they simply about to join the growing ranks of those who thought they could time the market… and, well, didn’t?

Take the mysterious “7 Siblings” group (because apparently, cryptos need more obscure names for groups these days), who boldly plunked down $42.66 million for 25,100 ETH at around $1,700. And because one whale is never enough, another whale borrowed 8.25 million DAI to snap up 5,227.3 ETH at $1,578. Because when you’re a whale, the risk is simply a minor inconvenience, right?

But should you follow suit? Should you start buying into the fear like a pro? Only time (and your bank account) will tell.

Ethereum on Whale Alert

As of the latest update (right now, as you read this, in fact), Ethereum is plummeting through multi-year lows, with the altcoin languishing at 16.8% down at $1,490. This is a level we haven’t seen in two whole years. Let’s just say the outlook is a little more “mysterious” than you’d like when you’re holding ETH. Expecting an immediate rebound is, frankly, a bit too optimistic for the current mood of the market.

Why, you ask? Because the “7 Siblings” group is sitting on a $5.27 million loss, which works out to about a $120 loss per ETH. Meanwhile, the other whale is currently clutching onto a $460,000 loss, no biggie. So yeah, while whales are snapping up ETH in droves, they’re still under a lot of pressure – and they’re not alone. The market remains fragile. Unless these big spenders turn a profit soon, there’s a very real risk of a mass sell-off, should they decide to break even and head for the exits.

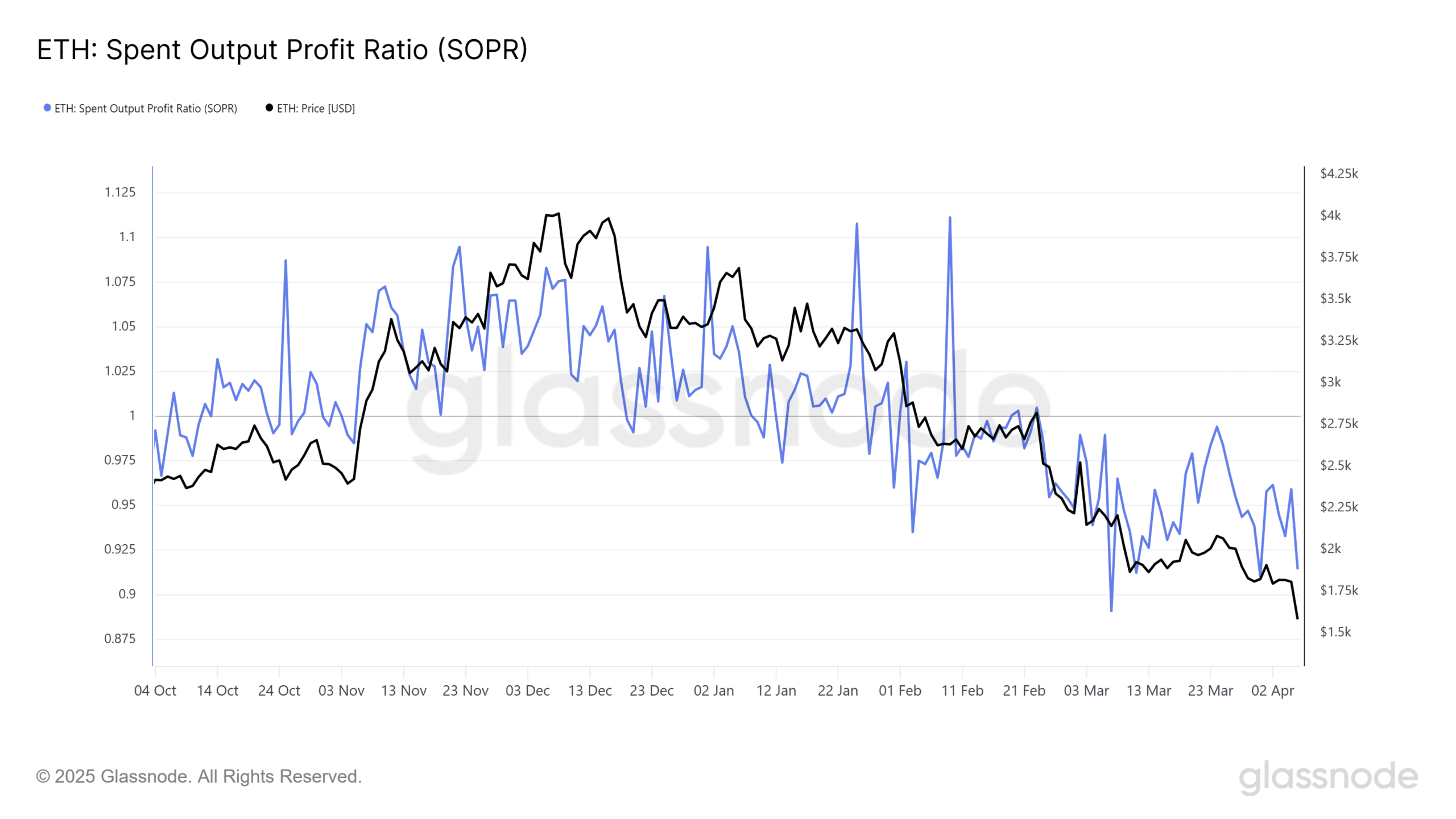

If you’re wondering why things are so tense, the SOPR (Spent Output Profit Ratio) chart makes it clear – we’re sitting at a six-month low. This metric shows that most market participants are currently sitting on losses, making liquidations a very real possibility.

