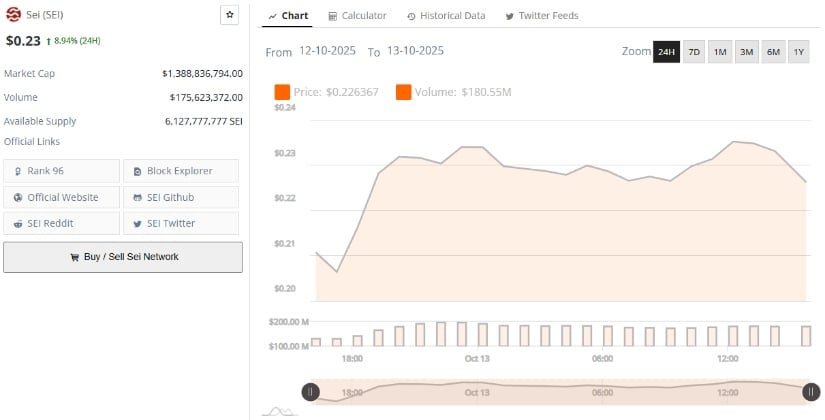

Ah, yes, the moment we’ve all been waiting for! Despite a brief and rather laughable 8.94% rebound-oh, the excitement!-taking SEI to a glittering $0.23, analysts are still warning us with their best “you’re not out of the woods yet” voices. The asset’s open interest, price structure, and all those fancy technical signals still scream “uncertainty,” as traders nervously eye the looming $0.16 range. We’re all just waiting for the inevitable, aren’t we?

Open Interest Data: The Grand Reset of Derivatives

Now, let’s talk open interest, because who doesn’t love a good liquidation panic? This week, SEI’s open interest dropped faster than your last “get rich quick” scheme. The latest tally stands at around $63 million, a significant drop from over $160 million just a few weeks ago. It’s almost like watching a market-wide exit, as leveraged traders flee for the hills, taking their dreams of infinite returns with them.

This sharp contraction tells us that all the speculative capital has pretty much been flushed down the toilet. What’s left? Mostly spot buyers and those sweet, sweet short-term swing traders who seem to thrive on chaos. And let’s not forget the price wick that sent SEI below $0.15 for a brief moment of pure horror-perfect for clearing out those overleveraged positions before the token found some semblance of stability in the $0.21-$0.23 zone. Progress, right?

There’s been a tiny rebound in open interest, but let’s not get too excited. Low leverage means hesitation-like a deer caught in the headlights. If open interest keeps rising without another ugly sell-off, we might, just *might*, see the bottom. But for now, we’re stuck in a fragile market, where the only thing holding it all together is hope (and that’s not worth much).

Market Data: A Rally That Feels Like a Dream

According to BraveNewCoin, SEI’s market cap is still sitting at a cool $1.38 billion, with $175 million in 24-hour trading volume. It’s even posted a modest 8.94% daily gain-good for you, SEI! Yet, let’s not forget it’s down 38% in the past month and 31% in the last week. But hey, who’s counting, right?

Despite a few brave traders buying up some of the crumbs at these levels, market sentiment remains as mixed as ever. The $0.22-$0.24 resistance zone is now the battlefront. If SEI manages to close above this range, we could see a short-term rally-just don’t hold your breath. Volume returning to the DeFi sector might make this rally last longer than a week, but don’t count on it.

If the bears wake up from their nap, we’ll be looking at the $0.19 support level next, with further downside risks bringing us to the truly horrifying $0.14-$0.16 range-where the panic sell-off might just kick off again. Oh, the joy.

TradingView: Technicals Still Look Like a Hot Mess

Charts from TradingView show that SEI is still nursing its wounds from the early October crash. The price structure is stuck in a downtrend, with every attempt to rebound getting rejected at those nasty descending moving averages. Honestly, it’s like watching a child try to climb a tree that’s just too tall.

The Chaikin Money Flow (CMF) is ever so slightly above zero-wow, look at that buying pressure (not). Meanwhile, the MACD remains deeply negative, confirming what we all already knew: bearish momentum is the name of the game here. And let’s not forget the sentiment trackers, who’ve slapped a big “Extreme Fear” tag on the coin’s outlook. Classic.

In terms of technicals, SEI’s future is all about defending that $0.20-$0.21 zone. If it fails, well, get ready to watch it tumble down to $0.16 again. But if, by some miracle, it breaks above $0.24, we might see some brief optimism, with price targets eyeing $0.27-$0.29. Don’t get too excited, though. Any upward movement is likely to be fleeting unless the market wakes up and starts buying again in decent volumes.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-10-14 01:45