Amidst the bustling world of cryptoland, where every whisper of a trend can send hearts racing and wallets trembling, there emerges a tale of Optimism, a token that seems to be on the brink of a grand adventure. Analysts, those soothsayers of the digital age, whisper that if this humble token can summon the strength to leap over the 21-week Exponential Moving Average (EMA), it might just find itself in the company of a broader recovery trend, much like a peasant finding himself in the royal court. Trading data and technical indicators, those ancient scrolls of the market, offer a glimpse into the current state of affairs, a tapestry woven with threads of hope and caution.

Building Pressure Around Key Levels

A recent missive from the wise Michaël van de Poppe, a sage among the crypto tribes, revealed that Optimism is now dancing perilously close to the 21-week EMA, a threshold often marked by the fates as a turning point for greater market upheavals. He observed, with a twinkle in his eye, that several other altcoins have already crossed this mystical line, igniting a spark of optimism (pun intended) for a brighter future across the sector.

Charts, those visual chronicles of market lore, show that this particular crypto asset has consistently found support during its periods of retreat, much like a knight finding refuge in a sturdy castle. Volumes, the lifeblood of any market, indicate a growing interest among buyers at lower price points, a sign that the forces of darkness (or rather, sellers) are not yet strong enough to push the price down. This steady activity not only reduces the risk of a significant downturn but also suggests that traders are biding their time, waiting for the right moment to charge forward.

Moreover, the market structure reveals a narrowing price range, a compression of volatility that could explode in either direction at any moment. Once the momentum breaks, the coin could experience a sharp adjustment, with the resistance above the EMA standing as the immediate challenge. It’s a game of cat and mouse, or perhaps more fittingly, a dance of bulls and bears, where the next step could lead to a grand finale or a sudden retreat.

Market Activity Signals Steady Interest

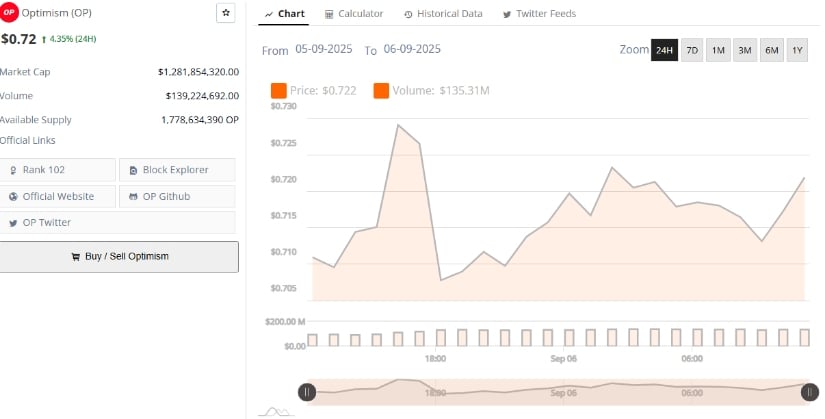

Data from the revered BraveNewCoin, a beacon of light in the crypto world, shows that Optimism is currently trading near the princely sum of $0.72, supported by a market capitalization that exceeds $1.28 billion and daily volumes that hover around $139 million. This level of liquidity, a measure of the market’s heartbeat, indicates active participation, even as the token remains within a relatively narrow range, a testament to the balance of forces at play.

Over the past 24 hours, the price has wavered between $0.71 and $0.73, a reflection of stability amidst the broader chaos of the crypto market. This pattern, much like the calm before a storm, highlights a consistent level of market engagement without the dramatic spikes in volatility that often accompany such moments.

With a circulating supply of 1.77 billion tokens, the supply-side dynamics remain a crucial factor to monitor. However, the stable volume profile suggests that interest in the coin has not waned, reinforcing a balanced outlook for the near future. It’s a delicate equilibrium, a dance of supply and demand, where each step is carefully measured.

Technical Patterns Indicate Neutral Setup

At the time of writing, according to the oracle known as TradingView, OP was trading at $0.7121. The daily chart, a map of the market’s journey, shows the token fluctuating within the confines of Bollinger Bands, with the baseline at $0.7184 acting as a pivot. The upper band, a distant but tantalizing goal, is set near $0.7880, while the lower boundary, a safety net, sits around $0.6488, creating a defined trading corridor in the short term.

The Relative Strength Index (RSI), a gauge of the market’s strength, currently stands at 49.33, indicating a neutral momentum. This position, neither overbought nor oversold, leaves the door open for a move in either direction, depending on external catalysts or shifts in market sentiment. The RSI’s proximity to the midline underscores a period of consolidation, a time when the market takes a breath before the next big move.

The candlestick movements from the past weeks reveal a narrowing range, a classic sign that volatility is brewing just beneath the surface. If the asset can maintain its footing above $0.70 and successfully test the mid-band levels, traders may anticipate a move toward the upper Bollinger Band, a journey that could be both thrilling and profitable. Conversely, a failure to hold these levels could push the token back toward the lower range, though steady support remains a comforting presence.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Witch Evolution best decks guide

- Cookie Run: Kingdom Beast Raid ‘Key to the Heart’ Guide and Tips

- Clash of Clans Meltdown Mayhem December 2025 Event: Overview, Rewards, and more

- All Boss Weaknesses in Elden Ring Nightreign

2025-09-07 00:29