The exchange, in a display of quiet efficiency, filed a request with the U.S. Securities and Exchange Commission (SEC) – a request which, should it be approved, promises to be a positively ripping good show, according to those in the know.

While America Was Occupied With Turkey, Nasdaq Placed a Rather Daring Bet on Bitcoin

Bitcoin, that rather volatile chap, was slowly chugging its way towards the ninety-two thousand dollar mark on Thanksgiving Day – and few, I say few, understood precisely why. The day before, whilst the citizenry was busy carving fowl, Nasdaq International Securities Exchange (ISE) petitioned the SEC to quadruple its permitted position limit for Blackrock Bitcoin ETF contracts from a modest 250,000 to a rather more substantial 1,000,000. Rather a leap, what?

“The Exchange, in its wisdom, believes that increasing the position limit (and the exercise limit, naturally) for options on IBIT to 1,000,000 contracts would enable liquidity providers to provide additional liquidity to the Exchange,” Nasdaq wrote in its submission. One suspects a touch of bureaucratic phrasing there, but perfectly harmless, I suppose. 🙄

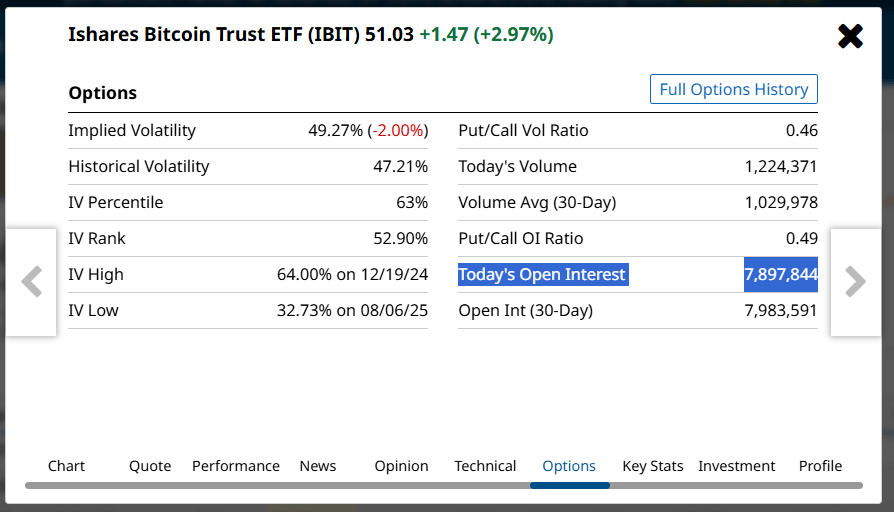

Traders, you see, employ these options contracts to have a bit of a flutter on bitcoin’s price without actually, you know, possessing the thing itself. The more lively these contracts are – a metric grandly dubbed ‘open interest’ – the more fluid the market becomes. Blackrock Ishares Bitcoin Trust (IBIT) options contracts represent wagers on IBIT’s price, a rather indirect way of playing the bitcoin game, if you ask me. IBIT currently boasts some eight million open contracts, but one was previously limited to a maximum of 250,000 contracts per punt.

Nasdaq’s bold move to raise that limit hints at increased institutional enthusiasm for BTC. Previously, the exchange was rather restricted with a measly 25,000 contract limit. That was bumped up to 250,000 in July, and now a request for a million? Clearly, the punters want more! “$IBIT is now the biggest bitcoin options market in the world by open interest,” declared Bloomberg’s Senior ETF Analyst Eric Balchunas. Quite!

But, and this is rather important, quadrupling the maximum – a safeguard against any unsavoury market trickery – suggests the SEC is feeling confident that bitcoin derivatives have matured enough to mingle with the big boys. There hasn’t been much in the way of jolly news for bitcoin lately, but for BTC investors, this Nasdaq manoeuvre deserves a little jig, even on Thanksgiving.💃

