Well, friends, the crypto market’s been a mighty tempestuous sea these past 24 hours, leaving many a trader shipwrecked and adrift. The total crypto market cap, once a proud beacon, slipped 2%, now hovering ’round $2.68 trillion on that fateful Thursday, April 3rd. A day when the East’s financial markets traded with a heavy heart. 😢

Oh, the tales of woe! More than $490 million went up in smoke, victims numbering over 160k, mostly them long traders who thought they had the winds at their back. The grandest tale of misfortune involved a Binance exchange trade, ETH/USDT, gone awry to the tune of $12 million. 💸

The Great Troublemakers Behind Today’s Crypto Market Doldrums

Trade Tensions: The Trump Tariff Tsunami and Inflation’s Iron Grip

Now, let me tell you ’bout the “Make America Wealthy Again Event,” where President Trump laid down the law with a 10% tariff hike. Europe, BRICS nations, led by the mighty dragon China, and the land of gold South Africa felt the brunt. 🐉

Markets held their breath as the “Make America Wealthy Again Event” drew to a close.

Then came the White House’s list of tariffs, like a bolt from the blue, sending futures to a new low. The S&P 500, once a titan, now teetering on correction territory.

What does it all mean for us poor folk?

— The Kobeissi Letter (@KobeissiLetter) April 2, 2025

While the Trump administration might fill its coffers with $600 billion a year, experts predict inflation to rise like a phoenix, soaring to around 5%. 📈

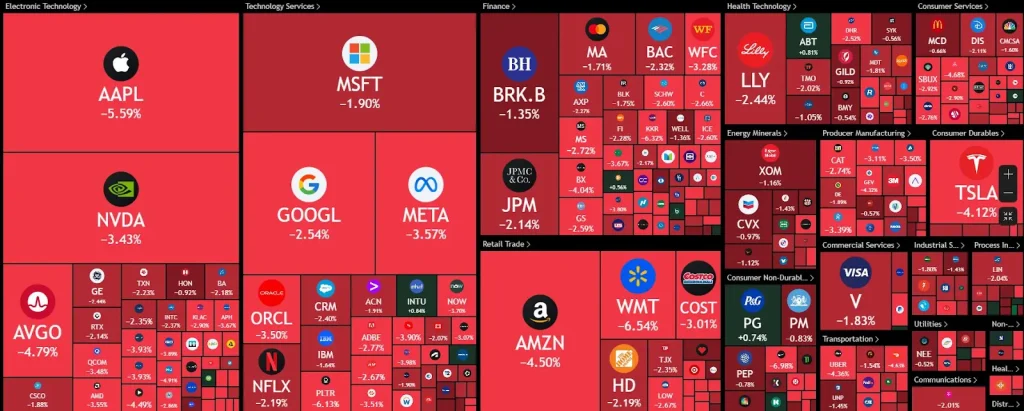

The Stock Market’s Heavy Sledgehammer

With crypto assets now bedfellows with the stock market, thanks to those deep-pocketed institutional investors and retail traders, the correlation grew stronger than ever. After Uncle Sam’s tariff tantrum, the S&P 500 futures lost $2 trillion in a mere 15 minutes. 😮

And so, the crypto market found itself in a bear’s den, facing a selloff storm, as the bears roared louder than the bulls could moo. 🐮

The Technical Fears: Bitcoin‘s Rising Wedge Woes

In recent days, Bitcoin, the king of cryptos, led the altcoin realm in a dance of doom, forming a rising wedge pattern in the four-hour time frame. When Bitcoin’s price was rejected above $87k, the writing was on the wall—a crypto correction loomed large, with Ethereum leading the charge. 🎩

Stay Ahead of the Crypto Chaos!

Don’t get left behind in the whirlwind of breaking news, expert analysis, and real-time updates on Bitcoin, altcoins, DeFi, NFTs, and more. It’s a wild ride, but we’ve got your back! 🛡️

FAQs

How’s the crypto market holding up today?

It’s down 2% to $2.68T, with $490M liquidated as volatility spikes due to U.S. tariffs, stock selloffs, and BTC‘s correction. A tale of woe, indeed.

What sparked Bitcoin’s recent price tumble?

Bitcoin formed a rising wedge pattern and faced rejection at $87K, triggering a market-wide correction led by Ethereum. The crypto king’s fall from grace.

How do stock market tremors affect crypto prices?

Crypto and stocks, tied together like Siamese twins; major selloffs in equities, like the $2T S&P 500 drop, often lead to crypto declines. When one falls, the other follows. 🔄

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-04-03 08:24