Ripple has launched a permissioned decentralized exchange (DEX) feature on the XRP Ledger (XRPL).

The network strives to connect the persistent divide between traditional financial compliance regulations and the realm of decentralized finance.

Ripple Unveils Permissioned DEX as XRPL Pushes for Institutional DeFi Relevance

Yoshitaka Kitao, CEO of Japan’s SBI Group and a notable supporter of XRP, especially in the Japanese banking industry, commended this feature highly.

Introducing Permissioned DEX on the XRP Ledger: Unlocking Institutional Access to DeFi

— 北尾吉孝 (@yoshitaka_kitao) June 26, 2025

Through Ripple’s Permissioned DEX, regulated financial entities can engage in trading or transfer of value within XRPL’s inherent decentralized exchange platform. This unique feature addresses crucial compliance needs such as Know Your Customer (KYC) and Anti-Money Laundering (AML), which have previously deterred banks and fintech companies from participating.

In the early part of this year, I shared my aspirations for institutional DeFi on the XRP Ledger – a vision centered around compliance-driven infrastructure, practical real-world applications, and equal access for all. The introduction of a Permissioned DEX (decentralized exchange) marks another substantial stride towards realizing that ambition, as I expressed in a recent blog post.

Ripple’s Permissioned DEX: What Users Need to Know

In contrast to the standard XRPL DEX order books, which are accessible to everyone, this innovative addition establishes restricted areas called “permissioned domains.” These zones ensure a secure environment where only authorized accounts with confirmed identities are permitted to engage in interactions.

In essence, financial institutions are able to establish specialized trading platforms tailored for assets such as XRP and stablecoins, which do not require the use of custom smart contracts or distributing liquidity among multiple platforms.

As a researcher delving into the world of Decentralized Exchanges (DEX), I’ve come to understand that each Permissioned DEX operates within its distinct domain, housing independent order books. This setup ensures that transactions are executed exclusively among authenticated participants, thereby maintaining a secure and controlled trading environment.

As a researcher delving into the realm of the XRP Ledger (XRPL), I am putting forth a proposition that utilizes two technical standards currently under scrutiny: verifiable credentials and permissioned domains. By harmoniously combining these standards, we can foster an environment conducive to enforcing compliance within our markets, thereby promoting transparency and trust.

Financial institutions and fintech companies can now establish controlled trading platforms linked to authenticated identities, ensuring that only approved participants can engage specific markets. This allows these entities to utilize the Decentralized Exchange (DEX) on the XRP Ledger right away, as compliance is integrated from the beginning,” Ripple highlighted.

A Compliance-First Pitch—But Where’s the Demand?

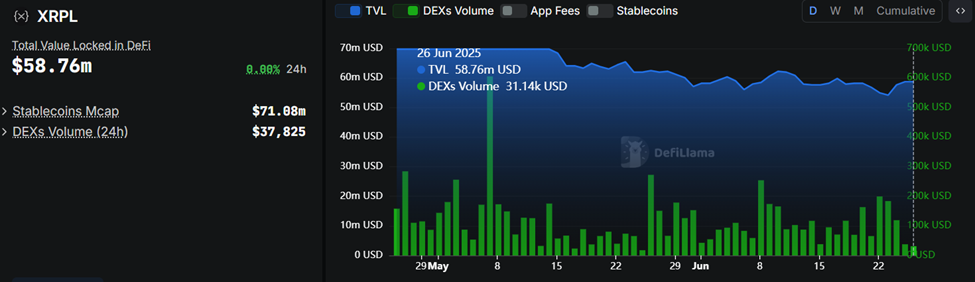

Although Ripple’s focus is geared towards institutional settings, the trading activity on the XRP Decentralized Exchange (DEX) remains surprisingly minimal. As per DefiLlama’s recent data, the 24-hour trading volume hovers around $50,000, and the Total Value Locked (TVL) on the XRP Ledger stands below $60 million.

According to DefiLlama’s data, decentralized exchanges (DEXs) on the Ethereum Layer-2 network like Base often process transactions worth millions daily.

Yet Ripple’s new DEX functionality is clearly geared toward unlocking real-world use cases such as:

- Stablecoin/Fiat FX Swaps across jurisdictions

- Cross-border payroll payouts in local currency

- B2B stablecoin payments and treasury conversions

- Corporate crypto-to-fiat management

Ripple’s Institutional Gamble

The XRP Ledger, dating back to 2012, is among the earliest blockchain systems equipped with Decentralized Exchange (DEX) capabilities. Yet, its relatively low adoption within the Decentralized Finance (DeFi) community has sparked debates concerning its significance.

As a researcher, I’m excited about the new development that hints at Ripple’s strategy: they are banking on the appeal of compliance-built innovations such as the Permissioned Decentralized Exchange to draw in institutions cautious about the regulatory uncertainties prevalent in other ecosystems.

Ripple pointed out that a Decentralized Exchange (DEX) with permissions addresses the issue head-on, all while maintaining the benefits of decentralization, cost savings, and user autonomy.

Will institutional flows materialize? Will the next wave of DeFi be permissioned? Time will tell.

According to Brett Harrison, the future leader in DeFi adoption calls for us to anticipate and strategize about regulatory and compliance issues. While permissioned DeFi might offer a solution, it’s just one piece of the puzzle, as Harrison hinted.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- M7 Pass Event Guide: All you need to know

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

- JJK’s Worst Character Already Created 2026’s Most Viral Anime Moment, & McDonald’s Is Cashing In

2025-06-26 13:26