Well, look who’s decided to get into the trendy crypto game—Russia’s biggest stock exchange, Moscow Exchange, is now offering futures trading for BlackRock’s iShares Bitcoin Trust ETF (IBIT). Because nothing screams “financial stability” like betting on a digital coin while international sanctions loom like a thundercloud. ☁️

Starting June 4th, the exchange—ever so eager to jump on the crypto bandwagon—announced it will support the product. But hold your horses! Only accredited investors get to play with this shiny new toy—because, apparently, the rest of us are too irresponsible to handle Bitcoin futures. (Or maybe just too broke.)

“Please note that today, June 4, 2025, trading in the IBIT-9.25 (IBU5) futures contract, permitted only to qualified investors, begins… Qualification checks on the exchange side will be implemented from June 23, 2025.” Apparently, they’ve got a gatekeeper making sure only the rich and reckless get in. Cheers to progress! 🥂

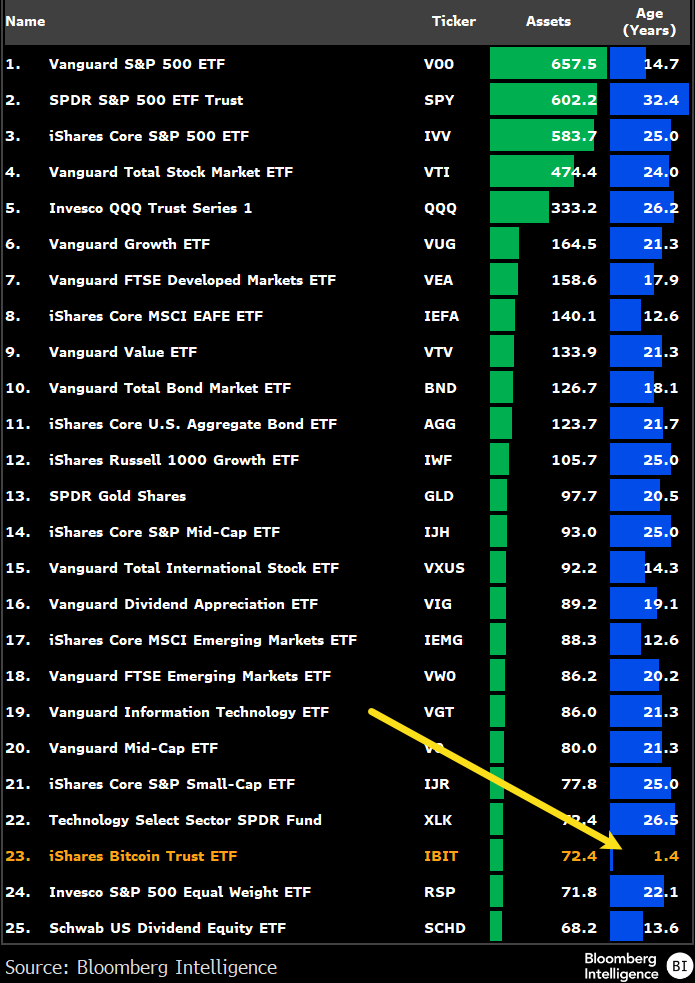

IBIT—launched in January 2024 after dodging regulatory bullets from the U.S. Securities and Exchange Commission (SEC)—has somehow climbed its way into the top 25 ETFs globally, boasting over $72.4 billion under management. That’s right, billion with a B. Because nothing says “trustworthy” like a fund that barely exists for a year and a half. 💸

Bloomberg ETF expert Eric Balchunas chimed in, noting that IBIT is pretty much the toddler of the ETF world.

“Here’s a table of the Top 25 biggest ETFs and their age. At 1.4 yrs old IBIT is [the] youngest on the list by nine times. It’s like an infant hanging out with teenagers and twenty-somethings. Quite [possibly] the most insane IBIT stat yet.”

As of now, IBIT is trading at a whopping $59.92—down a bit from yesterday’s high of “Hey, look at that” and now just waiting for the next rollercoaster. 🎢

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- How to find the Roaming Oak Tree in Heartopia

2025-06-04 23:06