Behold, dear reader, the grand unveiling of Cronos’ 2025-2026 roadmap-a document so ambitious it might as well have been written on parchment with quills dipped in unicorn tears. Yes, Cronos is launching a tokenization platform for every conceivable asset class under the sun (and possibly the moon if Elon Musk doesn’t get there first).

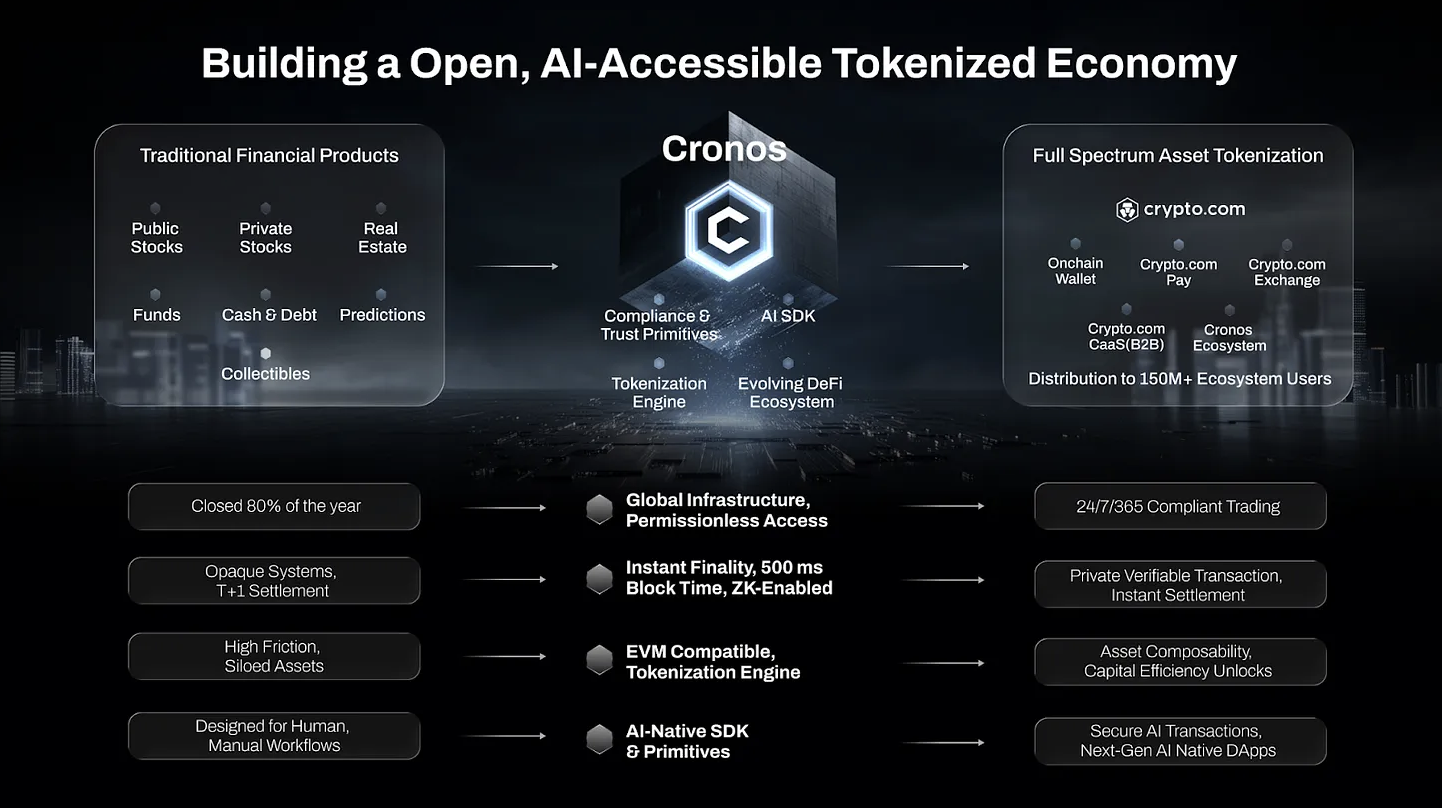

- Cronos will offer you instant settlement, yield generation, lending, and DeFi integration-all bundled into one shiny package. It’s like Christmas morning but without the awkward family dynamics or questionable fruitcakes.

- And lo, the savior of adoption appears: Crypto.com! With over 150 million users and 10 million merchants at its disposal, Cronos has hitched its wagon to this star-crossed crypto behemoth. Let us pray they don’t both crash into the blockchain equivalent of an asteroid field.

Indeed, Cronos (CRO) envisions itself not merely as another cog in the machine but as *the* core infrastructure provider for all things tokenized and AI-driven. How quaintly optimistic! Over the next 12 to 18 months-or roughly the amount of time it takes me to finish Proust’s In Search of Lost Time-Cronos promises to roll out support for equities, real estate, commodities, funds, insurance, forex, and perhaps even your grandmother’s secret recipe for mince pies.

But wait, there’s more! To ensure its systems are “AI-native” (whatever that means), Cronos plans to launch an AI Agent SDK and something called a Proof of Identity standard. Imagine Siri trading stocks while Alexa validates your digital passport. Truly, we live in strange times. 🤖✨

Of course, none of this would matter much without Crypto.com acting as Cronos’ personal cheerleader, megaphone in hand, shouting across the financial landscape about how wonderful everything is going to be. Adoption, they say, shall rain down upon them like confetti at a particularly lavish wedding.

When Institutions Come Knocking: ETFs, Treasuries, and Other Pretentious Sounding Things

Should retail investors prove too fickle, fear not! For Cronos has devised another scheme involving those ever-so-serious institutions. Enter stage left: CRO ETFs, courtesy of partners such as 21Shares, Canary Capital, and Trump Media Technology Group. One can only imagine the boardroom meetings where these deals were struck-with PowerPoint slides clashing dramatically against mahogany tables.

Furthermore-and I do mean further because apparently we’re still climbing this mountain of ambition-Cronos intends to back digital asset treasuries incorporating CRO. This comes hot on the heels of a $6.4 billion SPAC merger between Trump Media and Crypto.com, which sounds less like finance and more like the plot of a Bond film where everyone wears suits made entirely of Bitcoin logos.

By the end of 2026, Cronos aims to achieve the following Herculean feats: $20 billion in CRO demand from public market vehicles, $10 billion worth of tokenized real-world assets, and 20 million users flitting between centralized and decentralized platforms like moths drawn to whichever flame burns brightest. Ambitious? Certainly. Achievable? Well, let’s just say I wouldn’t bet my vintage wine collection on it. 🍷😂

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Arena 9 Decks in Clast Royale

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-08-29 11:25