Solana, having exhibited a rise of seven per cent in the past twenty-four hours, in concert with the general market’s recovery, doth present a semblance of promise. However, should one delve into the intricacies of technical and on-chain data, it becomes apparent that this coin may encounter resistance of a most significant nature.

Notwithstanding this recent dalliance with prosperity, SOL doth risk the shedding of these gains, and mayhap descend below the mark of one hundred dollars, should bearish inclinations hold sway. One shudders to think! 😱

Solana’s Price Surge: A Deficiency of Momentum

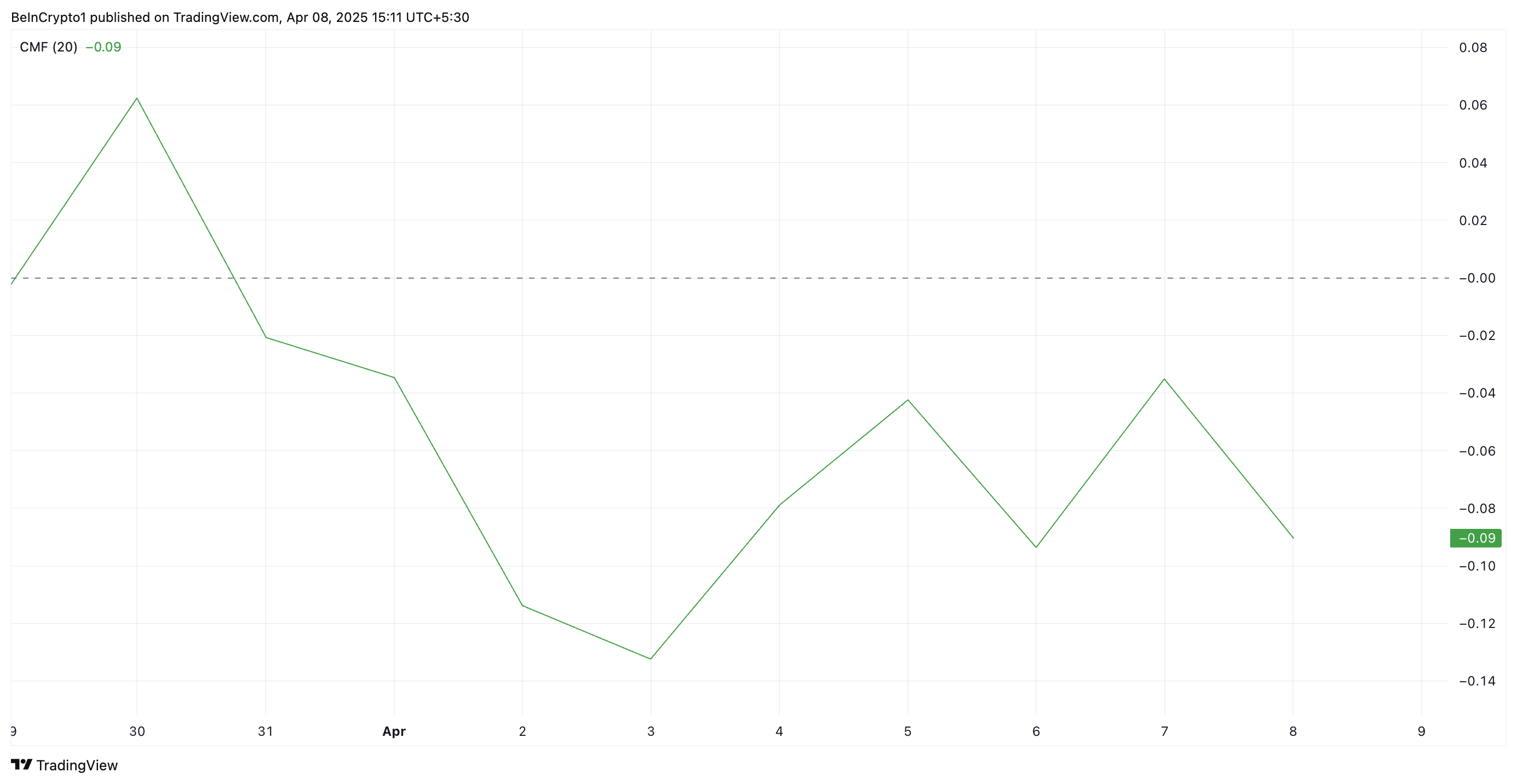

Though outwardly impressive, SOL’s current rally doth reflect the wider market’s whims rather than a genuine partiality for this altcoin. The bearish divergence, as evinced by its Chaikin Money Flow (CMF), doth exemplify this most aptly.

