Ah, dear reader, you have wandered into the Crypto Salon—a place where fortunes are forged before tea and reputations ruined just in time for luncheon. 🥂 Care for a morning scandal? Of course you do!

Take up your coffee like a knight girding for battle—Ripple, that dashing, if oft-misunderstood, scion of digital finance, has decided, quite sensibly, to entrust the sanctity of its RLUSD reserves to none other than the venerable BNY Mellon. Why trust a crypto startup with your fortune when you could simply summon the custodians of $43 trillion in civilization’s spare change? 😏

The Ripple Effect: Bankers, Blockchains, and Other Expensive Habits

With BNY Mellon on its arm, Ripple now twirls upon the ballroom floor, basking in the approving gazes of TradFi matrons and DeFi debutantes alike. The custodian’s duties? Nothing short of keeping RLUSD—Ripple’s strictly dollar-backed stablecoin—well-mannered, sober, and not at all inclined to run off to Vegas.

BNY’s legendary vaults—rumor has it there’s more gold than in Midas’s nightmares—will also handle transaction banking, so RLUSD’s operations won’t devolve into chaos (or, heaven forbid, a family dinner).

Ripple has selected @BNYglobal as the primary reserves custodian for $RLUSD, an enterprise-grade stablecoin built for real-world utility, supported by one of the largest and most trusted financial services companies in the world.

Learn more about our…

— Ripple (@Ripple) July 9, 2025

BNY brings a trunkload of “expertise” and a healthy appetite for innovation—by which we mean, engaging in just enough blockchain flirtation to keep the regulators happy and the board of directors awake. Apparently, the partnership is a “shared commitment to building the infrastructure for the future of finance,” though it sounds suspiciously like a promise to clean up after a particularly wild party. 💸

For those keeping score: RLUSD, Ripple’s darling, is not out to be a casino chip. It’s a New York DFS child—regulated, dollar-backed, and designed to please institutional suitors rather than the speculating rabble. Scandalously responsible.

And as if things weren’t sufficiently respectable, Ripple is now applying for a banking license. Yes, darling, a banking license—because why merely disrupt when one can acquire a government-sanctioned ticket to cocktail parties?

“BNY brings together demonstrable custody expertise and a strong commitment to financial innovation in this rapidly changing landscape. Their forward-thinking approach makes them the ideal partner for Ripple and RLUSD,” reads the announcement, attributed to Jack McDonald, Ripple’s SVP of Stablecoins—possibly the only man in crypto who maintains a straight face while counting stablecoins.

RLUSD is backed, so they say, 1:1 by “high-quality liquid assets”—cash, equivalents, US treasuries, and possibly the lost hopes of meme-coin investors. Max Keiser, ever the Bitcoin evangelist, points out that everyone’s hoarding treasuries these days. At least some traditions never die.

Meticulously audited, strictly reserved, and pledging clear redemption rights, RLUSD is so responsible it may one day lecture you about wearing clean socks. (Institutions and regulators adore that sort of thing.)

The Swiss, never ones to miss a well-guarded vault, have dived in: AMINA Bank now offers RLUSD custody and trading for those seeking the rare thrill of regulated clarity in a world of digital mischief.

RLUSD is now available at AMINA Bank

In collaboration with @Ripple, AMINA enables a regulated, secure, and seamless way to custody and trade RLUSD – ideal for both institutions and individuals who demand clarity, compliance, and control.

