Imagine a grand bureaucratic ballet, where the SEC dabbles in delay like an over-caffeinated playwright delaying the final act— only with ETFs instead of curtains. Today’s performance features Truth Social’s Bitcoin ETF, alongside the supporting cast of Grayscale’s Solana and Canary Capital’s Litecoin productions. 🎭🤡

Meanwhile, VanEck’s AVAX ETF finds itself battling the same theatrical fate—another deadline looms, and ‘setbacks’ are the latest fashionable accessory. The SEC, seemingly sympathetic to the cause, is merely ‘buying time’—a phrase more often heard in a dodgy used-car lot than a regulatory agency. 🚗⌛

New Wave of ETF Delays: The Never-Ending Sequel

Despite a shiny new management team—an almost humorous upgrade—nothing much has changed. Dozens of fresh ETF filings languish in bureaucratic limbo, waiting for the elusive blue approval or, more likely, a polite delay. Today, the permutation of frustration includes Truth Social’s Bitcoin ETF, a Solana venture from Grayscale, and Canary’s Litecoin scheme—each postponed with that signature SEC finesse. 🤹♂️

The social media grapevine initially buzzed, but official SEC documents confirmed the delays—because nothing says transparency like a scheduled “longer period” stamped in bureaucratic jargon. The first Trump-themed crypto ETF was unveiled in early June, only to be nudged further into the future. And, oh, the new deadline? September 18, 2025—because who doesn’t love a deadline that’s basically a fake-out? 🎯🗓️

“The Commission finds it appropriate to designate a longer period within which to take action on the proposed rule change so that it has sufficient time to consider the proposed rule change,” the SEC opines—because ‘consider’ clearly means ‘mire in delay.’

It’s an amusing dance—progress is just a series of deliberate, slow-motion step-backs. Despite the delays, some experts whisper hints of sympathy—perhaps the SEC’s inner Robin Hood yearns to approve, just not today. Just yesterday, they approved a multi-coin basket from Grayscale, only to slap another delay on it the very next morning. If rejection was truly the goal, they could have just said “no”—but instead, they chose to prolong the agony, a masterclass in bureaucratic finesse. 🎩✨

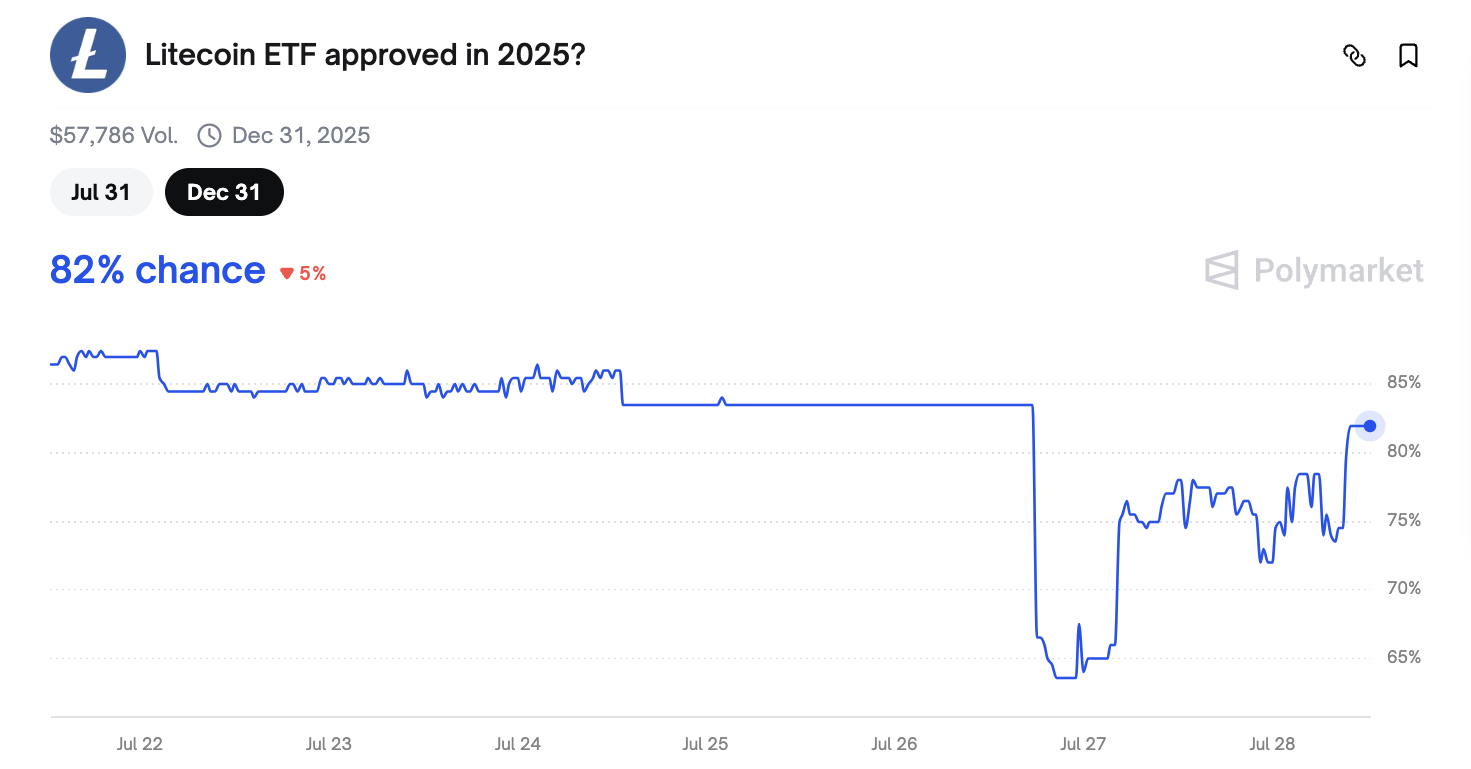

For the loyal altcoin enthusiasts: these delays are more akin to a frustrating game of ‘hot potato’ than a fatal blow. The community’s optimism persists because, gasp, the SEC might soon streamline the process—perhaps during the next episode of ‘Delays & Anticipation.’ Despite Litecoin stumbling today, Polymarket’s odds still shimmer promisingly in the distant future. 🚀🤞

As for VanEck’s AVAX ETF, the plot thickens. Today’s deadline could usher in approval—or simply another chapter of waiting. Either way, the long game looks bullish, with the SEC’s patience (or lack thereof) shaping a tale as old as time. ⏳📉📈

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Furnace Evolution best decks guide

- M7 Pass Event Guide: All you need to know

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Witch Evolution best decks guide

2025-07-28 21:06