Imagine, if you will, a world not governed by the gentle chaos of chance, but by the cold, unyielding order of stablecoins—those curious digital tokens shackled like prisoners to the mighty dollar, yet promising to rewrite the very laws of finance itself. Citigroup, that ever-watchful oracle, dares to peer into the murky abyss of the future and proclaims a market cap that might swell to $1.6 trillion by 2030, or—in a feat akin to some madman’s fevered dream—an astronomical $3.7 trillion, should these coins catch fire among the masses.

One cannot help but feel the weight of this prophecy, delivered with the somber inevitability of a Dostoevskian tragedy, where blockchain is not merely a tool but a revolutionary force, poised to crumble the ancient institutions of finance and governance.

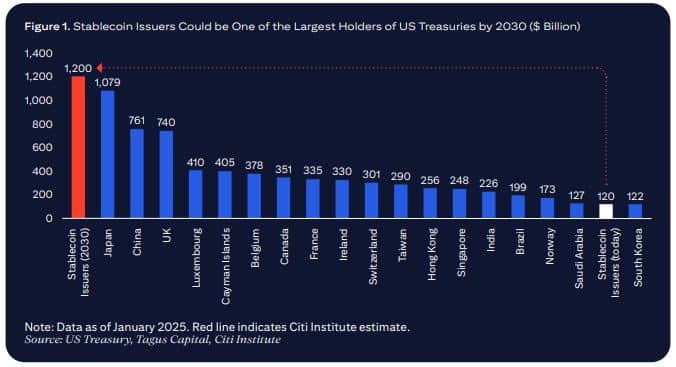

Stablecoins, these tethered specters of currency—like faithful dogs bound to the mast of the US dollar—have sprouted with a life and momentum that mocks the slow footed regulators. Citigroup suggests these spectral issuers may become the principal puppeteers of US Treasuries, commanding a staggering $1 trillion demand, all while backing their ethereal promises with cold, hard, and supposedly unshakable assets.

Even in the dreary year of 2024, Tether (USDT) stood proudly among the pantheon of US government debt holders. By next decade’s dawn, they imagine a kingdom ruled by stablecoins, where digital coins sway markets and, perhaps, sanity alike.

while other nations toy with their own digital currencies, like children showing off new toys, Citigroup bets that 90% of these stablecoins shall remain shackled to the almighty dollar—proof that even in the rebellion, the old empire casts a long, stubborn shadow.

Yet, dear reader, do not be lulled into complacency. Beneath this gleaming surface lurks chaos—nearly 2,000 moments in 2025 alone when stablecoins wobbled, slipping from their sacred $1 peg, like a drunken poet faltering on cobblestones. The collapse of Silicon Valley Bank was no mere hiccup; it was a warning from the abyss.

And what of those dark creatures—hacks, scams, technical failures? Like bandits in the night, they threaten to rob stablecoins of their promise, to drain money away from ancient banks and throw the financial order into disorder.

But governments, those slow-moving behemoths, are not idle. Behind closed doors, they whisper of blockchain’s broader uses—a ledger not just for coins, but for tracking subsidies, public spending, bonds, and even humanitarian aid. Here, the irony bites hard: a digital Doge leading the Department of Government Efficiency, the very avatar of bureaucratic toil.

- Tracking public spending with digital precision

- Disbursing subsidies to the restless masses

- Managing records that even memory would envy

- Issuing bonds to fuel dreams and debts alike

- Handling aid for those who need it most (or so they say)

- Constructing identities as fragile as smoke

The grand tale concludes with a solemn reminder (though one tinted with sardonic wit): stablecoins could synchronize money’s pace with the wild speed of the internet and global commerce, but only if the gods of regulation smile, and chaos is tamed into order. Ryan Rugg, the herald of digital assets, winks through the gloom, insisting that clarity in laws is the first step toward this brave new world.

One must wonder—will stablecoins be the heroes or the tragic jesters of finance’s next act? Either way, the show promises to be… unforgettable. 🎭💰

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-04-25 09:28