Markets

What to know:

- Bitcoin‘s volatility has stabilized, which is just a fancy way of saying it’s chilling out while silver’s volatility has skyrocketed due to supply constraints and increased demand. You know, the usual drama.

- Silver’s price has soared over 1575% this year. Why? Because apparently everyone wants to save the planet with green technologies while China is playing hard to get with export restrictions. Talk about a crush!

- Bitcoin remains languidly perched below its record high, as traders shake their heads at fading demand for spot ETFs. It’s not you; it’s me, says Bitcoin. 🙄

So, there we are-Bitcoin and silver are having a very public showdown as 2025 rolls in, with volatility data revealing that one asset is on a wild ride, while the other seems content to sip piña coladas by the pool.

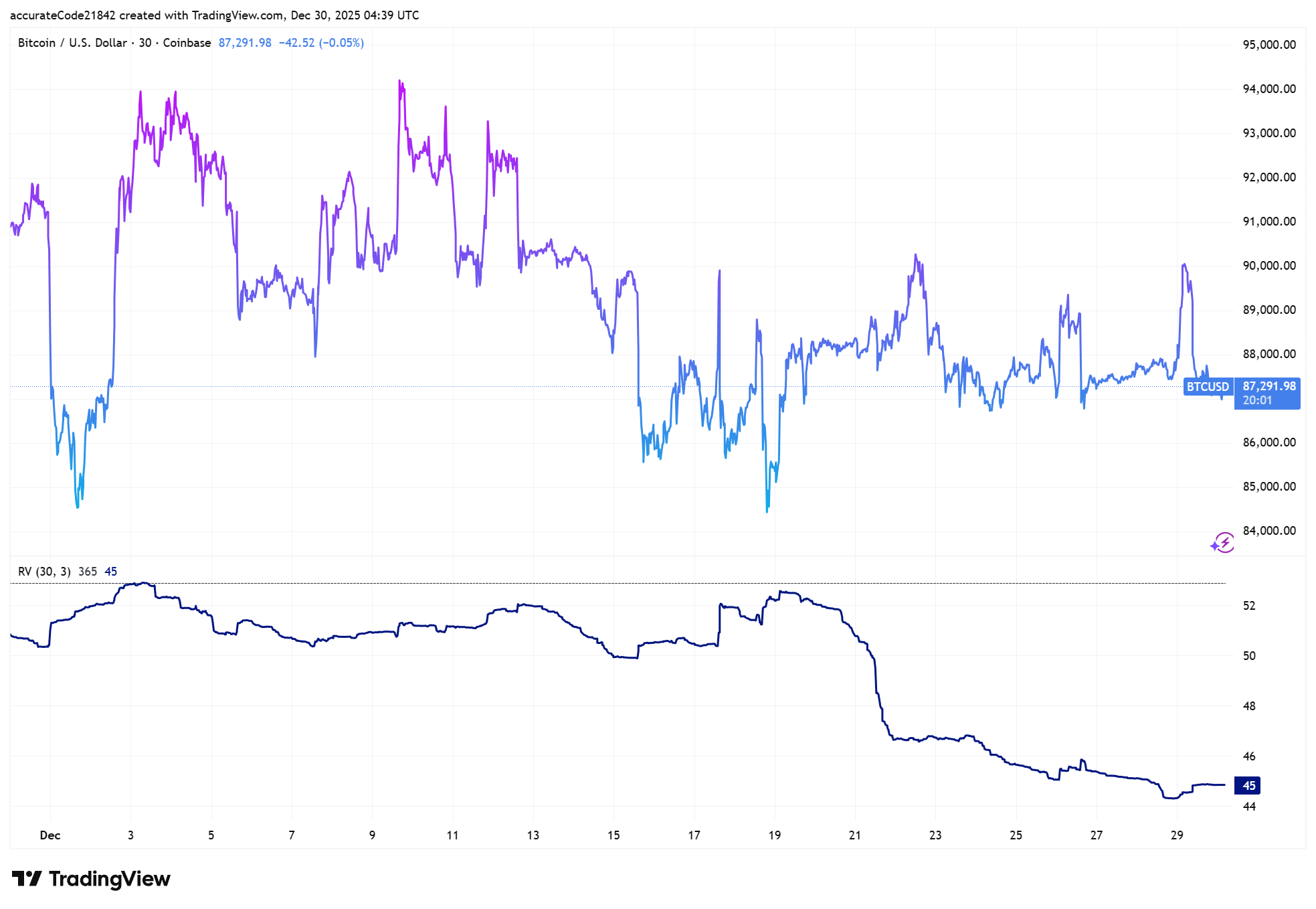

In the last month, bitcoin’s annualized 30-day realized volatility has squeezed itself into the mid-40s, reflecting a market that’s firmly stuck in neutral. At 45%, that’s still a snooze fest compared to silver, the shiny star of industrial metals.

