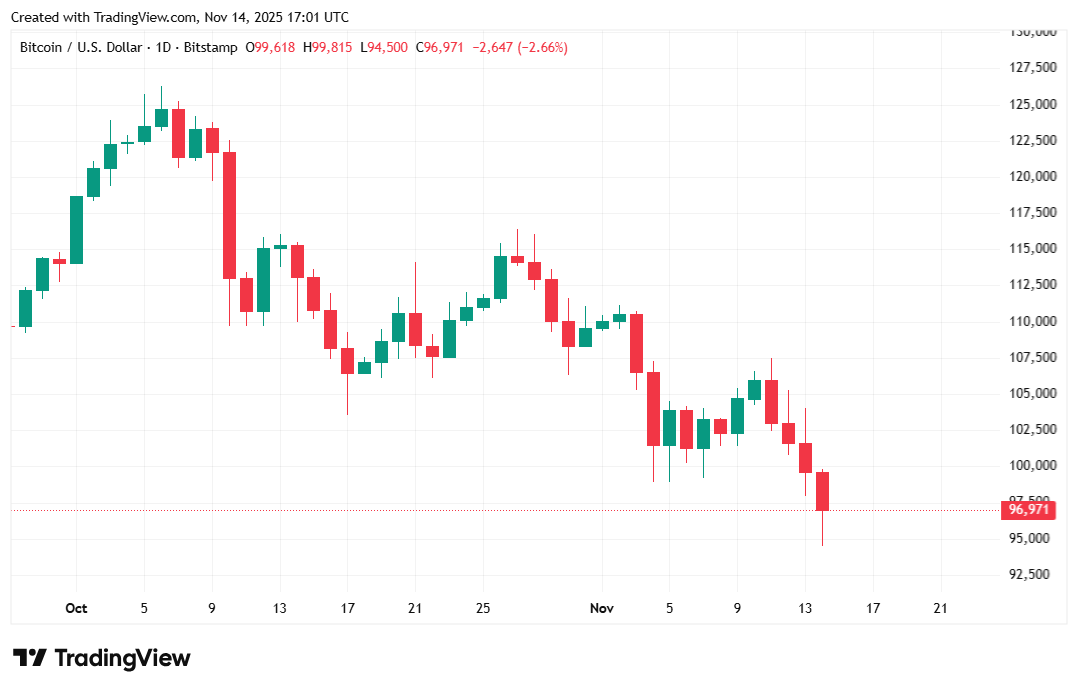

Who could have guessed that the mighty Bitcoin, which soared to heights higher than an eagle on a sugar rush, would plummet to a meek $94,525.06 in just a few frantic weeks? And here we thought it was invincible-like a stubborn mule in a hailstorm.

Market Madness Turns Bitcoin into a Yo-Yo – Down to $94K! BTC

With all the grace of a cow on roller skates, markets are tumbling. The usual suspects-fear of AI valuations inflating like a balloon at a clown convention, interest rates doing the hokey pokey, and the government shutdown that dragged on longer than grandma’s stories-have mashed together into a perfect storm of chaos for stocks and cryptocurrencies alike. 🌪️

Bitcoin took a nosedive to $94K on Friday, while stocks did somersaults into the red. Some blame the tech giants with their pockets full of AI dollars, raising fears of an internet bubble big enough to swallow the Dot-Com era whole. Others whispered about the Federal Reserve, which was supposed to cut rates but decided to play hard to get-thanks, Jerome Powell, for the December tease. Meanwhile, the White House announced that some economic data, like the CPI and jobs reports, might never be seen again-not exactly the economic version of a “where’s Waldo” chase.

“Some folks believe the government’s economic crystal ball is now just a shiny paperweight,” jibed White House Press Secretary Karoline Leavitt. “They’ve managed to turn the economic data into a permanent mystery, leaving the Fed to play cricket without a bat at the worst time.”

Just when you thought it couldn’t get any crazier, Kentucky’s Senators got into a spat that makes family dinners look tame. Mitch McConnell, sneaky as a fox in a henhouse, slipped a provision into the funding bill that effectively banned retail hemp products-imagine losing 300,000 jobs because of a senator’s midnight folly. Senator Rand Paul called it the “most thoughtless, ignorant proposal,” which is saying something when compared to a Friday night at the family reunion. 🎭

All these dramas have stirred the pot of disaster to a boiling point. Data from Coinglass shows that leveraged Bitcoin traders have seen nearly $660 million of their margin evaporate faster than snow in July. But despite this weekly soap opera of crashes and comets, some wise investors still hold hope – like Hunter Horsley from Bitwise, who believes we’re almost out of the woods after six months of bearish lamentations. Perhaps this is the crypto version of a “spring cleaning,” albeit with more explosions. 🌸💥

Market Numbers (Because Who Doesn’t Love a Good Number Salad?)

Reporting at $96,983.32 and dropping faster than a lead balloon, Bitcoin was riding the roller coaster at a 3.53% drop in a day, and over 4% since last week, per Coinmarketcap. Early Friday mornings saw it slide to a modest $94,525.06 after daring to peak at $100,770.97. Respect, but also, ouch.

Daily trading volume rocketed to a whopping $128.86 billion – enough to buy a small country or at least a really fancy yacht – reflecting the frantic sell-off. Market cap shrank to $1.93 trillion, and Bitcoin’s dominance shrank a tad to 59.55%, which is about as steady as jello in a tornado.

Open Bitcoin futures saw their total swell to $67.46 billion, but the real spectacle was liquidations – skyrocketing from $235.80 million to a staggering $658.96 million in just a day. Long traders lost a mind-boggling $604.20 million in margin, while the shorts suffered a little less but still lost over $54 million. Looks like the market’s playing a game of “who blinks first?” 🎲

FAQ ⚡

- Why did Bitcoin tumble to $94K?

A cocktail of AI bubbles, stalled rate cuts, and a government shutdown longer than your last holiday break brewed this storm. - Did missing economic data make things worse?

Yep. The White House’s failure to release key info is like trying to navigate a boat in the fog with a blindfold – not advisable and slightly terrifying. - What about the hemp ban?

A little provision in the bill with big consequences-300,000 people’s jobs hanging in the balance, all because some senator wanted a extra laugh. - Is the long-term outlook still positive?

Many experts, including Horsley, think we’re close to the end of the tunnel – or at least near the light that isn’t an oncoming train.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- How to find the Roaming Oak Tree in Heartopia

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

- What If Spider-Man Was a Pirate?

2025-11-14 21:28