Oh, the drama! The chaos! The sheer audacity of it all! Just when you thought the race for Hyperliquid’s USDH stablecoin infrastructure was getting predictable (*yawn*), three more bidders waltzed in like they own the place. Sky, Bastion, and Native Markets have thrown their hats into the ring, joining Frax Finance, Paxos, and Agora. It’s like a DeFi version of *The Bachelor*, but with more acronyms and fewer roses 🌹💸.

First up, we have Sky, formerly known as MakerDAO (because rebranding is so 2023). They’re proposing a decentralized issuance model for USDH that comes with a 4.85% yield-yes, you read that right, 4.85%! 🤑 Backed by a balance sheet bigger than my student loan debt ($8 billion-plus), Sky’s founder Rune Christensen is flexing hard. He’s offering $2.2 billion in USDC for instant off-chain redemptions and some fancy Layerzero multichain support. Oh, and did I mention they’re throwing $25 million at creating a “Hyperliquid Star”? Sounds less like a project and more like a pop star debut 🎤✨.

But wait, there’s more! Sky’s proposal practically screams, “We’re responsible adults!” with its seven-year security track record and S&P B- credit rating. They even promise to make USDH compliant with the U.S. GENIUS Act (because nothing says “genius” like regulatory jargon). And get this-they’re moving their $250 million annual buyback system to Hyperliquid. Cha-ching! All those yields will go toward HYPE token buybacks or the Assistance Fund. Someone call the DeFi paparazzi! 📸💎

Next, we have Bastion, strutting in like the overachieving sibling at Thanksgiving dinner. Their pitch? A neutral, scalable infrastructure designed for payments, exchanges, and trading. Translation: They want to be the Switzerland of stablecoins. 🇨🇭 Bastion’s big flex is regulatory licensing across jurisdictions, which means fewer frozen assets and smoother fiat on-ramps. No one likes a frozen bank account, am I right? ❄️🚫

Details on revenue sharing are still MIA, but Bastion insists they’re all about Hyperliquid’s ecosystem health. How noble! It’s almost like they’ve been binge-watching nature documentaries. 🌳🦿

Finally, we have Native Markets, led by Max Fiege, who seems to have taken inspiration from Bond villains with his Bridge infrastructure. Their plan? Globally compliant issuance with direct minting on HyperEVM and Hypercore transfers from day one. They’re even bringing Stripe-linked fiat rails to the party, ensuring GENIUS Act compatibility faster than you can say “blockchain.” 🚀🔗

And here’s the kicker: A “meaningful share” of reserve proceeds will flow back into Hyperliquid instead of disappearing into some offshore black hole. How refreshing! The team, including former Uniswap execs, is all about long-term growth. Clearly, they’ve been reading *The Tortoise and the Hare* before bed. 🐢💤

