- Bitcoin ETF outflows and miner activity say “Caution!” despite some bullish flirting.

- Bitcoin’s Apparent Demand shows a faint pulse, but sentiment is still clinging to the floor.

Ah, after weeks of hiding in the shadows, Bitcoin’s [BTC] 30-day apparent demand has, at long last, decided to show itself again—just a little, mind you. Could this mean a grand market shift? Or is it just a tease?

The 30-day metric, which had plunged to a measly -200,000 BTC—its lowest since early 2023—has finally nudged up a little. But don’t get too excited just yet. It’s only a tiny bump.

Sure, the rebound seems to hint that buyers might be starting to look, but demand still lingers in the red. So fragile, like a soufflé in a hurricane.

Until we see a real push into the positive, it’s safe to say investor confidence will remain on life support.

The Market is as Nervous as a Cat on a Hot Tin Roof

Of course, it’s not just demand that’s skittish. Oh no, sentiment has also taken a nosedive.

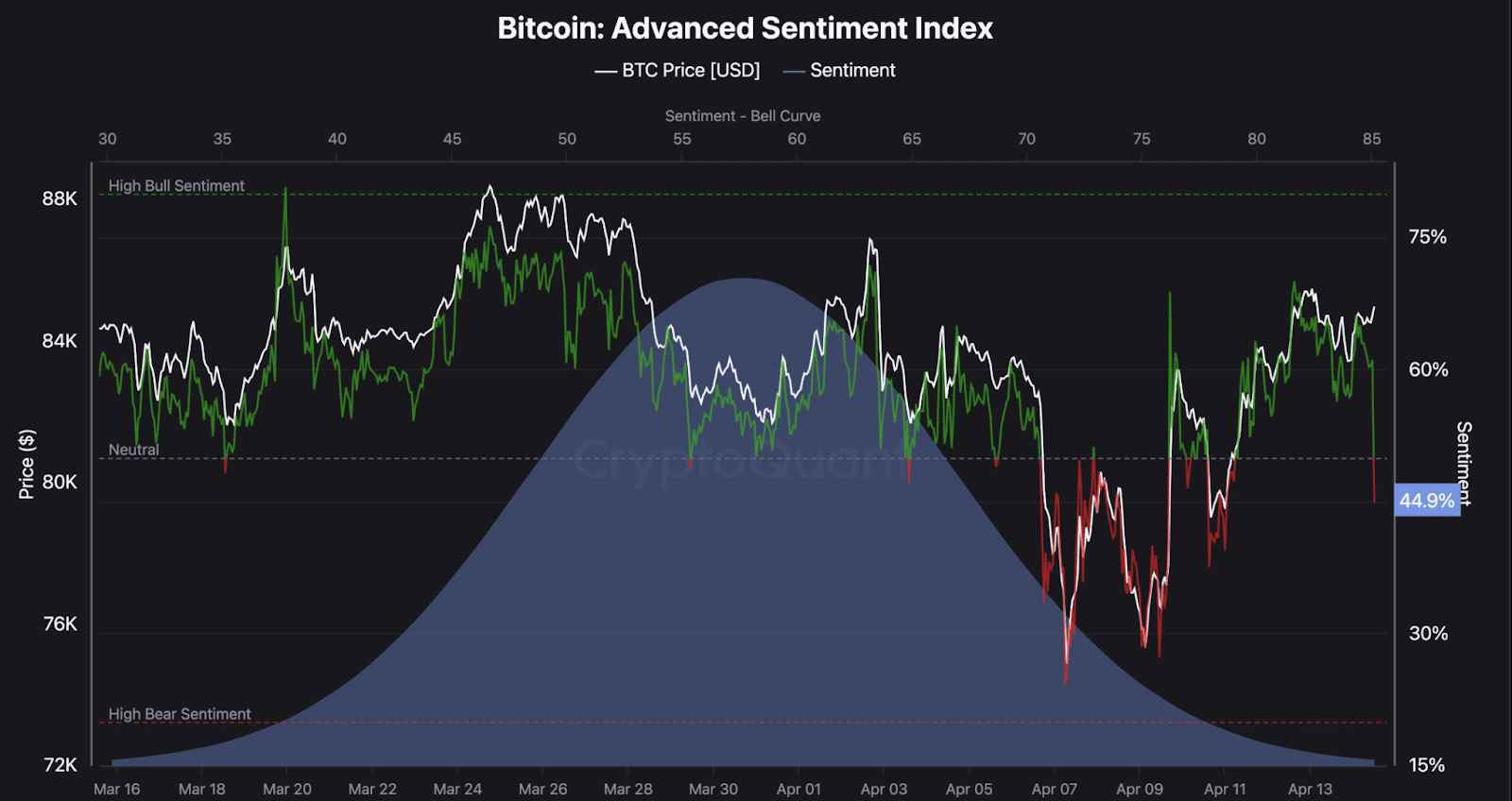

By the time this piece is being written, the Bitcoin Advanced Sentiment Index has dropped to 44.9%, going below the neutral zone and into the land of pessimism. How wonderful!

Just a month ago, sentiment was soaring at 70% in mid-March, only to plummet as volatility made a grand return. Ah, the thrill of market drama.

Bitcoin touched $88,000 on the 2nd of April, only to plummet to $75,000 shortly after. Classic case of “soaring high, crashing low.”

And now, with the price still hanging in there, sentiment remains as unsteady as ever. It’s like the market just can’t decide whether to party or cry in a corner.

Institutions Flee the Scene as Bitcoin ETF Inflows Take a Dive

The institutions, those grand pillars of Bitcoin’s strength, seem to be walking away. Spot ETF holdings dropped from 1.19 million BTC in March to a mere 1.115 million BTC in early April. Why, that’s below the dreaded alert threshold of 1,116,067 BTC. The horror!

This was a break from the steady ETF accumulation trend of 2024. So long, institutional support. How’s that for a vote of confidence?

And while institutions are taking their leave, retail interest is putting on its best show—still, it’s unclear if that will be enough to save the day.

Meanwhile, miners have joined the party, but not in a way you’d want. The Miners’ Position Index (MPI) surged almost 40% in a single day. Ah, the sweet sound of BTC flowing out of the mines and into who knows where.

Typically, this behavior means miners are gearing up to sell off some of their precious reserves. Perhaps they’re locking in profits? Or perhaps they foresee darker times ahead? Only time will tell. Either way, it’s not the most bullish thing to hear.

When you add this miner activity to ETF outflows and a sentiment that’s struggling to get out of bed, it paints a picture of a market that’s more jittery than a cat on espresso.

BTC Breakout Offers Hope… But Don’t Get Too Comfortable

On the technical front, Bitcoin has broken out of a descending trendline. A true hero’s journey, right? Perhaps this is the start of a bullish reversal? Bitcoin currently sits at $83,946—up 0.29% in the last 24 hours. Hold your applause.

But wait, there’s more! A double-bottom pattern has also appeared, making the bulls think, “Is this our time?” They can dream. BTC now flirts between $76,572 support and $87,889 resistance—two levels that are playing hard to get.

For the bulls to truly reign supreme, they’ll need to break decisively above $87,889. Only then can they dream of the mystical $98,825 level. Until that happens, it’s all just a delicate dance, and one wrong move could send it all crashing down.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- World Eternal Online promo codes and how to use them (September 2025)

2025-04-17 03:08