Ah, the capricious world of Solana, where the only thing more volatile than its price is the whimsy of its holders. As February 2026 unfurls its chilly tendrils, one cannot help but observe the crypto darling teetering on the precipice of either glory or ignominy. After a January that resembled a financial rollercoaster designed by a sadist, SOL now presents its devotees with a conundrum: is this consolidation the prelude to a triumphant ascent, or merely the calm before another plunge into the abyss?

The pain, my dear reader, is palpable. Price action, once the darling of network optimists, has cooled to a tepid indifference, while the broader markets oscillate with the predictability of a metronome on laudanum. Yet, beneath this veneer of ennui, on-chain whispers and ecosystem murmurs suggest that Solana may be metamorphosing into something… dare one say it?… structurally robust. How quaint.

Institutional Maturation: A Farce or a Triumph?

Meanwhile, the narrative has shifted-as narratives are wont to do-since the much-ballyhooed Firedancer validator client waltzed onto the mainnet stage in December 2025. No longer a mere theoretical curiosity, it is now the plaything of validators who, with all the enthusiasm of a cat chasing a laser pointer, are migrating stakes and diversifying clients. How charming. Single points of failure, it seems, are as passé as last season’s blockchain.

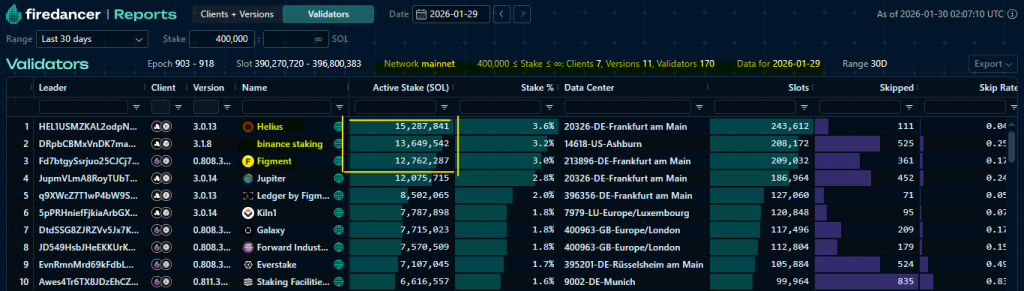

This transition, we are assured, is critical. Network resilience, that elusive siren, will only materialize when a supermajority deigns to participate. Progress, like a tortoise in a race against time, is steady if not swift. According to the oracles at “reports.firedancer.io,” 170 validators have joined the fray, with Helius, Binance staking, and Figment staking a collective 31.5 million SOL tokens. How very industrious of them.

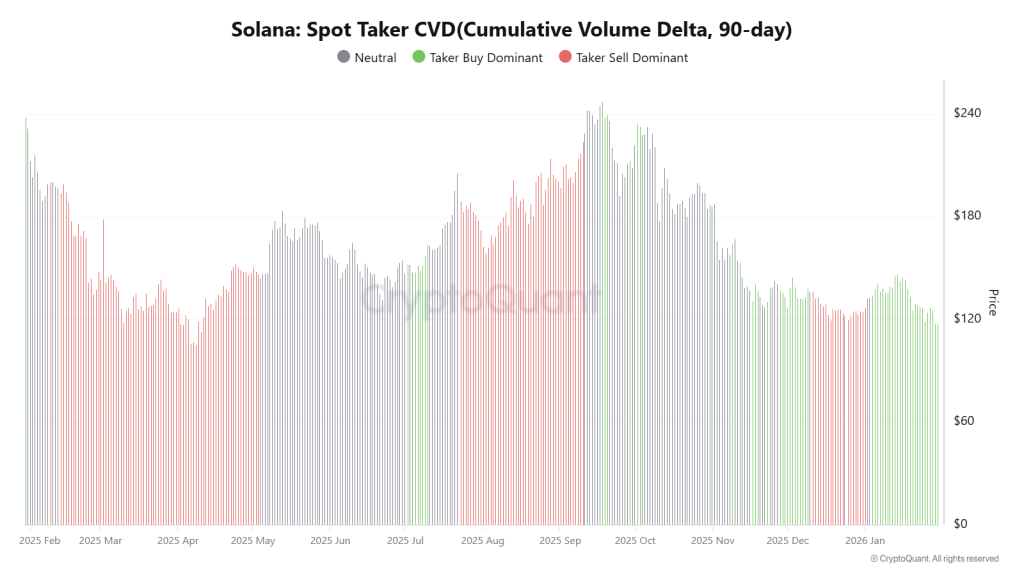

On-chain demand metrics, those fickle harbingers of fortune, paint a picture of taker buy-dominance since early January, even as prices flirted with disaster. History, that tiresome lecturer, suggests this alignment portends conviction-led accumulation rather than the panicked short covering of a cornered rat. The current red market conditions, one might posit, are but a shakeout-a dramatic flourish in the grand opera of crypto.