The bottom line? Unless more big fish come in to absorb the sell-side pressure, we could be in for a long, bumpy ride. Small hands (who are clearly not fans of the term “hodl”) are either panic-selling or waiting for Bitcoin to do something impressive. Until the larger whales step in to control the tides, we’re in for a bit of a rough patch.

What’s Next – A Short Squeeze or Just Endless Speculation?

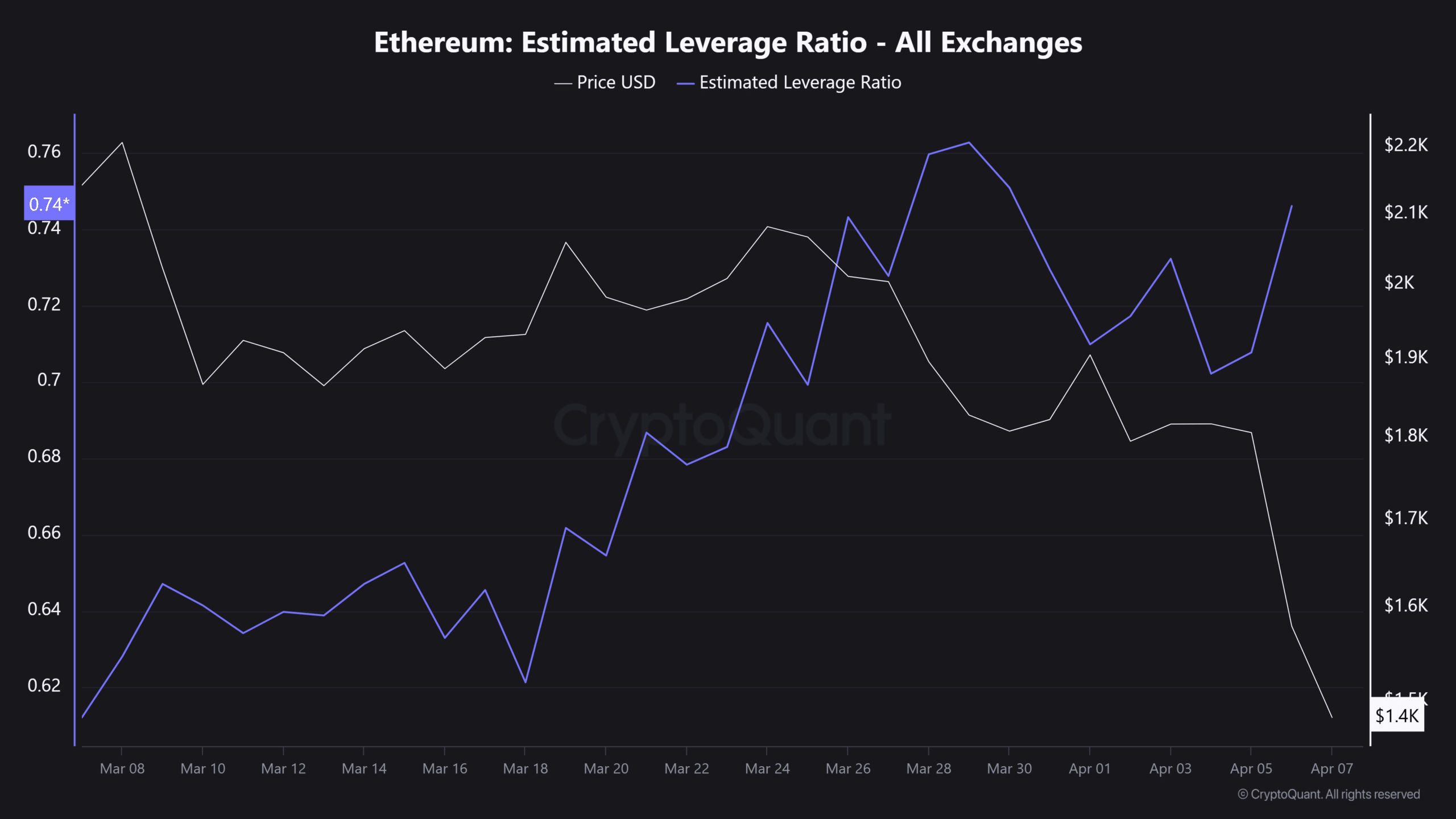

The unexpected crash took Futures traders by surprise, triggering a sudden wave of de-risking. Over $349.59 million in long positions were liquidated. You might be thinking, “Wow, that sounds like a disaster,” and you’d be right! But wait – Ethereum’s Estimated Leverage Ratio (ELR) spiked like a rocket, signaling that traders are still throwing caution to the wind and diving into high-risk, high-leverage bets. Because why not?

This could create the perfect setup for a short squeeze if the market decides to do a dramatic U-turn. But, as we know, Ethereum’s market right now is like an overcooked soufflé – it’s just as likely to collapse as it is to rise. And with sell-side pressure still looming large, Ethereum reserves are increasing (they’ve climbed from 18.21 million on April 1st to 18.50 million), which only adds more liquidity to the already turbulent mix.

So unless something miraculous happens, Ethereum is likely to stay stuck in a speculative loop, with whales happily “buying the fear and selling the greed.” The ELR will remain high, and the risk of more liquidations will continue to climb. It’s like a financial rollercoaster that never quite finishes its loop-de-loop. Buckle up, folks, this ride could get wilder!

Read More

- Clash Royale Best Boss Bandit Champion decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Best Hero Card Decks in Clash Royale

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Clash Royale Best Arena 14 Decks

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- All Boss Weaknesses in Elden Ring Nightreign

2025-04-08 01:14