In the realm of digital currencies, a curious spectacle unfolded between February 9th and 13th-a performance as divided as the opinions on a well-cooked borscht. The illustrious bitcoin and ether, whose reputations once soared like larks, found themselves beset by heavy net outflows, while the underdogs, XRP and solana, reveled in unexpected gains. This week revealed a striking divergence in the positioning of investors across the grand tapestry of digital assets.

The ETF Divide Deepens as Altcoins Defy Bitcoin Weakness

The second week of February unfolded with all the drama of a Tolstoy novel-a veritable tug-of-war. Early inflows sparked flickers of hope, yet midweek selling pressure, like an unwelcome guest, defined the narrative, particularly for bitcoin and ether.

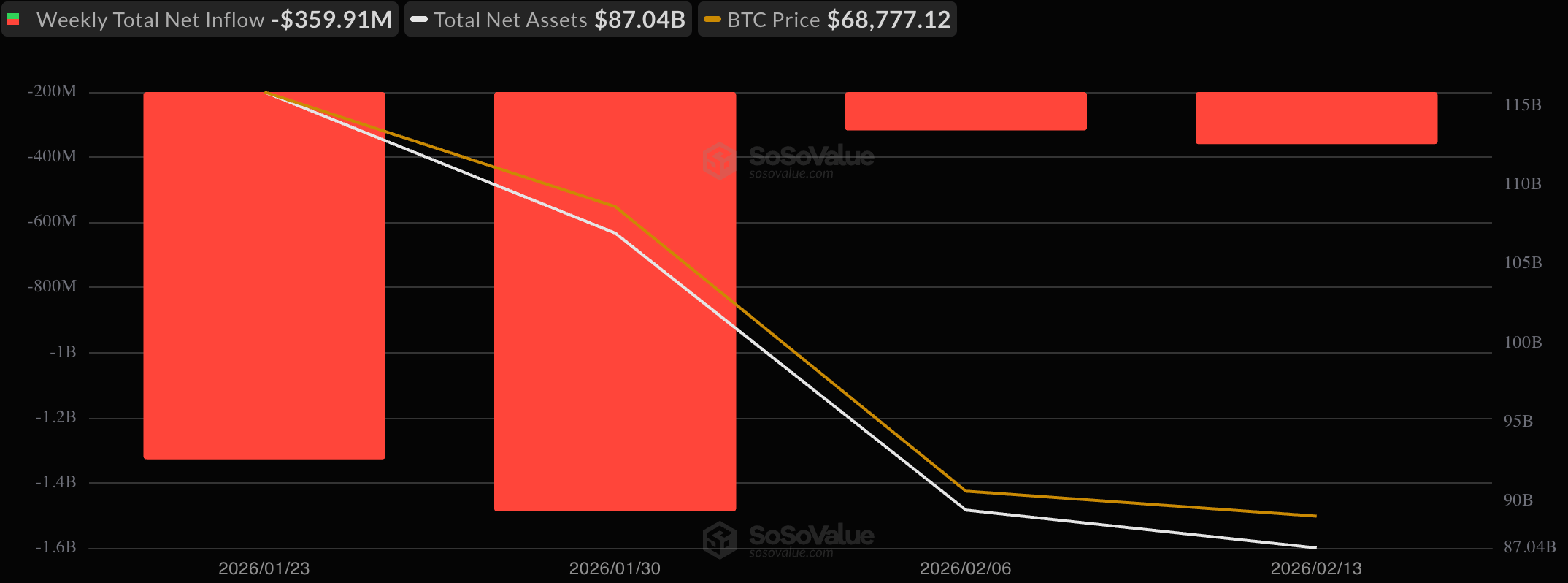

By the week’s end, the beleaguered bitcoin ETFs closed with a staggering $359.91 million in net outflows. One could almost hear the lamentations echoing through the halls of finance as Blackrock’s IBIT weathered a relentless storm of withdrawals, starting with a modest $20.85 million on Monday, and culminating in a cacophony of losses that would make even the most stoic of investors weep-$73.41 million on Wednesday, $157.56 million on Thursday, and a parting gift of $9.36 million on Friday, punctuated only by a glimmer of $26.53 million inflow on Tuesday. Thus, the fund found itself down approximately $234 million for the week, a feat that could only be described as tragicomic.

