Strategy founder Michael Saylor, in his signature theatrical fashion, unveiled a grandiose vision for Bitcoin to become the Middle East’s digital gold – and possibly the world’s. One might say he’s the Tolstoy of blockchain, weaving tales of financial revolution with the flair of a 19th-century Russian poet.

Saylor to MENA 2025: UAE, Lead the Charge or Be Left in the Dust 🏛️🇦🇪

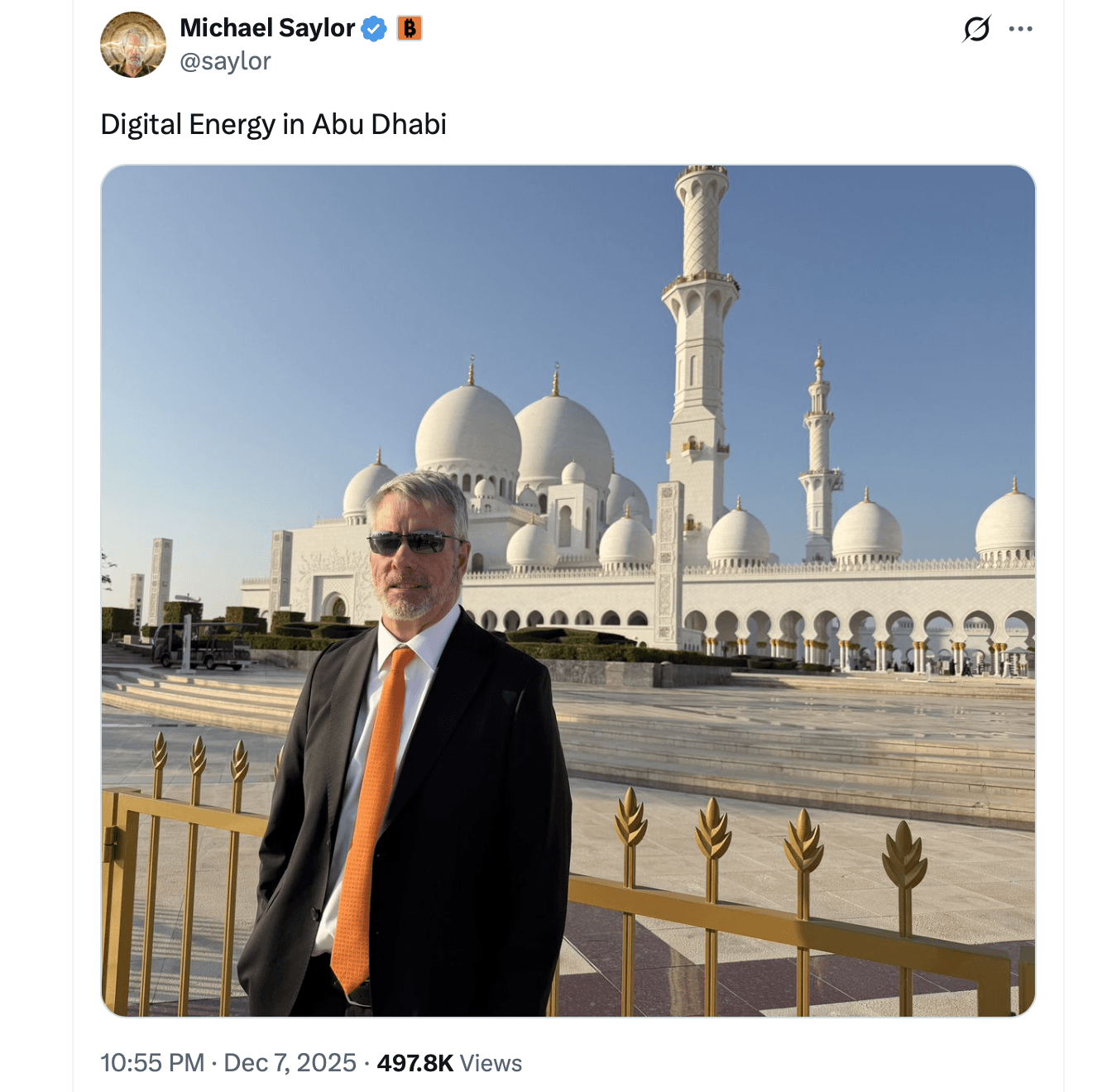

Michael Saylor, the man who could probably sell snow to an Inuit, arrived in Abu Dhabi like a literary character from Dostoevsky’s fever dream, armed with a PowerPoint and a PowerPoint-sized ego. To the crowd of investors, regulators, and bankers, he declared Bitcoin not just an asset but the “digital capital” of the future. One wonders if he’s ever met a metaphor he couldn’t overuse – “digital capital creates digital credit creates digital money” sounds like a mantra from a self-help cult for crypto bros.

He began with a geopolitical flourish: the U.S. government, once Bitcoin’s reluctant date to the prom, now dances in its tuxedo. Saylor claimed this shift signals a “structural realignment,” a term that makes one imagine a filing cabinet rearranging itself. He warned the audience that when the world’s most influential regulator nods, the ripple (pun intended) will shake continents – and maybe a few marriages.

But this wasn’t a speech; it was a sales pitch. Strategy, holding 660,000 BTC like a dragon hoarding digital gold, is building “bitcoin-backed financial products” – a phrase that makes one crave a stiff drink. Their treasury, Saylor claimed, isn’t a vault but an “engine.” One can only hope it doesn’t backfire like a Victorian steam engine with poor maintenance.

“We’re going to take it all, and we’re going to take it out of circulation,” Saylor declared, as if Bitcoin were a rare spice and he the last spice merchant on Earth. He dismissed the four-year cycle with the casualness of a man who’s never missed a train. “Bitcoin is going up 30% a year for the next 20 years,” he said, because who needs realism when you can have optimism?

Saylor’s vision? A world where Bitcoin powers a global credit transformation – a financial revolution for the masses. He compared digital credit to electricity: useful without understanding the physics. One suspects he’s never tried to explain blockchain to a grandparent, though.

Then came the pièce de résistance: digital money. Saylor proposed a stablecoin-like structure with “tax-deferred returns,” a concept that would make even Warren Buffett raise an eyebrow. “If you give people free money… all capital will flow into that country,” he proclaimed, as if economics were a game of musical chairs and he’d already claimed the best seat.

The Gulf, he argued, is primed to lead – because who better to reinvent finance than those who’ve mastered the art of turning oil into cash? With $200 trillion in global money supply at stake, Saylor’s pitch was less about innovation and more about convincing nations to become the next Dubai of digital finance – minus the palm-shaped islands, plus the volatility.

FAQ 🏙️🇦🇪

- What did Saylor emphasize at Bitcoin MENA 2025? He focused on Bitcoin as digital capital and outlined how it can power digital credit and digital money systems across global markets.

- Why the Middle East? Because they’ve got the regulatory clarity of a clear winter sky and the financial depth of a Siberian winter.

- How does Strategy fit in? By building Bitcoin-backed credit instruments – a financial Frankenstein, perhaps?

- Biggest prediction? Nations adopting digital money early could become global banking hubs. Or, as Saylor put it, “the new Dubai, but with fewer camels and more code.” 🐪💻

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Brawl Stars Steampunk Brawl Pass brings Steampunk Stu and Steampunk Gale skins, along with chromas

2025-12-10 21:55