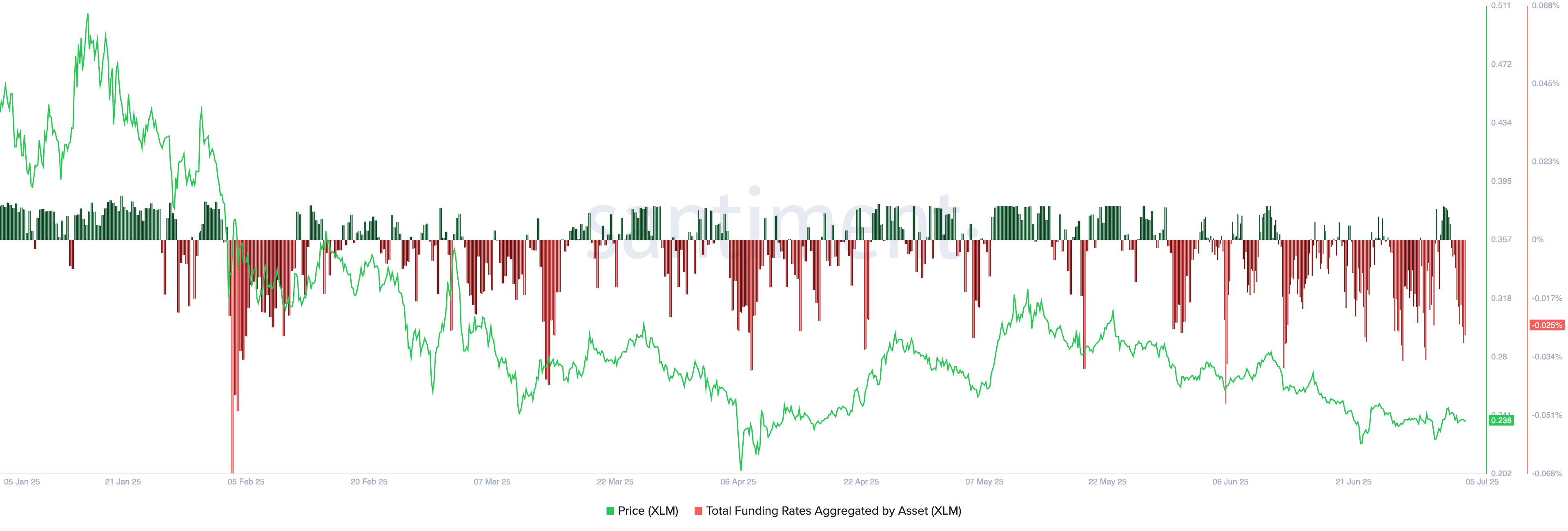

Oh, dear readers! The Stellar Lumens token is in quite the predicament, as its funding rate continues to decline, leaving our beloved XLM at risk of further downside. 😱

Despite strong on-chain growth—rising transactions, record stablecoin supply, and expanding real-world asset tokenization—Stellar Lumens (XLM) has plunged to a critical support level amid a sustained negative funding rate, suggesting growing bearish pressure. 🐻

If this support breaks, XLM could fall another 36%, underscoring the widening disconnect between network fundamentals and market sentiment. 📉

This week, Stellar dropped to the key support at $0.2175. That’s down by 35% from its highest point in May. It has also dropped by 62% from its 2024 high. 📉

XLM could be at risk of a steeper bearish breakdown as its funding rate crashed to its lowest level since June 30. It has remained in the negative zone on most days since May. 📉

Still, on the positive side, third-party data shows that the network is doing well. According to Artemis, the number of operations on Stellar rose to 197 million in June, while the stablecoin supply soared to a record high of $667 million.

Additional data indicates that the total value locked in real-world asset tokenization has risen to $487 million. It has jumped in the last five consecutive months, helped by the Franklin OnChain US Government Money Market Fund. 📈

Meanwhile, Nansen data shows that the number of transactions jumped by 11% in the last seven days to 18.2 million. The number of active addresses in the network rose by 10% to 146,700. 📈

XLM price technical analysis

The daily chart shows that the Stellar Lumens token price dropped to a key support level at $0.2175, a notable point that coincided with the lowest point in April, when most altcoins also plummeted. 📉

The support level was the lower side of the descending triangle pattern, a popular bearish continuation pattern. It has moved below the 61.8% Fibonacci Retracement level, where most rebounds happen. 📉

XLM price has dropped below the 50-day and 100-day Exponential Moving Averages. Therefore, a move below the lower side of the triangle will indicate further downside, with the next key level to watch being at $0.15, which is 36% below the current level. 📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-07-05 22:03