Pray, allow me to impart upon you the latest tribulations of the fickle Chainlink, whose price has taken a most unseemly tumble below its erstwhile esteemed levels. Analysts, those wise arbiters of fortune, declare the region of $14-$15 to be a critical accumulation zone within LINK’s long-term ascending channel. Should this support hold, a rebound toward $50 is not beyond the realm of possibility. Yet, for now, the token lingers near $16.70, mired in consolidation and a sentiment most cautiously bearish. 🌧️

A Head and Shoulders Breakdown: The Scandal of the Season

Alas, Chainlink has confirmed a Head and Shoulders breakdown on the daily timeframe, a pattern most dire and foreboding. Alpha Crypto Signal, ever the observant chronicler, notes that the breach of the neckline, coupled with rising sell volume, portends a shift from bullish exuberance to bearish despair. This traditional reversal indicator suggests that the recent momentum may be waning, leaving the token in a most precarious state. 😱

The analyst avers that the bearish structure remains intact so long as the price lingers below the neckline and fails to reclaim the 9-day exponential moving average (EMA) near $18.25. The token’s inability to regain this short-term trend indicator speaks volumes of the weakness among buyers. Likewise, LINK trades below its 50-day simple moving average (SMA) at $21.88, a circumstance that only serves to reinforce the downward pressure. A most unfortunate turn of events, indeed. 😔

Technical Outlook: A Confluence of Woes at $13-$14

The analysis identifies the next support zone around $13-$14, where both horizontal and ascending trendline supports align. This confluence level may act as a possible area for a technical rebound, should sellers begin to lose their vigor. For now, Chainlink remains in a corrective phase, its decline mirroring the completion phase of the Head and Shoulders setup, where sellers typically push prices toward the measured target range. Maintaining levels below the neckline confirms a continued bearish bias, though short-term consolidation may precede the next major move. 🌀

A Glimmer of Hope: $14 as a Potential Buy Zone

Analyst Ali, ever the optimist, presents an alternative long-term outlook, identifying $14 as a potential accumulation region. His chart reveals that the asset has remained within an ascending channel that has guided its price trajectory since 2023. The current retracement toward the channel’s lower boundary suggests the possibility of renewed buying interest near this level. 🌟

Ali’s projection envisions a rebound from this support, which could form the basis of a gradual recovery targeting $50 over time. The path includes reclaiming key resistances at $22 and $28 before advancing toward the upper channel limit near $45-$50. This scenario reflects a cyclical recovery pattern consistent with previous multi-year trends, but it hinges upon the token maintaining support near $14-$15. A most delicate balance, to be sure. 🤞

Current Market Conditions: A Study in Fluctuation

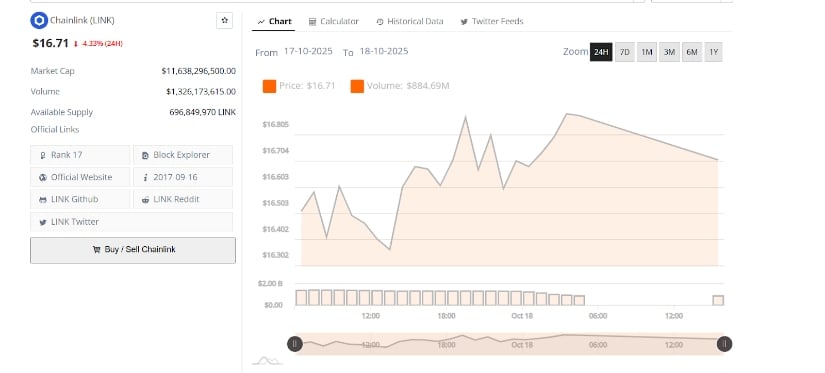

At the time of writing, Chainlink trades at $16.71, marking a 4.33% decline over the past 24 hours. Its market capitalization stands at $11.63 billion, while daily trading volume reaches $1.32 billion. The price action exhibits intraday fluctuations, with the asset briefly touching $16.80 before easing lower as traders took profits amid cautious sentiment. 🕰️

Technically, the price has lost upward momentum after recent rallies, with repeated failures to sustain higher highs above $16.80. The narrowing range between $16.60 and $16.70 indicates potential consolidation as volatility cools. Should the altcoin break below $16.30, traders may look for support at $16.20. Conversely, a move above $17.20 could renew short-term bullish momentum, potentially leading to a target of $18.00. A most intriguing dance, is it not? 💃

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- What If Spider-Man Was a Pirate?

2025-10-19 00:38