Ecosystem Expansion: More Than Mere Puffery?

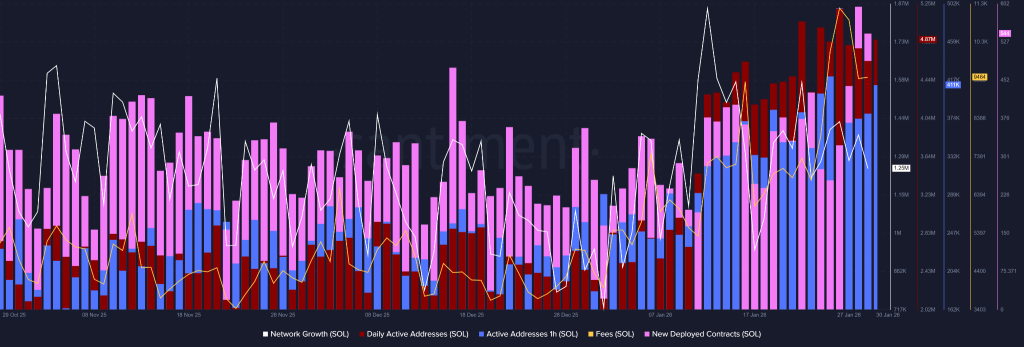

Yet, charts, those two-dimensional tyrants, tell but a fraction of the tale. Network growth data reveals a surge in new Solana addresses from 1.25 million to a peak of 1.86 million on January 12-a veritable stampede of onboarding. More astonishing still, daily active addresses executing SOL transactions soared to 4.87 million, nearly doubling since the dawn of January. How positively bustling.

From a revenue perspective, fees exceeded 11,000 SOL on January 26th, and by month’s end, hovered above 9,400 SOL-a doubling since January’s inception. This coincided with a surge in developer participation, as newly deployed Solana programs leapt from 226 to 544 in mere weeks. One can only assume these are not mere experimental contracts but the stuff of revolutionary applications. How thrilling.

Stablecoins, RWAs, and the Allure of Privacy

Stablecoin activity, that stalwart demand driver, has emerged as the belle of the ball. According to DefiLlama, USD1’s market capitalization surpassed $5 billion, with over $610 million circulating on Solana alone. Monthly growth of nearly 300% cements Solana’s position as the fastest-expanding USD1 chain-a preferred settlement layer, if you will. How très chic.

RWA tokenization by major funds and the launch of GhostSwap by GhostwareOS have introduced new capital flows and privacy-focused use cases. Together, these developments suggest an ecosystem of depth, not merely cyclical hype. How reassuring.

GhostSwap is now live.

A private cross-chain swap experience designed to let users move assets into Solana without exposing transaction metadata.

Built to extend privacy-preserving workflows for the Solana ecosystem.

– GhostWareOS (@GhostWareOS) January 29, 2026

Support and Resistance: The Dance of the Bears and Bulls

Structurally speaking, Solana faces levels as well-defined as a Waugh protagonist’s ennui. It may bleed more, or perhaps a liquidation grab with a long-wicked hammer candle will ensnare the bears. How deliciously dramatic.

One thing, however, is abundantly clear: the token’s current price is as misaligned with the ecosystem’s optimism as a debutante at a proletariat rally. The market, that great corrector of follies, will inevitably readjust, and when the noise subsides, a recovery rally shall emerge, lifting SOL from its undervalued state to something more befitting its aspirations. How poetic.

Support at $115-$120 remains the primary bulwark, though it teeters precariously. Should it falter, a secondary downside level near $105 awaits, should macro pressures resume their relentless march. On the upside, a sustained reclaim of $150 could herald a broader recovery phase, while $260 remains the longer-term extension zone for the intrepid accumulator.

In sum, this Solana price analysis presents a network in transition-a crypto phoenix, perhaps, awaiting its resurrection. February’s direction will hinge less on sentiment and more on whether infrastructure adoption and on-chain demand can sustain the charade of price resilience. How very Waugh.

Read More

- MLBB x KOF Encore 2026: List of bingo patterns

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Overwatch Domina counters

- Brawl Stars Brawlentines Community Event: Brawler Dates, Community goals, Voting, Rewards, and more

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Honkai: Star Rail Version 4.0 Phase One Character Banners: Who should you pull

- Gold Rate Forecast

- 1xBet declared bankrupt in Dutch court

- Lana Del Rey and swamp-guide husband Jeremy Dufrene are mobbed by fans as they leave their New York hotel after Fashion Week appearance

- Clash of Clans March 2026 update is bringing a new Hero, Village Helper, major changes to Gold Pass, and more

2026-01-30 18:22