Ah, the excitement of yet another day in the world of Bitcoin and Ethereum options expiring! On the illustrious 1st of August, 2025, a considerable sum—over $7 billion no less—finds its way into the abyss, tempting fate and fortune with each passing moment.

As with most monthly occurrences, one finds the weekly expiry just as capable of stirring the pot, influencing the price direction, or, indeed, causing it to come to rest near key strike prices. Traders, in their infinite wisdom, hedge or unwind positions, all with the fervor of those who have much to gain, or perhaps lose. 🧐

The Date with Destiny for Bitcoin and Ethereum: Over $7 Billion at Stake

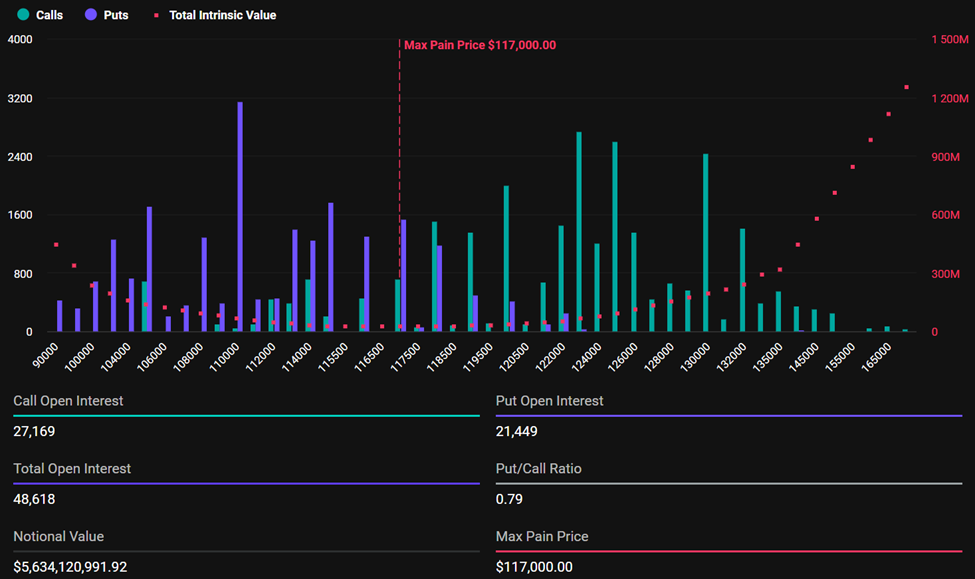

On this most fateful day, Deribit offers a glimpse into the madness. Bitcoin’s options for expiry hover at a rather extravagant $117,000—a rather lofty figure when compared to its current reality of $116,003. Quite the tease, wouldn’t you agree? 💸

Ah, but there is more: a grand total of 46,618 open interest positions (those alluring Put and Call options) strut around the market today. A cool $5.6 billion is at stake for Bitcoin, and the tokens themselves are holding steady at a respectable 48,568.75 BTC. But wait! The Put-to-Call ratio (PCR) of 0.79? Oh yes, that suggests the ever-so-optimistic air of a bullish market. 🙄

