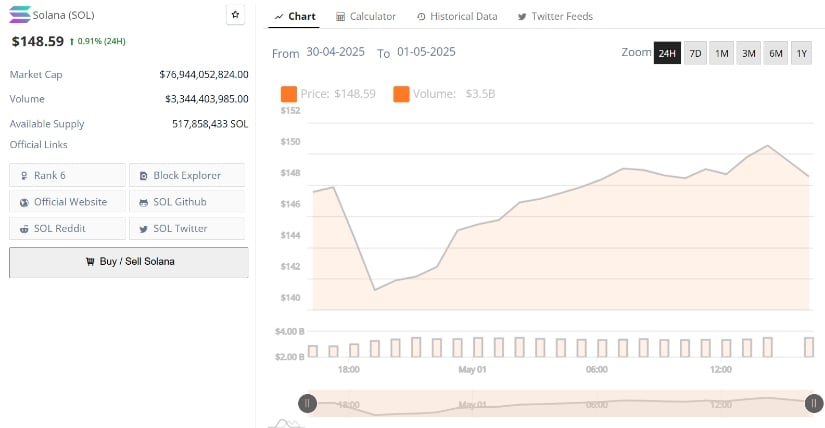

Observe Solana, that nimble, caffeinated sprite, pirouetting above $150 like a ballerina who just found her lost slipper. After a 30% flight from the valley of Mid-April Malaise, our mango-hued protagonist flutters with new-found élan—momentum billowing its skirts in every conceivable direction.

If, by twist or market mischief, SOL tiptoes past the shadowy $160–$165 corridor and waltzes toward $180, we may finally see what the chartist tribes call a “clean breakout.” Clean, in crypto, is always suspicious. The ETF rumor mill churns with operatic gusto, institutions are sniffing around with champagne flutes, and support near the lows is firmer than my conviction that Twitter memes move markets more than fundamentals. The Solana price prediction, once a soggy napkin in a rainstorm, is suddenly upright. Stranger things have happened—ask Luna, or my portfolio in 2022.

Enter, stage left, Mr. Eric Balchunas of Bloomberg: the academic oracle, announcing in dulcet, Bloombergian tones that Solana, Litecoin, and assorted index basket whatnots now have a 90% chance of ETF ascension in 2025. The gods smiled on Bitcoin and Ethereum first; now they offer Solana a golden ticket to Wall Street’s great casino, where every asset is welcome until it isn’t.

Should these celestial ETF gates actually swing open for Solana (big “if;“ angels may yet get stage fright), the narrative will undergo such a facelift that no Twitter avatar will recognize it. The price may erupt, ripple, slither—one can only hope the ride is less tumultuous than a lunch with Sam Bankman-Fried.

Solana’s Next High Wire Act: Can $180 Withstand the Weight of Hope?

Fresh from scraping its knee near $140, Solana now flexes its muscles, rehearsing its ascent. The crypto bard known as Owais claims, with all the flourish of a Nostradamus on-chain, that SOL has braced itself atop a confluence of moving averages—ready to bounce, or perhaps to sulk. Few remember March’s lows, though my therapist certainly does.

The chart, meanwhile, is a jungle of technical “levels.” The 50-day SMA curls demurely below at $133.69, blushing beneath the price. The 100-day and 200-day SMAs—at $159.72 and $181.24—loom above, resistance and promise in equal measure. If Solana muscles past $160 and finds itself robust above the 100-day…well, $180 is not an impossible dream, merely a probable nightmare for short sellers.

Bollinger Bands on the 4-hour chart are pinching tighter than a miser at a strip club. This compression, the sort that excites chartists and induces migraines in mere mortals, often prefaces an eruption. Should volume return and support hold steady, a new chapter—no, a novella!—may be written.

Perps: The Adult Playground, Population Increasing 🕺

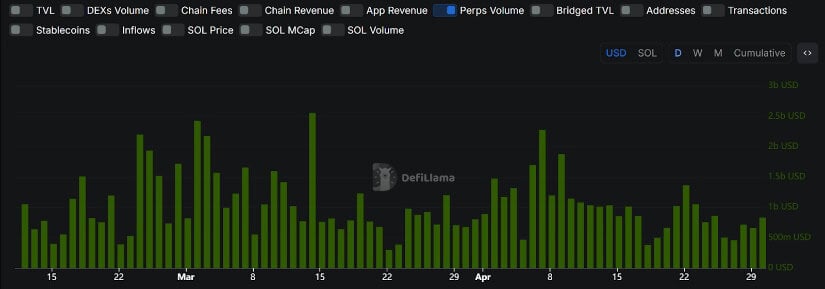

Even as price consolidates, ETF soothsayers whisper, and Twitter does… whatever Twitter does, Solana’s perpetual volume refuses to nap. DeFiLlama’s handiwork reveals a perpetual traffic jam across March and April. Supposedly, this means genuine market interest. Or perhaps traders just fear missing out on another moonlit frolic.

Daily spot trading volume still hums agreeably between $4B and $6B—Paltry? Titanic? Depends who you ask. Either way, January’s volcanic highs have cooled, but activity clings to its base like a barnacle on the hull of a blockchain yacht.

Sentiment: Last to the Party, First to Complain

Remarkably, as ETF speculation froths and perpetuals dart about, Solana has quietly surged 20% in a month, accompanied by a silence so profound even my notifications weep. SlumDOGE Millionaire, who knows a thing or two about chasing tails, observes that the social mood remains as limp as a forgotten NFT. History suggests such disconnects resolve, usually as institutions tiptoe in, building their positions while retail investors are distracted debating whether dogs or frogs should lead the next memecoin cycle.

Postlude, or: Don’t Say You Weren’t Warned

Market chatter may be muted, but the charts—and the capital—are whistling a different ditty. SOL grinds above $140, ETF anticipation simmering, peril and promise mingling like gin and vermouth. Should $160 be breached in force (with a coy glance at the 100-day SMA), momentum could ignite. The real crucible sits just above, near the 200-day SMA at $181; should our hero leap this hurdle, who knows? Maybe Solana will finally send its users something better than “network busy” notifications.

Keep half an eye on trading volume and any suspiciously robust move in the $160–$165 enclave. If sentiment wakes from its nap and remembers to shout, as SlumDOGE Millionaire hopes, Solana may discover new peaks—until the next plot twist, of course. Crypto never lets you die of boredom. 🕵️♂️🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-05-02 15:28