On Wednesday, the unassuming business intelligence and bitcoin treasury firm, Strategy, decided to make a statement and sent its stock soaring to a record $455.90. This sent the company’s market capitalization to an almost comically large $124.64 billion. Don’t worry, they’ve got Bitcoin to back it up. 🤑

Strategy’s Stock Hits New Heights, All Thanks to Bitcoin (And Some Luck)

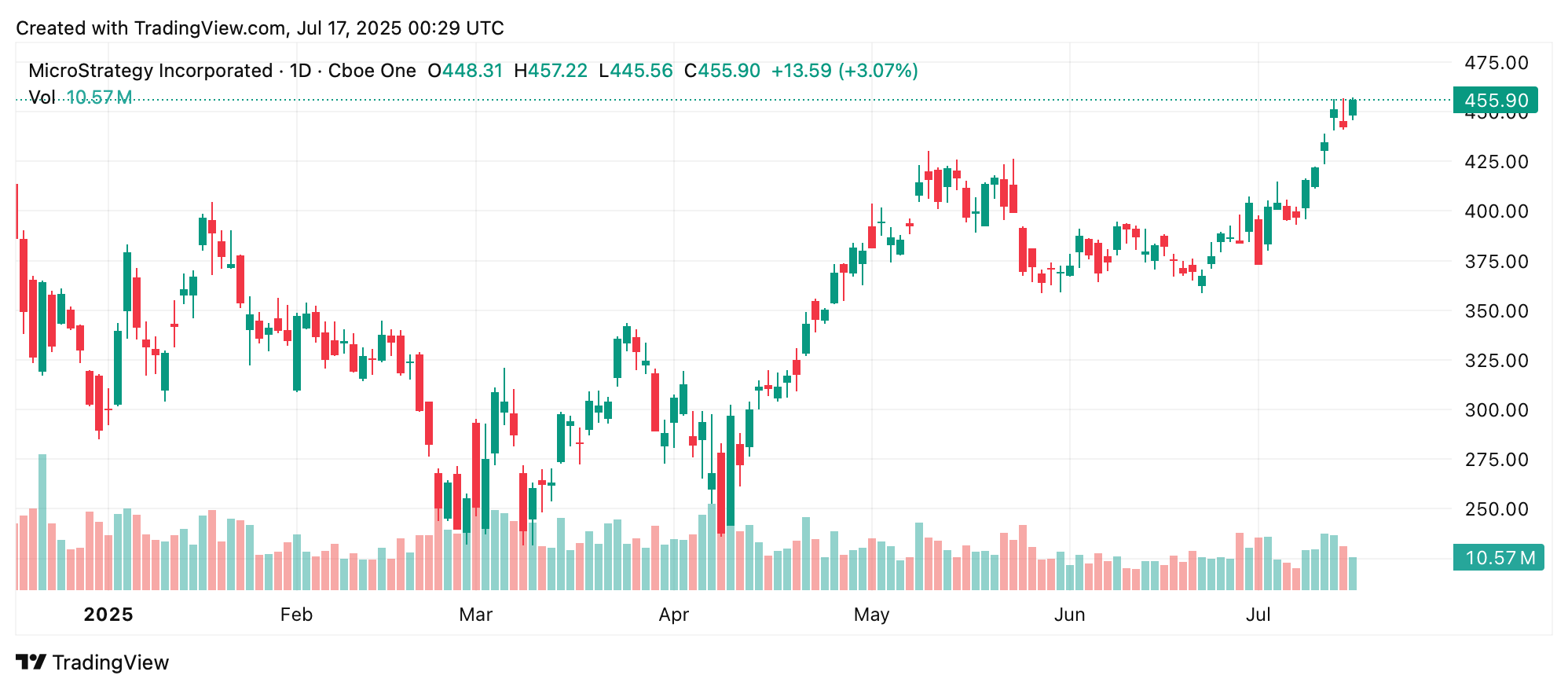

Market stats show that Strategy’s MSTR shares on Nasdaq climbed to a cozy $455.90 at Wednesday’s close, up more than 3% during the session. Over the last five trading days, MSTR gained 5.89%, and its monthly increase is over 17%. Over the long haul? A whopping 3,699% gain since its initial public offering (IPO). 🏆

Strategy, once known as Microstrategy Inc. (seriously, “Micro” in the name? This company’s anything but), hit the Nasdaq in June 1998 with shares priced at a modest $12. In the tech boom of 2000, MSTR soared to $139 per share before plummeting like a stone after the bubble burst in 2001. After nearly two decades of misery, MSTR barely budged above $20. Talk about a rough start! 🤷♂️

In 2013, the company’s founder, Michael Saylor, was notorious for his disdain for Bitcoin. He once compared it to gambling, which, considering the direction his company would later take, sounds like one of those “Oops!” moments. Back then, he said, “Bitcoin days are numbered.” He didn’t know that his future self was about to become the ultimate Bitcoin cheerleader. 🚀

Fast-forward seven years and, surprise, Saylor and Strategy went full-throttle into Bitcoin, saying, “Forget everything I said about Bitcoin. That was an experiment.” In August 2020, the company made its big Bitcoin splash, purchasing 21,454 BTC for about $250 million. Since then, it’s kept buying like an overzealous collector, now owning 601,550 BTC worth a cool $71.4 billion. Forget stocks, they’ve got digital gold. 💰

Strategy’s grand Bitcoin strategy (and it’s totally strategic, of course) was to buy Bitcoin for $43.324 billion. Now, they’ve made over $28 billion in gains. This is all well and good because, for investors, MSTR is the most leveraged proxy for Bitcoin there is. When Bitcoin’s on the rise, so is MSTR, and the stock gets that sweet, sweet NAV premium. Cha-ching! 🎉

Of course, not everyone’s buying into this Bitcoin-fueled dream. Some critics, like Peter Schiff, claim that it’s all a house of cards, or more aptly, a ticking financial time bomb. Investors like Jim Chanos argue that MSTR’s model can’t last forever. The company raises cash by issuing more stock, then buys more Bitcoin. It’s like a game of “raise, rinse, and repeat” — but if Bitcoin crashes or cash runs dry, things could go sideways fast. Thankfully, for now, MSTR’s stock is still going strong with a 65% gain. But who knows for how long? 🤔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- How To Watch Tell Me Lies Season 3 Online And Stream The Hit Hulu Drama From Anywhere

2025-07-17 04:57