The potential approval of a Solana staking ETF in the US is becoming the center of attention, much like a particularly interesting cheese at a mouse convention. 🧀🐭

Combined with the fact that major “treasuries” are hoarding SOL like dragons with gold and technical signals continue to point upwards (because, let’s face it, charts love going up until they don’t), Solana stands on the verge of a new breakout cycle-or, alternatively, a spectacular pratfall. Either way, it’ll be entertaining.

SOL ETF Expectations (Or: How to Lose Friends and Influence Regulators)

As October looms-spookier than a ghost in a spreadsheet-the crypto market’s spotlight shifts toward Solana (SOL) and several other altcoins that may or may not be backed by actual magic. Analyst Nate Geraci, a man who presumably owns at least one suit, suggested that the SEC might approve Solana staking ETFs. Because nothing says “financial revolution” like filling out paperwork.

“Enormous next few weeks for spot crypto ETFs…” Nate Geraci noted, presumably while sipping coffee and wondering if he should’ve become a llama farmer instead.

If this actually happens (big “if”), Solana could replicate Ethereum’s ETF-induced price bump-or, alternatively, become a cautionary tale about what happens when hedge funds discover memecoins. Either way, institutional money will flow in, the circulating supply will tighten like a corset at a Victorian ball, and Solana will either moon or become a very expensive screensaver.

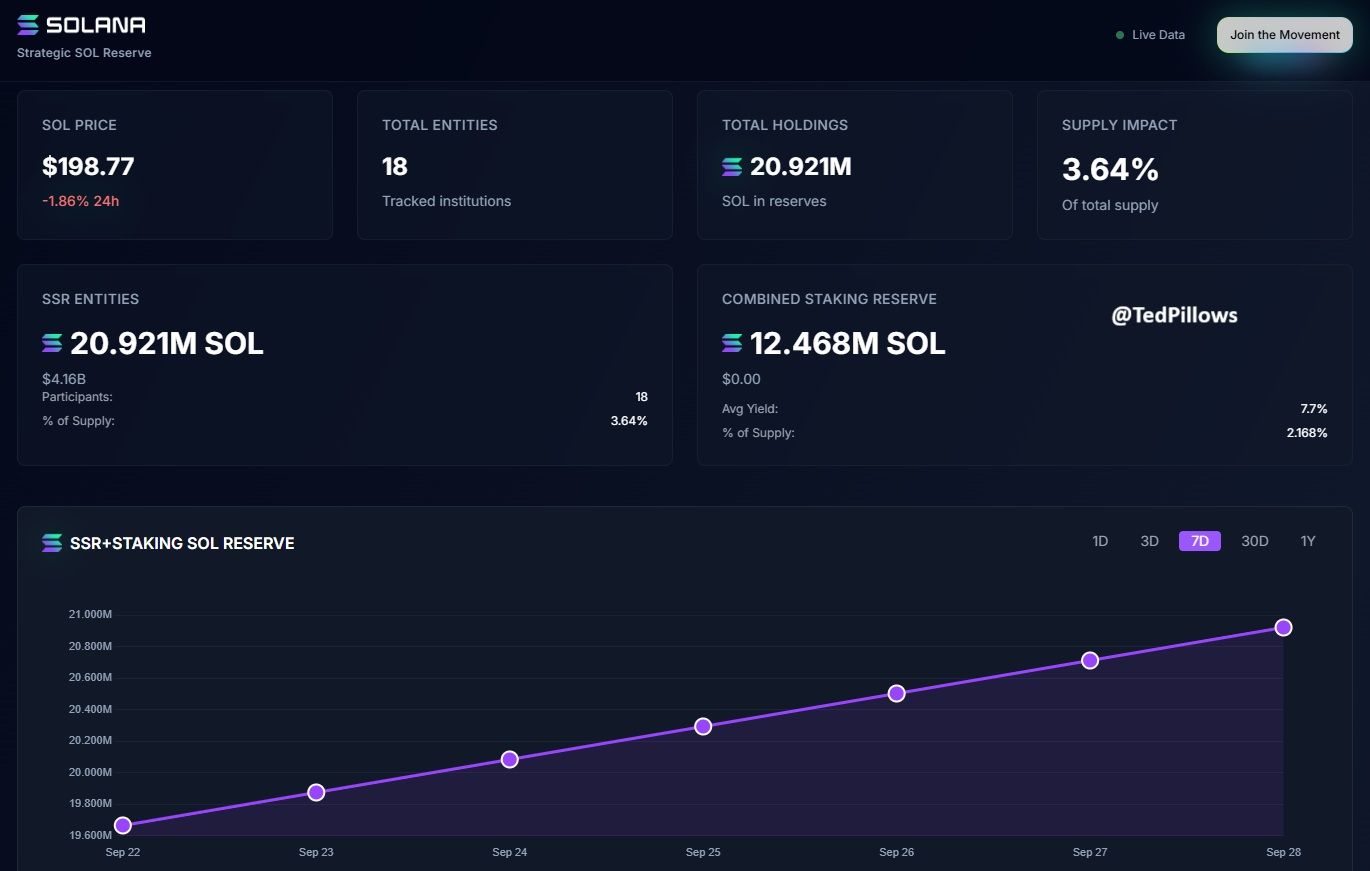

Meanwhile, Forward Industries is sitting on 6.8 million SOL like a very nervous hen on a golden egg. Treasury companies collectively hold over 20.9 million SOL, which is roughly 3.64% of the total supply-or, as mathematicians call it, “enough to panic-sell and crash the market.”

These numbers suggest institutions have confidence in Solana-or, at the very least, they’ve run out of other things to gamble on. If an ETF gets approved, expect more money to flood in, because nothing attracts capital like government-approved speculation.

Technical Analysis: The Chart Whisperers Speak 🧙♂️📈

Technically speaking (which is different from speaking technically), SOL recently dipped below $200, causing traders to clutch their pearls and mutter things like “retest” and “parallel channel uptrend” while nervously eyeing their leverage.

“Looks like a perfect bounce opportunity before we head back to $260+ and eventually new highs. Buy the dip,” one analyst remarked, moments before the market did something entirely unpredictable.

Another analyst-let’s call him “Optimistic Dave”-observed that SOL is holding ascending support, which is trader-speak for “it hasn’t crashed yet.” He predicted $300 as the next target, because round numbers make people happy.

Meanwhile, Wyckoff accumulation theorists believe we’re in the “last big dip” before Q4 rally season, which is either brilliant insight or wishful thinking. (Spoiler: It’s probably both.)

SOL is currently “oversold,” which either means it’s a bargain or it’s about to become even more of a bargain. Experts remain optimistic, because pessimism doesn’t get retweeted. That said, Solana’s on-chain activity slowed in September, threatening its four-year streak of “winning Septembers,” which sounds like a sports stat but is actually just crypto being crypto.

At press time, SOL is trading at $210.21, up 4.2% in 24 hours-because in crypto, even the numbers are memes. 🚀📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-09-29 11:37