Avalanche Price Today

| Cryptocurrency | Avalanche |

| Token | AVAX |

| Price | $26.7729 2.90% 2.90% |

| Market Cap | $ 11,305,545,194.04 |

| 24h Volume | $ 1,054,619,487.1856 |

| Circulating Supply | 422,275,285.4892 |

| Total Supply | 457,277,985.4892 |

| All-Time High | $ 146.2179 on 21 November 2021 |

| All-Time Low | $ 2.7888 on 31 December 2020 |

Oh, the divine mischief of the market! Avalanche finds itself in a delightful frolic, ambling along with a gaiety of 4% since yesterday, now perched at the elegant price of $26.94. Its market valuation pirouetted up to a staggering $11.37 billion, while the trading volume erupted like an unexpected sneeze, skyrocketing nearly 44% to $1.02 billion. With its daily dance floor ranging from $25.67 to a fanciful max of $27.05, our dear AVAX is charming both regular folks and those with crested hats and wallets fat enough for a feast!

But lo! This extravaganza of price surges is not happening in a vacuum. No, my friends, ETF speculation is stirring like a pot of borscht on a chilly evening, and Avalanche’s network activity is breaking records faster than one could say “Prokofiev!” Let us peel back the layers of this enigma, my dear comrades, and delve into the realms of on-chain wonders and enticing charts.

On-Chain Activity

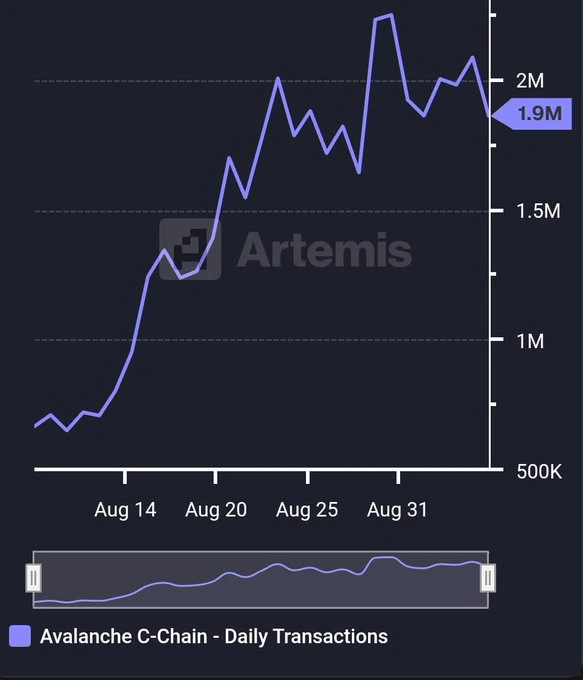

In a most serendipitous turn of events, Avalanche has taken great strides of improvement over the past month. In a recent dispatch from the land of AVAX, the C-Chain processed a staggering 35.8 million transactions in August, setting records that would make even the most passive sloth weep. While daily transactions have tripled-yes, tripled!-to 1.9 million in just the last 30 days. Such an impressive spectacle suggests that developers and enterprises are holding hands with Avalanche, likely singing songs of adoption. For example, Toyota’s factory of blockchain dreams is already at work testing vehicle finance solutions upon this snowy canvas.

Meanwhile, RWA volumes have surged like a curious raven in flight, climbing 58% month-over-month! Ah, Avalanche’s aim for institutional utility is as clear as a moonlit night. However, let not our hearts be too light-active addresses have dipped by a cheeky 10% last week, a subtle signal of waning retail interest. This whimsical combo of burgeoning enterprise appetite and shrinking small-holder enthusiasm may add a sprinkle of chaos to our joyously rollercoaster price adventure.

And then, another delightful development: a $300 million increase in AVAX’s stablecoin supply over the last week! This towering refreshment is second only to Ethereum, creating a liquidity fountain that translates to more on-chain buoyancy. One might say it’s like adding whipped cream to one’s coffee-it simply invites more delightful indulgence!

AVAX Price Analysis

Turning our gaze to the esteemed AVAX tradingview chart, one could sense that fortune favors the brave. The token has jubilantly smashed its way above the 23.6% Fibonacci retracement at $25.64, and now dances above the critical moving averages. Take note: the 7-day SMA is at $24.88, while the 30-day SMA is trailing behind like an overly cautious aunt at $24.29.

Simultaneously, the MACD histogram has flipped to a cheerful positivity, while the RSI-14 struts its stuff at 75.24, which may cool down like a prancing horse mid-race, but fear not-the broader trend looks splendid indeed.

Keep your peepers peeled, dear scholars, for the next striking resistance is the illustrious 127.2% Fibonacci extension sitting rather comfortably at $27.89. Should our chummy AVAX breach this barrier, it may find itself gleefully summoning the mythical $30 milestone. On the contrary, should it falter, support awaits at $25.64 and $24.29, aligning harmoniously with our friend Fibonacci’s levels and moving averages.

FAQs

Why is AVAX price going up right now?

AVAX is ascending amidst the rising speculation regarding ETFs, a robust stablecoin supply, and a hurricane of on-chain activity-35.8 million transactions in August alone!

What’s the next resistance level for AVAX?

The next key resistance is awkwardly perched at $27.89, the 127.2% Fibonacci extension. If it pops, AVAX could set its sights on $30 with glee!

Is Avalanche adoption growing?

Yes indeed! With daily transactions nearly tripling in only thirty days and RWA volumes jumping 58%, there’s a palpable thrust toward enterprise and institutional enthusiasm.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-09-10 14:56