- Ah, PEPE’s October rally! A tale of a 227% price hike that could make even the most stoic investor chuckle.

- To see if PEPE is ready to dance again, we must scrutinize its current technical setup like a hawk eyeing its prey.

In a recent market commentary, analysts, with all the confidence of a cat walking on a tightrope, hinted at a potential 100% upside for Pepe [PEPE]. They drew parallels with its October breakout pattern, as if it were a Shakespearean drama unfolding before our very eyes. 🎭

2024 was a breakout year for this memecoin, posting a jaw-dropping 1,435% year-over-year gain. It surged from a New Year opening price of $0.0000013, closing the year with returns that would make even the most seasoned investors weep with joy.

But hold your horses! At press time, PEPE was trading 61% below its Q1 2025 opening, reflecting the broader market’s mood swings. Yet, its current 1-day chart structure resembles the late October consolidation range, like a tightly coiled spring ready to unleash chaos.

Historically, this pattern has been a precursor to a sharp breakout, with PEPE once skyrocketing by 227%, peaking at $0.00002597 on November 14. Will history repeat itself? Or are we just chasing shadows? 🤔

Breakdown of PEPE’s Fundamental Setup

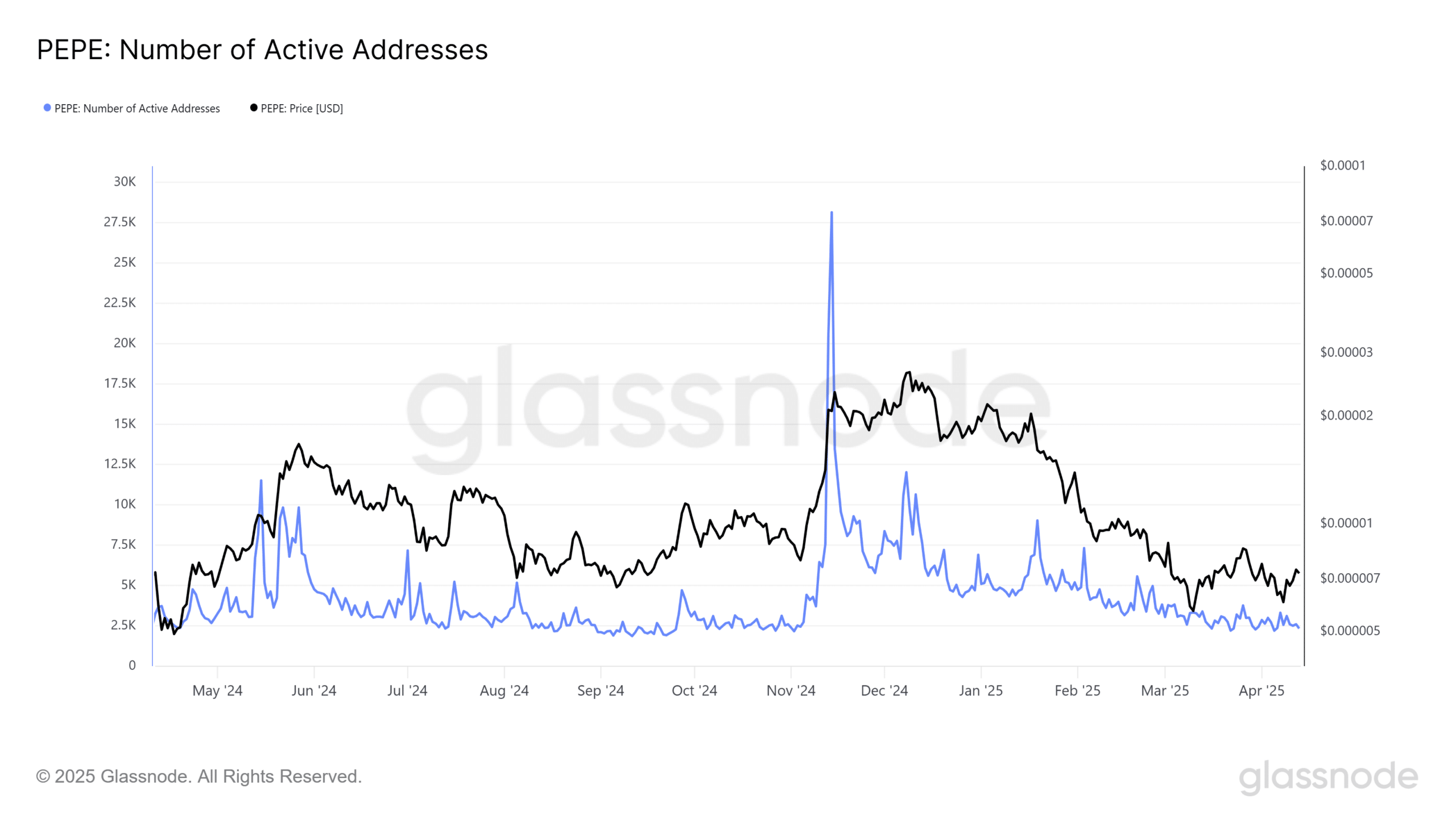

Interestingly, active addresses on the PEPE network averaged 2,500 before a significant surge to 20,500 in mid-November, aligning perfectly with the token’s parabolic price movement. It’s like watching a caterpillar transform into a butterfly, only to realize it’s a butterfly that can’t stop fluttering! 🦋

Historically, such an uptick in on-chain activity has been a leading indicator of bullish momentum. However, current network metrics are as flat as a pancake, with active addresses at 2,587—mirroring previous consolidation phases before breakout events.

In other words, this could mean we’re witnessing a similar accumulation pattern that preceded a significant price shift before. Or maybe it’s just a bunch of folks waiting for the right moment to jump in. Who knows? 🤷♂️

Despite the lack of concrete confirmation, PEPE’s speculative rally potential might be a double-edged sword. Particularly when considering derivative market data. 📉

For instance, Coinglass data indicated that despite muted on-chain activity and a lack of clear accumulation signals in spot market volume, Open Interest (OI) on PEPE Futures has risen sharply. It’s like watching a balloon inflate, but we all know what happens when you blow too hard! 🎈

In fact, it surpassed November’s levels with a near 5% uptick, pegged at $301.48 million at press time. Consequently, PEPE’s 20% weekly gains may be at risk of triggering liquidation cascades, especially on long positions, due to the absence of dip-buying support. This would put short-sellers in control, highlighting the need for cautious risk management.

While historical patterns seemed to hint at a potential breakout, the crypto market relies on hard data, not coincidences. PEPE’s gains have been driven by leveraged liquidity rather than organic buying, making this rally as vulnerable as a house of cards in a windstorm. 🌪️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-04-15 09:14