Arthur Hayes, the crypto version of a conspiracy theorist with a PhD in “I Told You So,” claims Tether is secretly preparing for the Fed’s rate-cut party by hoarding gold and BTC. Spoiler: It’s not a party if you’re betting your entire portfolio on a coin that’s basically a fancy IOU. 🎉💸

Arthur Hayes: Tether Prepares For Low Interest Rate Scenario

The Facts

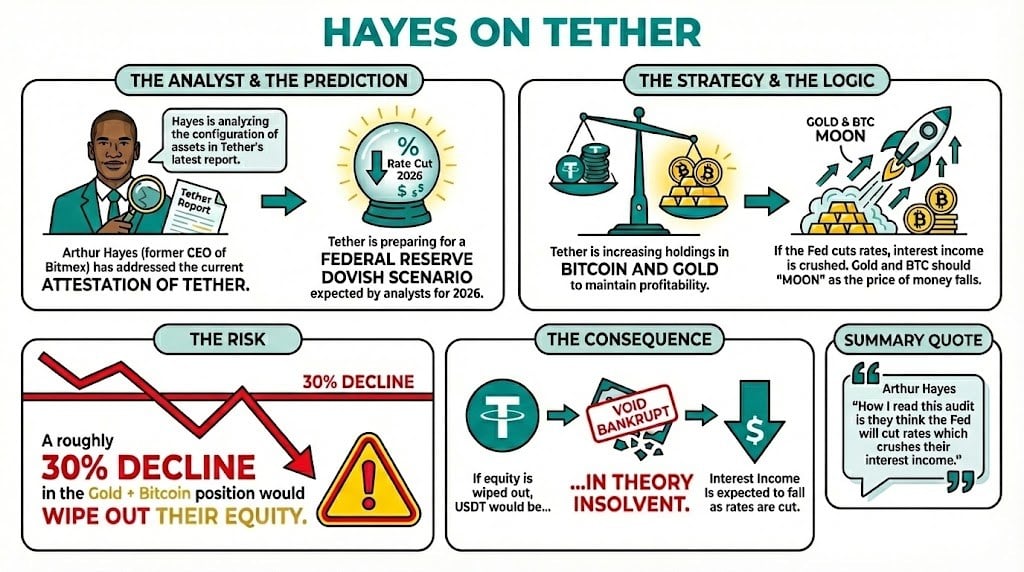

Arthur Hayes, former CEO of Bitmex, has addressed the latest attestation of Tether, one of the largest cryptocurrency companies in the industry. Because nothing says “trust me” like a company that’s basically a black hole of financial transparency. 🌌

According to Hayes, the configuration of assets in Tether’s balance sheet means that the company is preparing for an upcoming Federal Reserve dovish scenario, as several analysts predict for 2026. Because who wouldn’t want to bet on a future where the Fed’s interest rates are lower than a toddler’s attention span? 🤷♂️

Hayes stated that the increase in Tether’s bitcoin and gold holdings is part of a shift to maintain profitability as the Federal Reserve cuts rates, affecting the company’s inflows. Because nothing says “financial stability” like swapping dollars for digital confetti. 🎉

He explained:

How I read this audit is they think the Fed will cut rates which crushes their interest income. In response, they are buying gold and BTC that should in theory moon as the price of money falls.

Nonetheless, this could also have dire repercussions for USDT’s backing, as Hayes stated that “a roughly 30% decline in the gold + $ BTC position would wipe out their equity, and then USDT would be in theory insolvent.” Because nothing says “solvency” like a 30% drop in assets that are basically a gamble with a side of uncertainty. 🤯

Why It Is Relevant

If Hayes’s assumptions are correct, with this move, Tether’s move puts part of USDT’s backup in jeopardy, allowing it to fluctuate as gold and BTC move according to market dynamics. Because nothing says “stable” like a currency that’s as reliable as a toddler’s promise to clean their room. 🧸

Nonetheless, Joseph Ayoubm, former Research Crypto Lead at Citi, stated that Hayes had missed a few things, claiming that this opinion was “highly misleading,” as Tether produced this attestation with a “matching” philosophy. Because nothing says “transparency” like a company that’s basically a magician with a spreadsheet. 🎩

This means that Tether only discloses the assets backing the USDT issued, but it still holds other assets and investments that are not publicly disclosed. This undisclosed balance sheet would be composed of equity investments, mining operations, corporate reserves, and possibly more bitcoin, Ayoubm assessed. Because who needs transparency when you can have a mystery box full of financial surprises? 🎁

Looking Forward

Tether’s balance sheet and the lack of a proper audit of its assets and holdings will create distrust among some, as the financial standing of a company that has issued over $180 billion in stablecoins is considered uncertain by some. Because nothing says “trustworthy” like a company with more money than a medieval king and no idea how it’s spending it. 💰

FAQ for Tether’s Recent Attestation

What is the significance of Tether’s latest attestation?

Former Bitmex CEO Arthur Hayes suggests it indicates Tether’s preparation for an anticipated Federal Reserve rate cut in 2026. Because who doesn’t want to bet on a future where the Fed’s policies are as predictable as a toddler’s mood swings? 🤷♀️How are Tether’s asset holdings changing?

Tether is increasing its holdings in bitcoin and gold to maintain profitability amid potential interest income declines from Fed rate cuts. Because nothing says “profitability” like investing in assets that are as volatile as a caffeinated squirrel. 🐿️What are the risks associated with Tether’s asset strategy?

Hayes warns that a significant drop in gold and bitcoin prices could jeopardize USDT’s backing, leading to potential insolvency. Because nothing says “insolvency” like a 30% drop in assets that are basically a gamble with a side of uncertainty. 🤯What do experts say about Tether’s financial transparency?

Joseph Ayoub from Citi, argues that Tether’s disclosed assets are only part of a larger, undisclosed balance sheet, dispelling the concerns about its overall financial stability. Because nothing says “stability” like a company that’s basically a magician with a spreadsheet. 🎩

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-12-02 01:49