A Glimpse into the Cryptic Unfolding:

- Ah, dear reader, behold the spectacle! On February 10, 2026, the illustrious Robinhood Chain unveiled its public testnet-a veritable gladiatorial arena for compliant, ever-vigilant on-chain finance, ready to dazzle and bewilder.

- As Bitcoin waltzes around a stately $66.7K and Ethereum flirts with $1.98K, we find ourselves at the mercy of ETF whims and the fickle spirits of macroeconomic sentiment. What a delightful dance it is!

- ETF outflows are akin to a magician’s vanishing act-one moment liquidity is abundant, the next it disappears quicker than your last date. Higher-beta tokens? Good luck, my friends!

- Enter BMIC-the paragon of post-quantum wallet security, redefining ‘self-custody’ from a mere user experience feature into an existential puzzle of long-term threat management. How quaint!

Robinhood’s audacious crypto aspirations have entered a new, serious chapter. With the launch of their ‘Robinhood Chain,’ they aim to transform the mundane into the magnificent-a regulated sanctuary for tokenized real-world assets (RWAs) and other fanciful on-chain financial services.

This is not just another ‘brand chain’ headline, oh no! A Robinhood-backed Layer 2 promises to overhaul the intricate plumbing of the crypto world: settlement rails, compliance, and a shiny new gateway for institutional knights seeking glory.

Yet, as fate would have it, this timing is both opportune and riddled with complications. The crypto realm is gingerly emerging from a sharp downturn, like a cat that has fallen into a fishbowl. Bitcoin and Ethereum twitch with every twist of ETF flows and the ominous specter of macro risk, a reminder that in this carnival, sentiment can turn on a dime.

And lo! In markets where infrastructure headlines jostle with risk-averse undercurrents, the narrative of security grows louder still. Not ‘security’ as in price stability, but rather the tantalizing intricacies of cryptography, custody, and survival-especially as long-term holders ponder the uncomfortable truths lurking in the shadows.

Herein lies the grand entrance of BMIC ($BMIC) into our discourse.

Check BMIC HERE.

Robinhood’s L2 Adventure: A Quest for Secure Self-Custody

The testnet of Robinhood Chain heralds a bold direction: more assets on-chain, endless composability, and markets that never sleep. But heed this, dear audience: scaling settlement is but one half of the odyssey. The true peril lies in broader adoption-ushering forth a sprawling attack surface ripe for exploitation.

The trends scream a predictable bottleneck: as tokenized assets and consumer-facing apps multiply, key management and wallet security become the hushed systemic risks, lurking in the corners of our crypto carnival. More users. More transactions. A veritable treasure trove resting on the delicate assumptions of a pre-quantum universe.

This is precisely the conundrum BMIC ($BMIC) seeks to unravel. An ERC-20 marvel positioning itself as a quantum-secure wallet play, promising a full suite of ‘wallet + staking + payments’ shielded by the elegant armor of post-quantum cryptography. Its pitch? Simple and rather unnerving: ‘harvest now, decrypt later’-a delightful prospect for long-term capital!

BMIC flaunts features like Zero Public-Key Exposure, AI-Enhanced Threat Detection, and a whimsical ‘Quantum Meta-Cloud’ layer, all nestled within ERC-4337 smart accounts. In a market obsessed with speed and distribution, it offers a contrarian twist: security crafted for tomorrow’s threats, not yesterday’s blunders.

$BMIC is available here.

BMIC Presale Stirs Up the Market as Risk Gets a Re-Price Makeover

While the major coins languish in uncertainty, presales tethered to clear narratives, RWAs, infrastructure, and security capture the spotlight. Why, you ask? Because they present asymmetric bets! But beware-the caveat lurks: during a downturn, liquidity evaporates faster than a rabbit in a hat, leaving new tokens vulnerable to the winds of change.

