In the grimy alley of cryptocurrency’s soul, Sam Bankman-Fried’s X account howled once more, scattering the tale that FTX, that “bankrupt tragedy,” might’ve been a liquidity crisis masquerading as a rags-to-riches hustle. Genius? Fraud? You decide. Maybe the real question is: who’s funding this? 💸

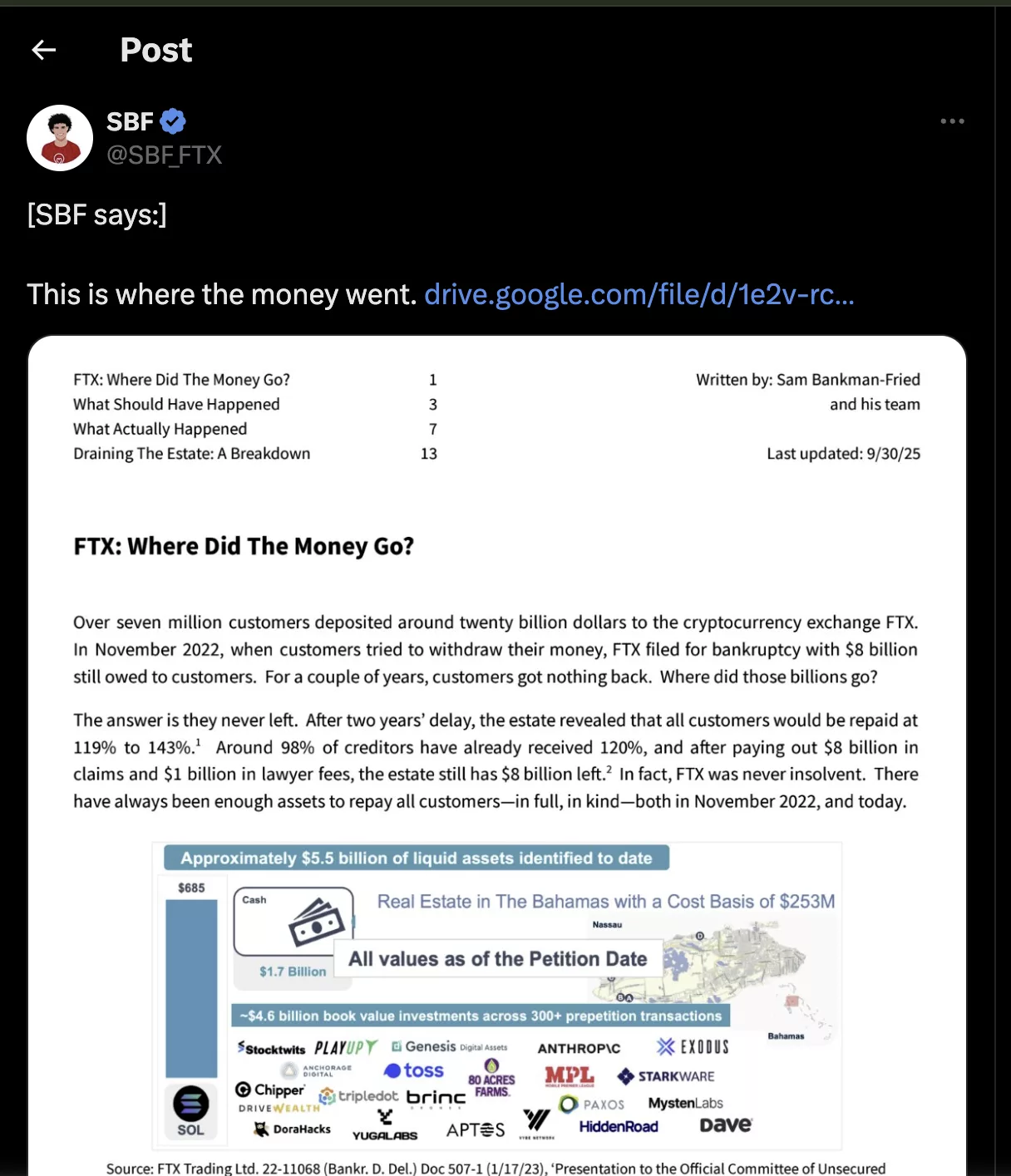

- Behold! SBF’s ghostwriter (or a bemused friend) unleashed a 15-page treatise titled, “FTX: Where Did The Money Go?” (Spoiler: It didn’t leave, it just took a detour through Robinhood, SpaceX, and ‘I’m-not-actually-bankrupt’ land).

- The scroll claims FTX suffered a liquidity slap, not insolvency. “A liquidity crisis?” they scream. “We just needed more cash cousin money!”

- Now, the estate boasts $8B post-repayments and legal largesse-stellar, perhaps? Or a magic trick where 8% turns into 136B? 🪄

- FTT token subscribers: “Predictably thrilled.” Token spiked to $0.84, then melted faster than a Binance CEO’s patience. 📉

Amidst the crypto chaos, a cryptic document arrives like a neutron star-packed, unyielding, and sure to collapse under its own weight. Bankman-Fried’s realtor-for-his-soul pal allegedly uploaded this masterpiece on Oct 31, claiming FTX was never truly bankrupt. “Why?” it shrieks. “We had enough assets to hand out free crypto to the moon!” 🌌

Of course, this contradicts a jury that may have been sleep-deprived. Or maybe they just prefer affidavits to affidavits. The report slams FTX’s lawyers for “premature bankruptcy,” arguing assets were sufficient to bury creditors under a heap of Bitcoin and Robinhood shares. “FTX was never bankrupt,” it gasps. Oops. “Even when we said it was.” 😁

Among the “magical” assets? A 14.3B stake in Anthropic (because LLMs are obviously not mad at you), 205,000 BTC, and enough SOL to make Elon nod. The “valuable” portfolio? $136B if left untouched. Who knew bankruptcy could smell like income? 🤑

Eight billion dollars owed? Seven million customers? No matter-now 98% have gotten 120% of claims. Suspicious, yes, but who are we to question the arithmetic of a man who once considered donating to charity? The estate still lounges on $8B after debts and lawyer tips. Luxury!

This echoes SBF’s classic script: “We had the money!” “We’re blameless!” “Wait, who pressed bankruptcy?” The legal drama is a Shakespearean tragedy if Shakespeare had a crypto wallet and a publicist. 🎭

Meanwhile, the FTT token briefly rose to $0.84-a YOLO move from investors who read the headlines and said, “Sure, why not.” Then it crashed, because of course it did. Crypto moves like the stock market, minus the logic. 🙃

Crypto detective ZachXBT, armed with spreadsheets and sarcasm, retorted: “You repaid at 2022 prices. My congratulations. And your misinformation buffet gets an extra course.” Meanwhile, users seethed over China’s crypto void and SBF’s “signing” of bankruptcy papers. Maybe it’s a loophole? Or just hopelessly recursive chaos?

Rumors swirl that SBF’s cheerfans are scheming a presidential pardon, like crypto Voldemort showing up with legal leeway and coffee. Some say Trump already pardoned CZ, so the next target’s clear. Nov 4th looms, and the cottage industry of crypto introspection grows: Should corporate “leaders” be allowed to gamble with public trust? Or is bankruptcy just capitalism’s way of saying, “Oopsie”? 🤷♂️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-10-31 11:03