Your digital dollars are protected…

— AMINA Bank (@AMINABankGlobal) July 3, 2025

Ripple’s RLUSD: A Cinderella Story (But With Fewer Talking Mice)

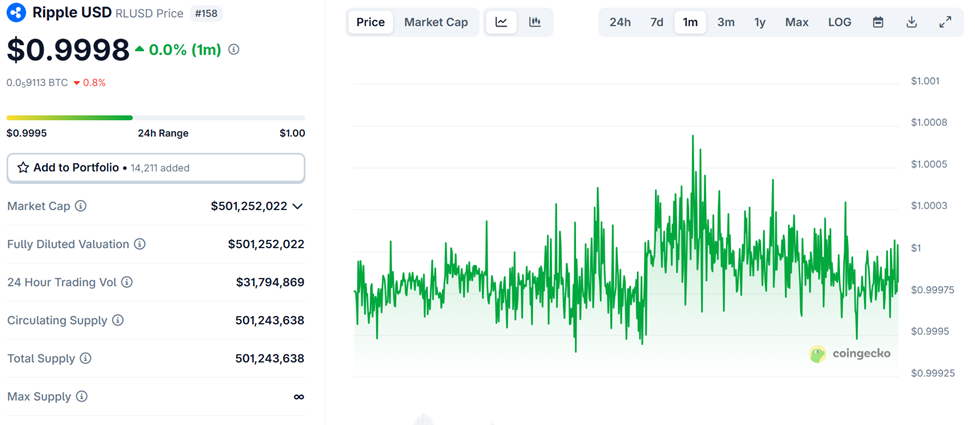

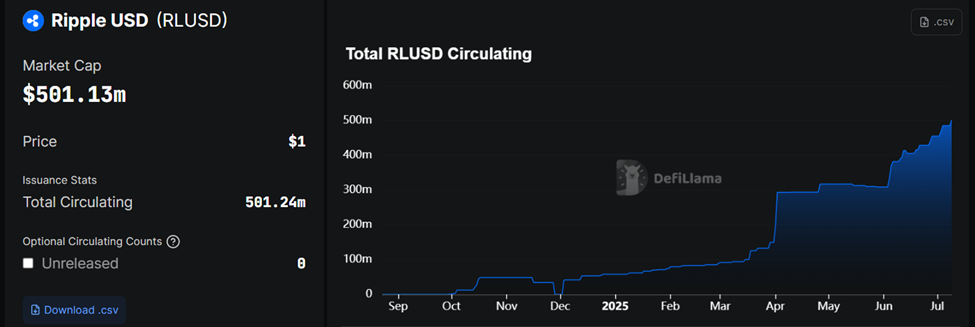

Ripple’s prudent obsession with Wall Street-grade security appears timely: RLUSD’s circulating supply, in true social climber fashion, has soared past $500 million in only seven months. One can only imagine the blushes on Tether’s cheeks. RLUSD was minted in December 2024 and already rubs elbows with the stablecoin elite—ranked 16th on DeFiLlama, after a 47% surge last month. Breathtaking, really. 🔥

@Ripple’s RLUSD stablecoin is growing on @ethereum, with supply up ~4x since January.

— Token Terminal (@tokenterminal) June 28, 2025

According to CoinGecko, RLUSD trades around $26 million a day, occasionally gathering up the courage to nudge $32 million. One imagines a stately waltz of cross-border remittance and institutional trading, rather than a frantic disco.

The stablecoin market now counts more than $255 billion, with dollar-tethered tokens dominating—because who needs variety when one can have the dollar?

RLUSD’s meteoric rise is proof that, in crypto as in dinner parties, nothing impresses like a good pedigree and proper supervision.

The Obligatory Chart (For Those Who Think In Numbers)

Bite-Sized Alpha (Yes, With a Yawn)

Curtain Up: Crypto Equities Pre-Market Theatre

| Company | At the Close of July 8 | Pre-Market Overview |

| Strategy (MSTR) | $396.94 | $399.03 (+0.53%) |

| Coinbase Global (COIN) | $354.82 | $357.00 (+0.61%) |

| Galaxy Digital Holdings (GLXY) | $19.46 | $19.50 (+0.21%) |

| MARA Holdings (MARA) | $17.52 | $17.70 (+1.03%) |

| Riot Platforms (RIOT) | $11.57 | $11.70 (+1.12%) |

| Core Scientific (CORZ) | $14.02 | $14.18 (+1.14%) |

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-07-09 18:13