It appears the esteemed firm of Coinbase-a name now echoing, rather loudly one might add, through the hallowed halls of NASDAQ and even brushing shoulders with the S&P 500-has deigned to offer a novelty to the public. A product, if you will, allowing exposure to those thoroughly established concerns of the stock market, alongside… well, the somewhat less established world of digital curiosities. One begins to suspect they’ve run out of genuinely new ideas.

The offering? A curious mingling of the so-called “Magnificent Seven”-a rather boastful appellation, don’t you think?-the respectable (and immensely profitable) funds of BlackRock, and, naturally, Coinbase’s own shares. A most convenient arrangement, one imagines. It expands their derivatives portfolio as naturally as a pond expands after a generous rain.💧

A Convergence of Worlds (Or Just More Options?)

Coinbase, that bustling bazaar of digital tokens, announces its forthcoming “Mag7 and Crypto Equity Index Futures,” to be unleashed upon the world on the twenty-second of this month. A first, they declare! A hybrid, they proclaim! It seems everyone is desperate to claim ‘first’ these days, as though novelty alone guarantees wisdom. 🤔 One almost forgets that others, the Kraken among them, have been dabbling in similar, less extravagantly announced, endeavors. Robinhood’s “xStocks,” for instance… A quiet murmur, easily overlooked amidst this fanfare.

Coinbase Derivatives, already a purveyor of energies and metals (one wonders if a futures contract on melancholy is forthcoming), shall preside over this new creation. Mr. Armstrong, the esteemed head of the exchange, has rather dramatically proclaimed it “the everything exchange” on that modern bulletin board, X. One can only hope it does not, in fact, contain everything. The resulting chaos would be considerable.

We’re launching the first US futures that give exposure to the top US tech stocks and crypto at the same time.

We’ll launch more products like this as part of the everything exchange.

Coming on September 22.

– Brian Armstrong (@brian_armstrong) September 2, 2025

Thus, the discerning trader is offered the opportunity to partake in the fortunes of Apple, Microsoft, and the like, without the bother of actual ownership. And, of course, BlackRock’s Bitcoin and Ethereum ETFs are included – a prudent inclusion, one must concede. All wrapped in the neat package of a futures contract. Efficiency, access, new strategies! Such promises… 😴

The Composition of This Modern Marvel

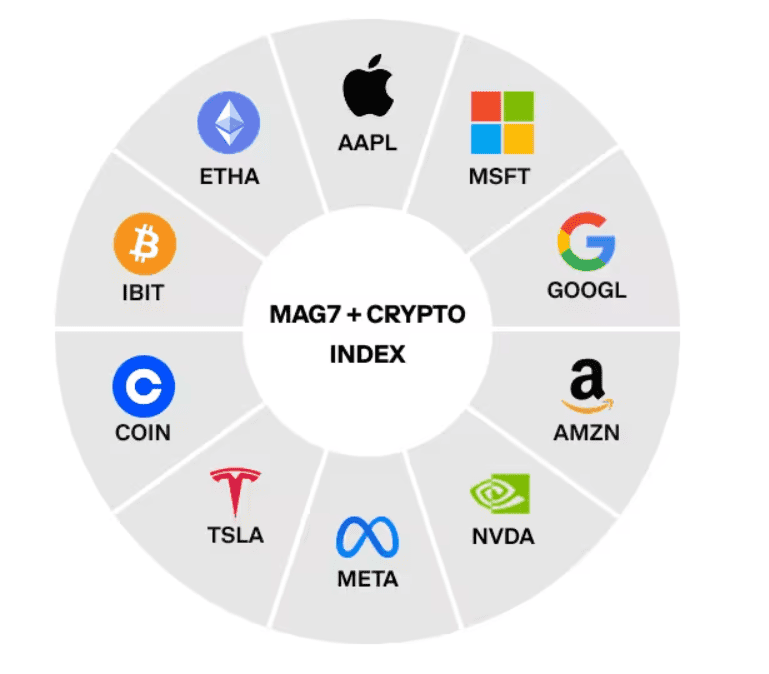

The “Mag 7” themselves: Apple, Microsoft, Alphabet, Amazon, NVIDIA, Meta, and Tesla. A collection of names so familiar they practically vibrate with corporate power. And as for BlackRock’s contribution? The iShares Bitcoin Trust ETF (IBIT) and iShares Ethereum Trust ETF (ETHA). And, lest we forget, a sprinkling of COIN itself.

COIN, at the moment of this writing, trades around a modest $303, having experienced a negligible decline of 0.32% in the last day. Yet, a respectable 22% gain for the year. One wonders if this new index will, perhaps, offer a helping hand in such endeavors.

The index, it is said, will apportion equal weight to these ten instruments-a 10% share apiece. Though, as nature often dictates, such balance is fleeting. Quarterly rebalancing will restore order, ensuring each receives its due. A firm named MarketVector will diligently maintain this equilibrium. The contracts, settled in cash, will represent a tidy $1x the index. A remarkably simple arrangement, perhaps too simple… 🤨

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

2025-09-04 07:19