Oh dear, oh dear, XRP‘s price has been one of the hottest topics for discussion amongst the crypto community for a while now, and we just can’t help but sympathize with the poor souls who’ve been caught up in the hype.

After all, it’s an O.G. cryptocurrency that’s been around for the past few cycles, but its status has been debated at length, especially during Ripple‘s legal battle with the US Securities and Exchange Commission. The outcome of this was long touted as a massive catalyst for XRP’s price, and, well, it seems that the dispute has reached a turning point – but not quite the one everyone was expecting.

XRP and the Outcome of the Ripple v. SEC Lawsuit

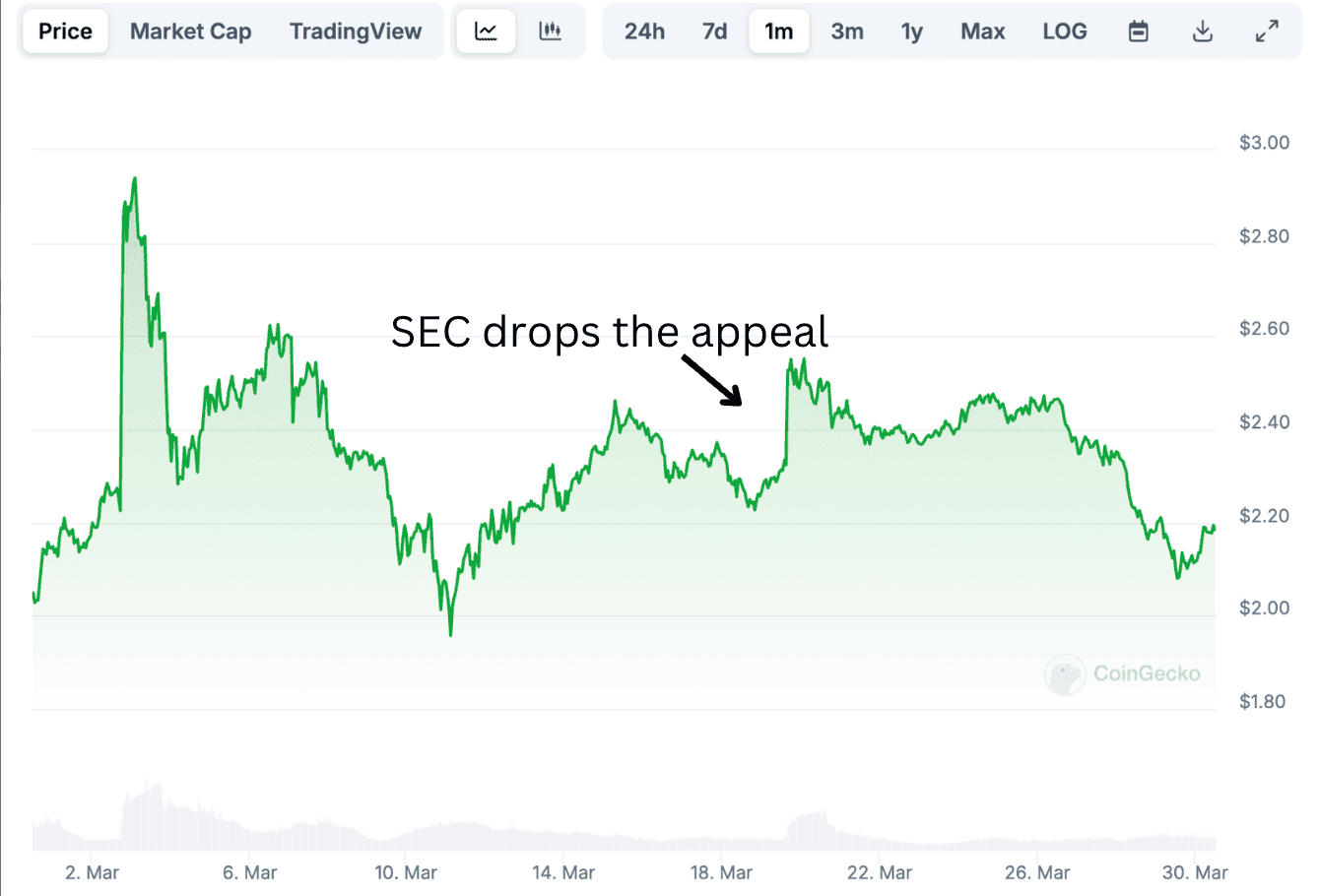

Just recently, Brad Garlinghouse, the CEO of Ripple, took to social media to share the “big news” – the Commission quit the pursuit of its appeal, essentially putting a de-facto end to the lawsuit – the moment the community was waiting for. Or so they thought…

There it was – the massive catalyst everyone was waiting for, so how did the XRP price react? Initially, there was a surge, but things calmed down almost immediately, and the price has since retraced to the levels from before the self-proclaimed victory. Who knew?

This begs the question – what now? Well, it appears that the market is chasing the next potential catalyst – namely, the approval of spot XRP exchange-traded funds in the US. Because, you know, one catalyst just isn’t enough.

XRP ETFs: The Reality

Multiple high-profile asset managers have filed applications for the approval of a spot XRP ETF in the United States, the majority of which are awaiting decision by the end of this year. The list includes, but is not limited to, Franklin Templeton, Grayscale, Bitwise, Canary Capital, and so forth. Because, why not?

Many industry experts are of the opinion that following Ripple’s de-facto victory in the battle against the US Securities and Exchange Commission, the path to an approval is more or less paved. Why? Well, according to the standing decision of Judge Analisa Torres, XRP sales on the secondary market to regular users do not constitute an investment contract. But let’s not get too excited…

But is the approval of an XRP ETF a potential catalyst for a surge in its price? This depends on one major factor – demand. And let’s be real, folks, XRP’s supply is heavily concentrated, and the company behind it – Ripple – controls the market. It’s as simple as that. No locking structures and promises can change the fact that there’s a single centralized entity capable of shifting the market dynamics at any time – something that could be seen as a major deterrent for serious investors even upon the potential approval of a spot XRP ETF.

And while a short-term surge is likely a given, the longer-term impact on ETFs on XRP’s price is far from certain. So, go ahead and put your hopes up, but don’t say we didn’t warn you…

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-03-30 13:55