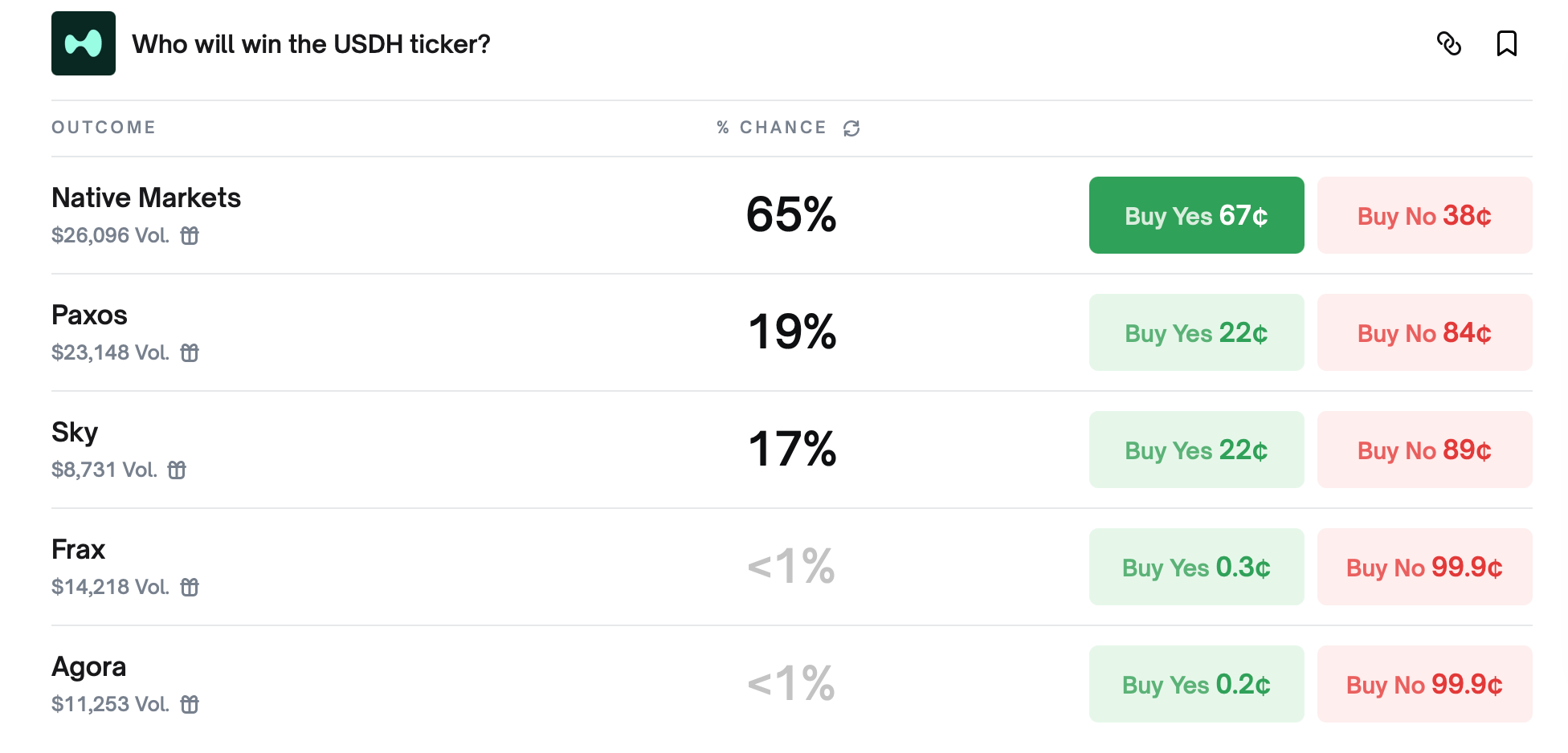

According to Polymarket odds, Native Markets is sitting pretty at 65%, while Sky lags behind at 17%. Poor Bastion didn’t even make the cut-it’s like being uninvited to the cool kids’ table. 🙈

All bids were due by Sept. 10, and validators will crown the winner on Sept. 14. With Hyperliquid currently holding $5.7 billion in stablecoins (mostly USDC), USDH could be the golden goose everyone’s been chasing. Reduced fees, captured yields-it’s enough to make a crypto enthusiast weep tears of joy. 🦆💰

So grab your popcorn, folks. This DeFi soap opera is just getting started, and I, for one, can’t wait to see who gets voted off the blockchain island. 🏝️🔥

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Best Arena 9 Decks in Clast Royale

- How to find the Roaming Oak Tree in Heartopia

- Country star who vanished from the spotlight 25 years ago resurfaces with viral Jessie James Decker duet

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Solo Leveling Season 3 release date and details: “It may continue or it may not. Personally, I really hope that it does.”

- ATHENA: Blood Twins Hero Tier List

- Kingdoms of Desire turns the Three Kingdoms era into an idle RPG power fantasy, now globally available

2025-09-09 20:03