A Brief Overview of the Market Situation

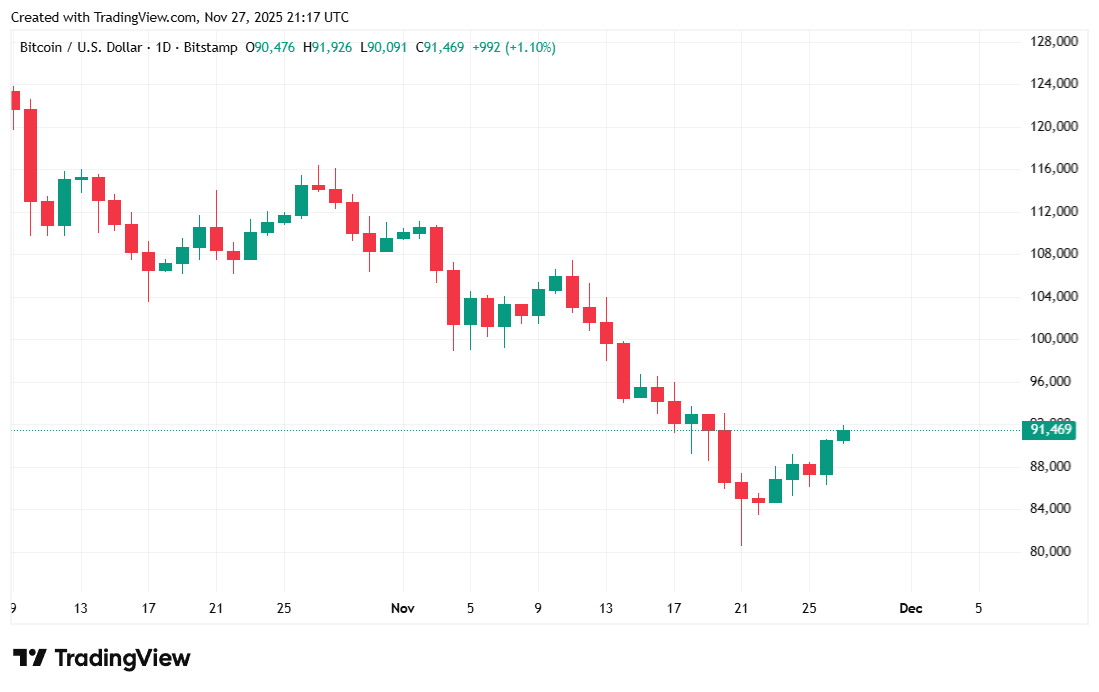

Bitcoin experienced a rather respectable 1.63% increase on Thanksgiving Day, trading at a not-unpleasant $91,351.49 at the time of writing, according to Coinmarketcap’s reckoning. Weekly performance was also in the green, at 5.38%. Volatility was, thankfully, relatively restrained, with BTC’s price fluctuating between $89,824.37 and $91,897.58 over the 24-hour period.

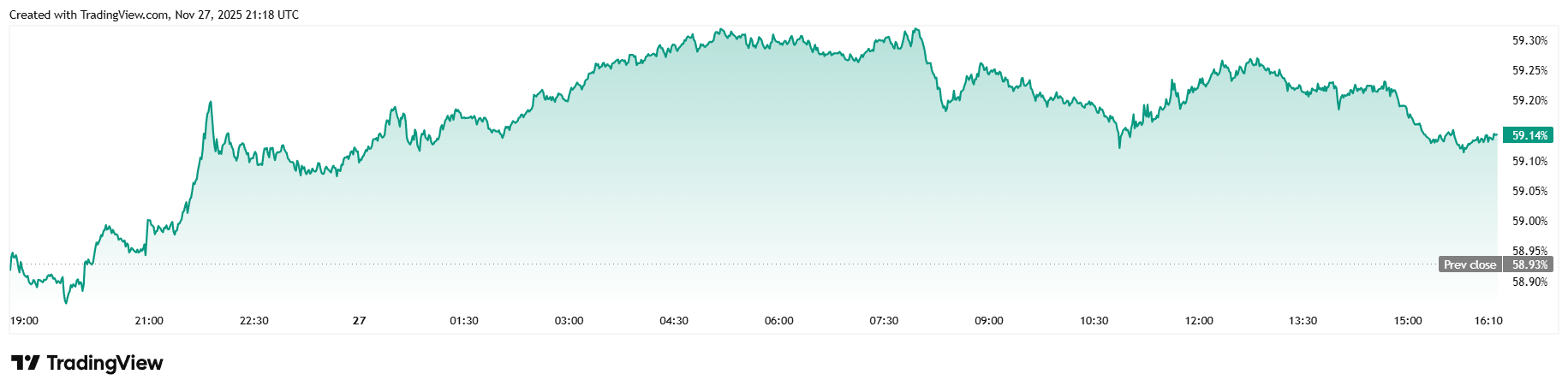

Daily trading volume dipped slightly, understandably given the holiday, falling 8.73% to $59.79 billion. Market capitalization rose to $1.82 trillion, in line with today’s price action, and bitcoin dominance swayed upwards 0.37% to reach 59.14%, recovering a bit of its lost swagger.

Total bitcoin futures open interest was remarkably steady at $60.19 billion, according to Coinglass. Liquidations were down, totaling $76.19 million, mostly short sellers getting their comeuppance to the tune of $66.68 million. Long investors weren’t entirely unscathed, losing $9.51 million on overly optimistic wagers.

Frequently Asked Questions ⚡

- Why did bitcoin suddenly perk up on Thanksgiving?

Bitcoin experienced a rally, partially fuelled by Nasdaq’s surreptitious filing to increase IBIT options limits from 250,000 to 1,000,000 per trader. - What, precisely, does Nasdaq’s request accomplish?

It permits significantly larger positions in BlackRock’s bitcoin ETF options, bolstering liquidity and encouraging greater institutional participation. - Why should bitcoin investors take notice?

Increasing the cap signals that U.S. regulators deem bitcoin derivatives sufficiently mature and safe for more substantial institutional exposure. - Is IBIT truly the largest bitcoin options market now?

Indeed. IBIT options presently lead the global bitcoin options markets by open interest.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-11-28 03:07