In the autumn of 2025, the tide of retail investors, having tasted the elixir of September’s meteoric gains, now found themselves retreating from the treacherous waters of leveraged ETFs, their pockets lighter by a staggering seven billion dollars. 📉💸

Retail traders, those fickle lovers of risk, are now withdrawing their funds from the high-risk havens of leveraged ETFs, as if the market itself had whispered, “Enough!” The data, a grim testament to this exodus, reveals net outflows of approximately seven billion dollars this month-a sum that eclipses all previous records since the dawn of 2019. 🧐

The Lament of Leveraged ETFs: A Torrent of Funds Escapes

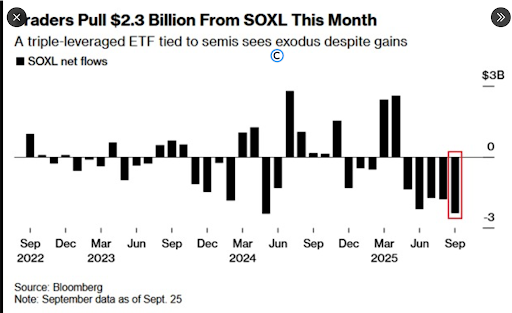

According to the enigmatic The Kobeissi Letter, leveraged ETFs saw a deluge of $7 billion in outflows month-to-date, with the semiconductor-focused SOXL leading the withdrawals. SOXL, that proud titan of the tech world, though soaring by 31% in September, witnessed a hemorrhage of 2.4 billion dollars, a paradoxical dance of gains and losses. This marks its fifth consecutive month of retreat, a saga of waning enthusiasm. 🧠

Other leveraged ETFs also experienced a mass exodus. TSLL, the Tesla-bound vessel, recorded a monumental 1.5 billion dollar withdrawal, its largest in history. The traders, having reaped their profits, now turn their backs on the volatile tides, even as the broader market remains anchored near its zenith. 🚀

Bloomberg Intelligence, ever the chronicler of financial folly, noted that these outflows are the biggest since leveraged ETF data began in 2019. This trend reflects a shift among day traders who had fueled rallies earlier this year. Instead of adding new money, they are reducing exposure to riskier positions while stock indexes remain strong. 🧠

Market Strength Meets Rising Caution

The S&P 500, that venerable sentinel, slipped 0.3% for the week, its first stumble in a month, while the Nasdaq 100, the tech behemoth, fell 0.5%. Treasury bonds, once steadfast, now wavered, their losses extending for a second week. These modest shifts, though seemingly trivial, whisper of a market entering a more circumspect phase. 🌬️

Cryptocurrency, that capricious jester, shed a staggering 300 billion dollars in value earlier in the week. The leveraged positions in Bitcoin and Ether, like overzealous dancers, were forced into a frantic waltz, their prices swinging wildly before a partial recovery by Friday. This decline, a balm to the overzealous, dulled some of the gains retail investors had meticulously built throughout the year. 🪙

Despite these developments, there are no signs of a widespread downturn. Instead, investors appear to be preparing for potential volatility in the months ahead. Analysts point to possible government shutdown risks, which could delay economic reports and affect investor confidence. 🚨

Retail Traders Adjust Strategies as Firms Add Protection

Retail investors, those latecomers to the dance, have, this year, been the harbingers of change. They fueled the initial rallies, adding risk when markets momentarily faltered in April. Now, their decision to retreat from leveraged ETFs may signal a shift towards a more prudent stance. 🧭

Investment firms, ever the pragmatists, are adjusting their sails. Lido Advisors, with its 30 billion in assets, now dons protective armor while remaining steadfast in its investments. The firm, in a bid to generate income, sells covered calls and purchases put spreads for downside protection. “We stand at the precipice,” mused Nils Dillon, the firm’s director of portfolio strategy, “when does adverse data morph into calamity?” 🧠

Meanwhile, capital flows into safer havens-cash-like funds, gold, and volatility products-accelerate at a pace unseen in months. These movements, a testament to the investors’ resolve, show they are not abandoning the market but rather seeking solace in more tranquil waters. 🌊

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

- Best Hero Card Decks in Clash Royale

2025-09-29 12:38