Fidelity’s FBTC danced dramatically, beginning with a promising $3.08 million inflow before plummeting to losses of $92.60 million and $104.13 million midweek, before recovering with a paltry $11.99 million on Friday, leaving a net loss of about $124 million. Grayscale’s GBTC finished its performance down roughly $77 million, while Ark and 21shares’ ARKB lost close to $19 million. Smaller players, BITB, HODL, EZBC, BTCO, and BRRR, all ended in negative territory, while Grayscale’s Bitcoin Mini Trust shone briefly as one of the few bright spots, posting net weekly inflows of approximately $7 million, like a lone sunflower amidst a field of wilted daisies.

Ether spot ETFs fared slightly better, with $161.15 million in weekly outflows. Blackrock’s ETHA led this parade of losses, with cumulative redemptions surpassing $112 million, while Fidelity’s FETH shed a respectable $40 million across various sessions. Grayscale’s ETHE posted a negative exit of $24.90 million, though its Ether Mini Trust saw an influx of $49.90 million, proving that even in despair, hope can bloom. Bitwise’s ETHW (-$32.82 million) and 21Shares’ TETH (-$2.88 million) conspired to deepen the drawdown, and despite a few fleeting inflow days, ether finished the week firmly entrenched in the red.

Meanwhile, XRP spot ETFs conjured a different fate, delivering $7.65 million in net inflows. Franklin’s XRPZ ($5.42 million) and Bitwise’s XRP ($3.92 million) consistently attracted capital, akin to moths drawn to a flame, while Canary’s XRPC added incremental gains. Grayscale’s GXRP experienced midweek volatility but ultimately failed to derail the broader positive trend. Thus, XRP quietly emerged as one of the week’s steadiest performers, much to the chagrin of its more illustrious counterparts.

Solana spot ETFs displayed a commendable performance with $13.17 million in net inflows, the strongest showing among major crypto ETFs. Bitwise’s BSOL ($12.72 million) accounted for most of these gains, maintaining steady buying throughout the week, while Fidelity’s FSOL and Invesco’s QSOL provided much-needed support, and minor outflows from Vaneck’s VSOL did little to hinder their momentum.

Ultimately, the week painted a portrait of clear divergence: Bitcoin and ether bore the brunt of heavy institutional selling, while XRP and solana attracted selective capital. It seems that investors are not retreating but rather rotating within the grand theater of the crypto ETF market, like a dance of the desperate yet hopeful.

FAQ 📊

- Did bitcoin ETFs lose money this week?

Indeed, bitcoin spot ETFs recorded roughly $360 million in net outflows from February 9th to 13th, a number that might make one question their life choices. - How did ether ETFs perform?

Ethereum spot ETFs saw about $161 million in cumulative outflows during the week, as if the universe was conspiring against their success. - Which crypto ETF category performed best?

Solana ETFs led the pack with approximately $13 million in net inflows, becoming the toast of the town amidst a sea of disappointment. -

Were XRP ETFs positive overall?

Yes, XRP spot ETFs posted around $7.6 million in net inflows for the week, proving that even in turbulent waters, some boats still float.

Read More

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- eFootball 2026 is bringing the v5.3.1 update: What to expect and what’s coming

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- Country star Thomas Rhett welcomes FIFTH child with wife Lauren and reveals newborn’s VERY unique name

- Decoding Life’s Patterns: How AI Learns Protein Sequences

- Mobile Legends: Bang Bang 2026 Legend Skins: Complete list and how to get them

- Denis Villeneuve’s Dune Trilogy Is Skipping Children of Dune

- Peppa Pig will cheer on Daddy Pig at the London Marathon as he raises money for the National Deaf Children’s Society after son George’s hearing loss

- Gold Rate Forecast

- Are Halstead & Upton Back Together After The 2026 One Chicago Corssover? Jay & Hailey’s Future Explained

2026-02-16 20:27