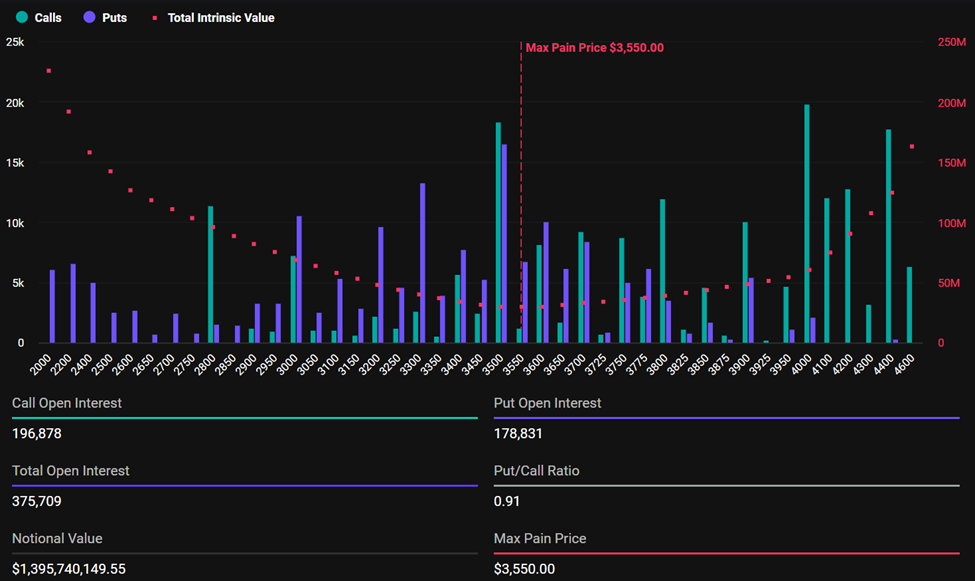

But now, allow me to turn your gaze to the more enigmatic Ethereum. Expiring options have a PCR of 0.91, indicating a certain caution, tempered by an optimistic view. After all, purchase orders do tend to outnumber their sell counterparts, which is always a good sign, right? 🤷♀️

For Ethereum, however, the ‘maximum pain’ level (the point of greatest agony, if you will) sits at $3,550—oh, how our hearts ache for it! Unlike Bitcoin, Ethereum remains perched well above its strike price. But fear not! The total open interest for ETH options is a rather impressive 375,709, suggesting that more capital is being poured into Ethereum contracts than Bitcoin. A sure sign of those with an eye on the near future, it seems. 😏

In fact, the rising prominence of Ethereum in the derivatives market might just explain this disparity. With a current notional value of $1.39 billion, Ethereum is certainly making waves. 🌊

As we inch closer to expiry, one finds that prices tend to gravitate towards their max pain levels, inevitably causing a modest correction for Ethereum, while Bitcoin may experience a slight recovery. Ah, the art of manipulation—some might call it clever hedging, others might deem it a convenient way to ensure that retail traders’ options expire with a resounding whimper. 😏

But let us not be too harsh. Sometimes, market forces move with the elegance of a grand waltz, and there is no need to attribute ill intent to what could merely be a natural gravitation towards the inevitable. 😌

“BTC positions are wide, but price is holding right above max pain. ETH’s also pinned just above $3.5K. Will expiry act as a magnet or a springboard?” wondered analysts at Deribit. A question, indeed! 🤨

The Corporate Lifeline: Hope Amidst the Chaos

Now, dear reader, a ray of hope emerges from the corporate world. Analysts at Greeks.live observe a market divided on Bitcoin’s future, with $116,000 standing as a crucial support. Beyond that? The 118 mark could offer resistance, though there is much disagreement as to whether the recent dip signals a bargain or an impending catastrophe. Such is the fickle nature of the market. 📉

“…[there’s] disagreement on whether the recent dip represents a buying opportunity or the start of a deeper correction,” lamented Greeks.live. How truly prophetic. 🙄

Indeed, the correction seems tied to the FOMC’s decision to maintain interest rates, casting a shadow over the market. But fear not! For Michael Saylor’s grand Strategy ensures that Bitcoin’s fortunes are somewhat cushioned, preventing the spiral into utter despair. 🍂

“Strategy Corp closed $2.52B IPO and immediately purchased 21,021 bitcoins at $117,256, providing significant institutional buying pressure,” analysts cheerfully noted. Well, that’s one way to prevent disaster. 🤭

On one hand, the supply shock caused by such a purchase may push Bitcoin prices upwards. But on the other, some wise souls caution that this purchase may only offer provisional support at the $114,000 level. After all, without corporate buying, who knows where the price would have gone? Down, down, down… 👀

“Traders noted this purchase was likely the primary buy support at the 114 level, explaining why open interest remained flat during the bounce. Community expressed concern that without this institutional flow, price could have easily dropped to 115 or lower, highlighting the market’s current dependence on corporate treasury flows,” analysts wisely opined. Indeed, the plot thickens. 😤

As the expiry draws near, traders must steel themselves for the volatility that is sure to follow. But fear not, for once the options have expired at 8:00 UTC on Deribit, all will return to normal—at least, for a time. 😌

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- ATHENA: Blood Twins Hero Tier List

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Furnace Evolution best decks guide

2025-08-01 09:07