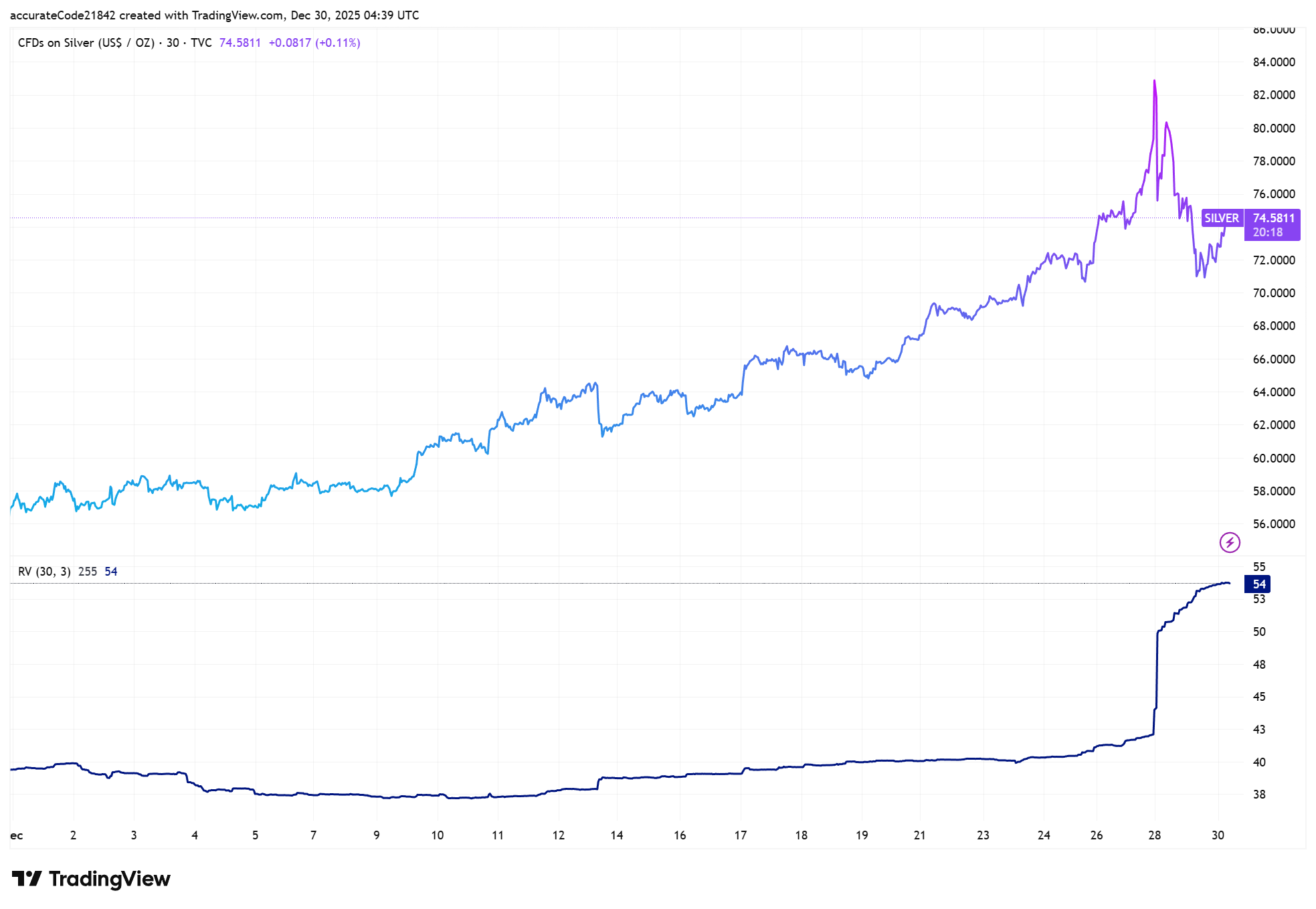

Now, for a metal that’s supposed to be “semi-precious,” silver is throwing quite the tantrum. Its realized volatility has shot up to the mid-50s, spurred on by a sharp rally and some serious stress in global bullion markets. Who knew silver could be so dramatic?

This divergence in volatility is as clear as day: silver is flexing its muscles with a 151% increase this year, while BTC is sulking with a nearly 7% drop. A classic case of “you had one job!”

So what’s behind silver’s meteoric rise? A little thing called supply-demand mismatch. With solar panels and electric vehicles requiring more silver than a cat needs naps, supply just can’t keep up. It’s like trying to fill a bathtub with the drain open-good luck with that!

To add to the chaos, China’s decided it’s time for a silver export license, effective January 1. It’s like they’re throwing a wrench into the plans of every silver enthusiast. Prices in Shanghai and Dubai have been flirting with $10 to $14 above COMEX. So romantic!

Meanwhile, the London forward curve is slipping into steep backwardation. Sounds technical, but basically, it means there’s an immediate scarcity even as futures markets play it cool. Silver really knows how to keep us all on our toes.

Bitcoin, on the other hand, is lounging nearly 30% below its October record high. Traders are blaming everything from waning interest in spot ETFs to the fact that nobody really wants to dance anymore. The Oct. 10 crash? Just a bad breakup!

QCP Capital chimed in, noting that bitcoin’s price action looks more like a mechanical failure than a heartfelt change in sentiment. Holiday-thinned liquidity has turned into a party pooper, amplifying all those short-term moves while last week’s large options expiry left traders with a half-hearted enthusiasm.

About 50% of open interest rolled off after expiry. It’s like everyone went home early from the party, leaving behind a lot of awkward silence and reluctance to make any bold moves.

Prediction markets are reflecting this split personality. On Polymarket, where they’re betting on silver prices, optimism runs high, with little worry about a dramatic collapse. But Bitcoin? Well, traders predict it will mostly stay within its cozy range, with a mere 70% chance it’ll hover above $86,000 through early January. The odds of breaking above $92,000? Let’s just say it’s not looking great.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- ‘SNL’ host Finn Wolfhard has a ‘Stranger Things’ reunion and spoofs ‘Heated Rivalry’

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- M7 Pass Event Guide: All you need to know

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-12-30 10:43