😲 Oh, the irony! The Sei blockchain’s native token, SEI, has been experiencing a peculiar market trend: surging trading activity while its price takes a nosedive. This curious disconnect between on-chain growth and market valuation has left investors scratching their heads and wondering about the future direction of the token. As network usage increases and derivatives volumes soar, bearish momentum continues to weigh heavily on SEI.

Active Addresses Surge, but SEI Price Drops 📉

SEI, the talk of the town in the last few days of June, saw its trading activity rise, which positively impacted the token’s value. However, the bears decided to cash in their profits, and the price has been bearish since the beginning of the month. 🐻

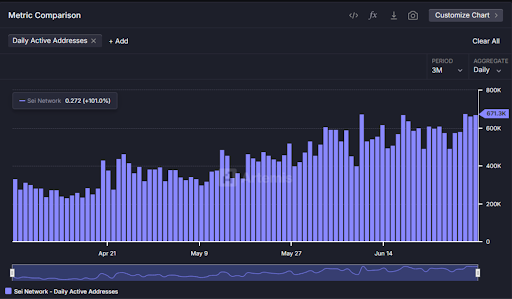

The daily active addresses of SEI have skyrocketed, indicating strong trading activity on the platform. On the other hand, the SEI price has been plummeting, and this disconnect suggests that the speculative sentiment in the broader market remains bearish. However, the active addresses are expected to climb next week with the news of the Japanese Financial Services Agency (JFSA) approving the listing of SEI on Japanese exchanges. So, buckle up for some volatility! 🎢

SEI Price Prediction: Can it Break Above $0.5? 🚀

The rising momentum of the SEI price had a positive impact on the token, pushing the price above the 200-day MA. Additionally, the Gaussian Channel turned bullish, hinting at a change in the bearish trend. After reaching a local peak above $0.3, the bears took over as the volume dropped, and the price returned to its initial range, placing it at a critical juncture. The token is now testing the pivotal support at the 20-day MA, and a drop below this range may not be healthy for the SEI price rally. 🚨

The SEI price appears to be bullish in the daily chart, as it is trapped within a bullish flag; however, the technicals do not point towards a breakout. Although the price is above the Ichimoku cloud, which could be a bullish indicator, the conversion line has displayed a bearish divergence, indicating the growing dominance of the bears. Furthermore, the MACD shows a drop in bullish pressure, which will be confirmed by the upcoming bearish crossover. 📉

So, bearish clouds continue to loom over the Sei price rally, as a drop below the support zone between $0.2683 and $0.2517 could push the token close to $0.21. On the other hand, a rebound could elevate the levels above $0.4, potentially opening the gates for $0.5. 🤔

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- M7 Pass Event Guide: All you need to know

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-07-04 16:00