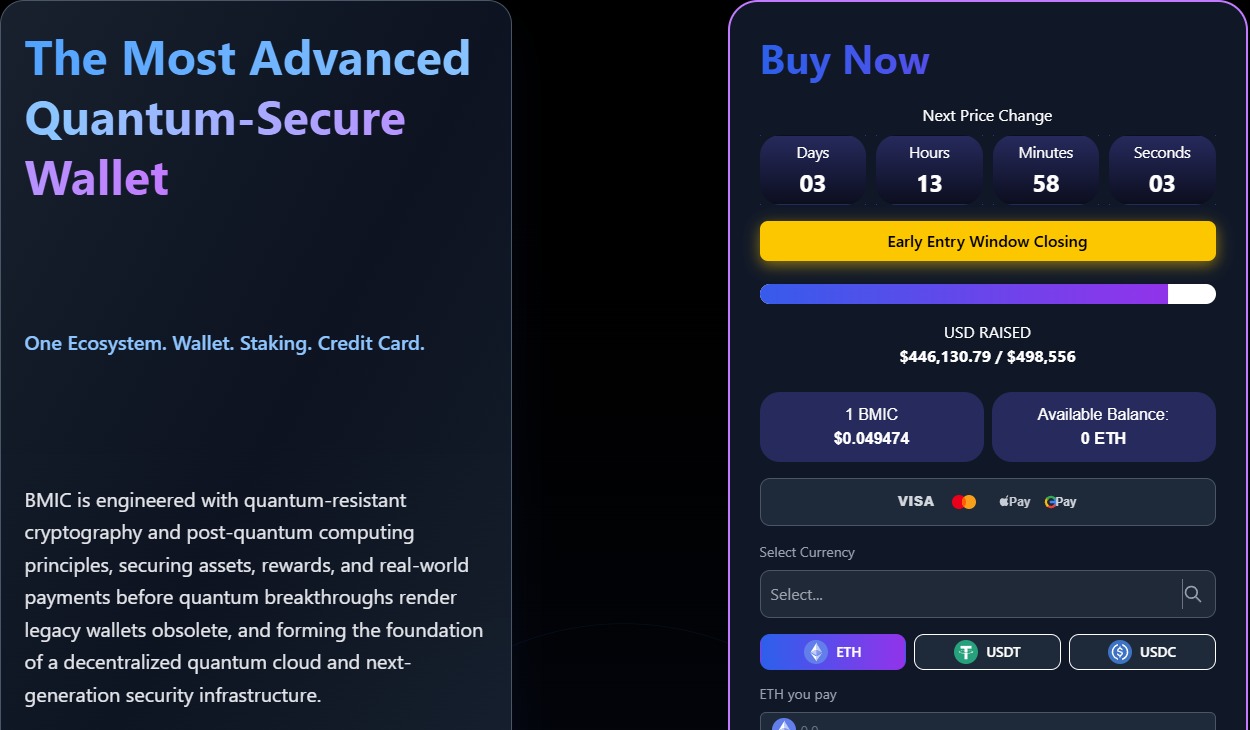

Amidst this chaos, BMIC is already garnering attention. As per its official presale page, the project has raked in $446K, with tokens currently priced at a tantalizing $0.049474.

These figures stand firm in a market where many ‘hot’ narratives trade on little more than ephemeral vibes.

BMIC doesn’t aim to out-meme the competition; instead, it seeks to endure the tempest. The project ties token utility to tangible functions like ‘Ecosystem Fuel’ and ‘Staking & Governance’ while emphasizing quantum-secure staking without exposed keys. And how refreshing it is that they’ve refrained from promising a specific APY-yield expectations ought to be approached with caution, indeed!

Looking ahead, astute investors are keeping a keen eye on two pivotal questions. First: can Robinhood Chain genuinely expedite user onboarding and usher self-custody into the mainstream? Second: can security-focused projects like BMIC transform an ‘inevitable future risk’ into present-day demand, especially as ETF volatility keeps the market teetering?

Buy your $BMIC here.

Disclaimer: This article is not financial advice; crypto is volatile, presales carry risks, and product claims may ebb and flow; always verify details independently, dear reader.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Kylie Jenner squirms at ‘awkward’ BAFTA host Alan Cummings’ innuendo-packed joke about ‘getting her gums around a Jammie Dodger’ while dishing out ‘very British snacks’

- KAS PREDICTION. KAS cryptocurrency

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Hailey Bieber talks motherhood, baby Jack, and future kids with Justin Bieber

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- How to download and play Overwatch Rush beta

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

2026-02-11 14:25