In a stunning move that’s bound to make your jaw drop (and your bank account shake with envy), Tether, the USDT stablecoin giant, just stuffed a whopping 80 tons of gold into a single Swiss vault. That’s about $8 billion of glittering metal! And surprise, surprise—gold’s been climbing faster than your ex’s excuses for not texting back. 💸

But hold on to your hats, folks—this stash is still less than 5% of Tether’s supposed USDT reserves. Aaaaand guess what? No audit yet. Shocked? Didn’t think so. While Tether may be flexing its shiny new vault, there are still big questions swirling around the company’s inner workings. 🤔

The Glittering New Gold Reserve 🏆

Ah, Tether. The stablecoin mogul known for mixing crypto with gold like it’s some kind of magical potion. Two years ago, they launched a token backed by gold—because, of course, why not throw gold into the mix when you’re already stirring the crypto cauldron? 🪙✨

Earlier this year, Tether boasted that it held 7.7 tons of gold. Fast forward to today, and—surprise!—they’ve piled even more up, with Bloomberg spilling the tea on their shiny Swiss stash:

“We have our own vault. I believe it’s the most secure vault in the world. If you have your own vault, eventually with the size, it gets much cheaper to do custody,” said CEO Paolo Ardoinio. He then proceeded to declare gold “should logically be a safer asset than any national currency.” 🤷♂️

So, since their Q1 2025 report dropped, Tether’s picked up an additional 0.3 tons of gold. At this point, they’re practically swimming in it. And if there was any doubt—Tether’s now one of the largest gold holders in the world. Just don’t ask about their competitors (you know, like actual banks or governments). 😏

And while Tether’s flexing on the gold front, the broader financial world is kind of… well, watching. With a few geopolitical events boosting gold’s appeal, it’s probably a good time to consider buying some shiny stuff—if you can afford to. (And by “can,” I mean, *definitely can’t*.) 😬

But it’s not all rainbows and sunshine—moving all the gold into one vault saves Tether some overhead. Less hassle, fewer costs, more gold… and a pretty epic public show-off. Because who doesn’t want to have the “most secure vault” in the world, right? 💼💎

But wait—Tether didn’t buy this gold as some rich person’s weekend project. No, no. It’s all part of the stablecoin backing. Which, by the way, has *still* never been audited. Spoiler alert: despite promising to do it, and despite looming threats from the U.S. legal system, Tether has… *yet to audit anything*. 👀

Some crypto enthusiasts are less than thrilled about the Swiss vault announcement, claiming it’s just a shiny distraction from the audit issue. After all, Tether’s likely about to play a major role in global dollar dominance, so a little transparency wouldn’t hurt. Just saying. 💁♀️

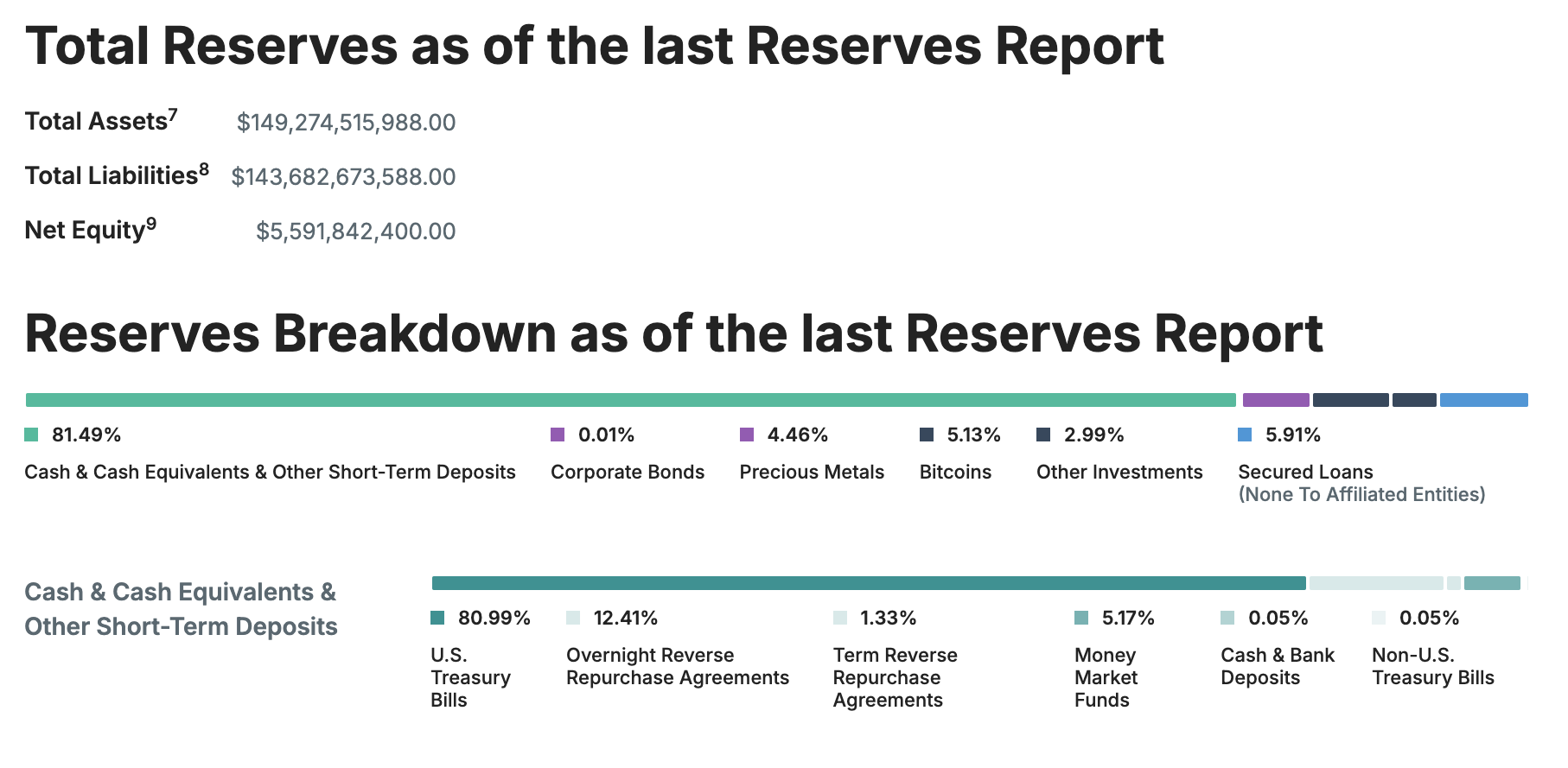

The real kicker here? Tether holds $8 billion in gold, but has issued more than $159 billion in USDT tokens. So, yes, Tether is sitting pretty on a mountain of assets, but there’s still the small matter of the other 95% of its reserves that no one really knows much about. 🤷♀️

Tether’s Q1 2025 report also showed a hefty $98 billion in US Treasury bonds (because why stop at gold, right?), and that number’s probably bigger by now. But don’t get too excited—gold still makes up less than 5% of the total portfolio:

In conclusion: Tether’s shiny new $8 billion gold vault? Impressive. But does it settle the reserve issue? Not quite. It’s still just a tiny piece of the puzzle, and until that audit happens (spoiler: it won’t anytime soon), we’ll just have to wait and wonder about the *other* 95% of their assets. 🔍

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-07-08 23:16