Bitcoin and ether ETFs kicked off November with the grace of a drunk flamingo, losing over $320 million, while Solana ETFs were the only ones with a smile, raking in $70 million. Clearly, Solana is the new favorite at the crypto party, and Bitcoin is just trying to catch its breath. 🚀😭

Bitcoin and Ether ETFs Extend Red Streak With Solana Defying Outflow Trend

The week began with sharp contrasts across the crypto ETF landscape. Bitcoin and ether funds saw another wave of redemptions, while solana ETFs continued their ascent, reinforcing a growing narrative that investors are diversifying beyond the top two cryptocurrencies. Because nothing says “diversification” like throwing money at a coin that’s not Bitcoin. 🤷♂️

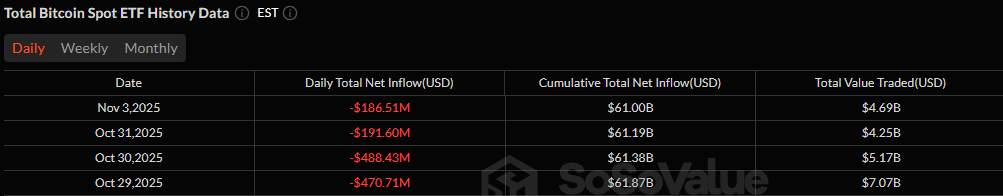

Bitcoin ETFs logged their fourth straight day of outflows, shedding $186.51 million in a quiet yet decisive session. All redemptions were concentrated in Blackrock’s IBIT, which bore the entire brunt of the day’s exits. None of the other 11 bitcoin ETFs saw any movement, marking an unusually one-sided trading day. Despite the low fund participation, total trading volume reached $4.69 billion, and net assets dipped to $143.51 billion, extending last week’s downtrend. Blackrock’s IBIT: The only ETF that’s ever been a “star” in a horror movie. 🎬

Ether ETFs followed a similar script, registering a combined $135.76 million outflow across six funds. Blackrock’s ETHA led the redemptions with $81.70 million, trailed by Fidelity’s FETH at $25.14 million. Grayscale’s ETHE and Ether Mini Trust lost $15.03 million and $5.07 million, respectively, while Bitwise’s ETHW and Vaneck’s ETHV closed out the session with smaller exits of $6.19 million and $2.64 million each. Trading volume stood at $2.51 billion, and net assets fell to $24.02 billion, reflecting cautious sentiment in the ether market. Ether: The crypto equivalent of a sad trombone. 🎺

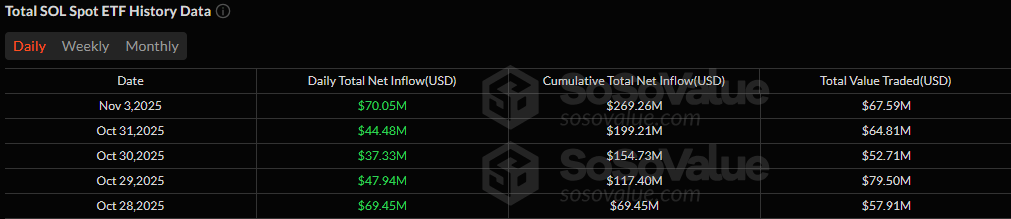

But the bright spot of the day belonged to solana ETFs, which continued their streak of green with a $70.05 million net inflow. Bitwise’s BSOL captured the majority at $65.16 million, while Grayscale’s GSOL added $4.90 million. The day’s trading volume reached $67.59 million, with net assets climbing to $513.35 million, a strong sign that investor enthusiasm for solana exposure remains undimmed. Solana: The crypto world’s version of a hype machine. 🔥

As traditional crypto ETF heavyweights face headwinds, solana’s steady inflows suggest that market attention is slowly but steadily expanding beyond bitcoin and ether. Because nothing says “market attention” like chasing the next big thing. 🕵️♂️

FAQ 💰

- Why did Bitcoin and Ether ETFs see heavy outflows to start November?

Investors pulled over $320 million from bitcoin and ether ETFs as cautious sentiment lingered after recent market volatility. Because nothing says “cautious” like panic. 😂 - Why are Solana ETFs attracting strong inflows?

Solana ETFs drew $70 million in new capital as investors diversify into high-growth Layer-1 assets beyond bitcoin and ether. Diversification: The art of spreading your bets so thin even a hedge fund would weep. 🥺 - Which funds led the ETF redemptions?

Blackrock’s IBIT and ETHA accounted for nearly all bitcoin and ether outflows, signaling profit-taking among large holders. Profit-taking: When your investments are doing so well, you just want to take a nap. 😴 - What does this shift mean for crypto markets?

The contrast between solana inflows and bitcoin-ether outflows highlights growing investor appetite for alternative blockchain exposure. Alternative blockchain exposure: Because Bitcoin is so 2020. 🙃

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Clash Royale Witch Evolution best decks guide

2025-11-05 03:08