At the present moment, SOL’s CMF lingers below the zero line at a paltry -0.09, which doth indicate a lamentable lack of buying momentum amongst those who dabble in the SOL market. One might even call it a trifle discouraging. 😒

The CMF indicator, as it is known, doth measure the ingress and egress of money from an asset. A bearish divergence doth emerge when the CMF is found to be negative whilst the price doth ascend. This divergence doth signal that, despite the upward trajectory, selling pressure doth outweigh buying interest, which doth suggest a feebleness in bullish momentum.

This doth intimate that SOL’s present price rally may lack the fortitude to endure and could be at risk of reversing or, worse, stalling altogether, as new demand remains woefully scarce. One trembles at the prospect! 😨

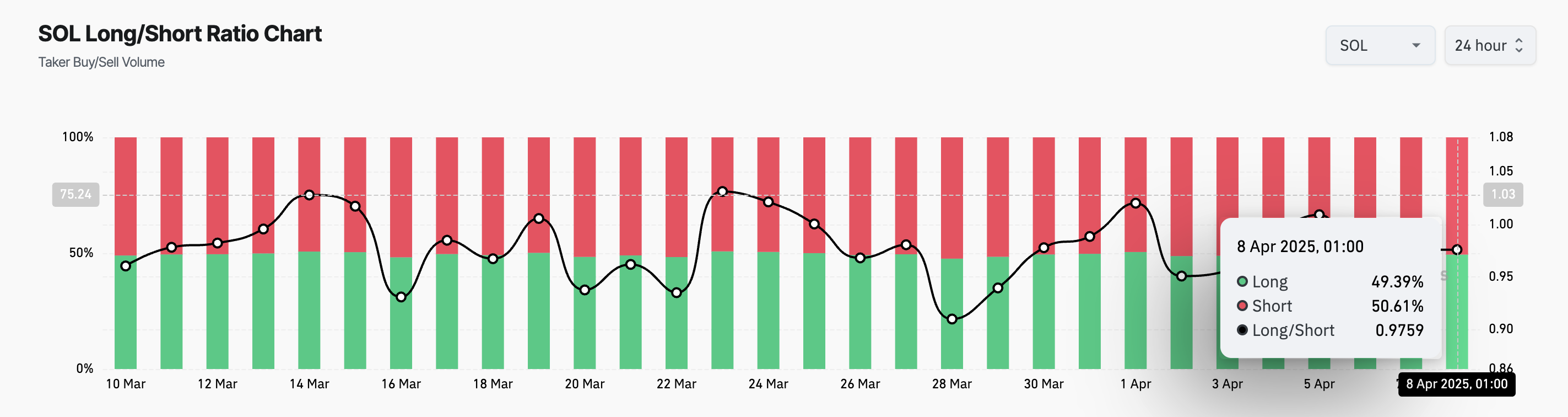

Furthermore, the coin’s long/short ratio doth highlight that those who partake in this market lean heavily towards the short side. At this juncture, it stands at a mere 0.97.

The long/short ratio doth measure the equilibrium between long positions (those who wager on price increases) and short positions (those who wager on price decreases) in the market. When this ratio skulks below zero, as it doth here, it doth indicate a preponderance of short positions over long.

This doth suggest that bearish sentiment remains dominant in the SOL market, and its futures traders are anticipating a decline in the asset’s value. A most unsettling premonition, indeed! 😟

Solana in a Crucial Predicament: Will Ninety-Five Dollars Endure, or Lead to a Further Descent?

During the intraday trading session of Monday last, SOL did plummet to a twelve-month nadir of ninety-five dollars and twenty-six cents. Though it hath since rebounded, trading at one hundred and eight dollars and seventy-seven cents at present, the lingering bearish bias doth leave the coin vulnerable to relinquishing these gains. One can scarcely bear to contemplate such a misfortune! 😫

Should SOL befall a pullback, it may breach the support at one hundred and seven dollars and eighty-eight cents. And if it should further descend below one hundred dollars, the coin’s price could tumble towards a paltry seventy-nine dollars. Heaven forfend! 🙏

On the contrary, should the uptrend persevere, buoyed by a surge in new demand, SOL’s price could breach the resistance at one hundred and eleven dollars and six cents and ascend towards a more respectable one hundred and thirty dollars and eighty-two cents. One dares to hope! 🤩

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Wuthering Waves Mornye Build Guide

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

2025-04-08 19:31