Today, the MYX price didn’t just dip; it staged a brutal long squeeze, the kind of moment you remember while brushing your teeth and realizing your portfolio has a personality disorder. It collapsed about 50% in what felt like the blink of an existential crisis, wiping out overheated positioning and turning derivatives dashboards into a red neon Christmas tree that keeps blinking even after you’ve unplugged the toaster.

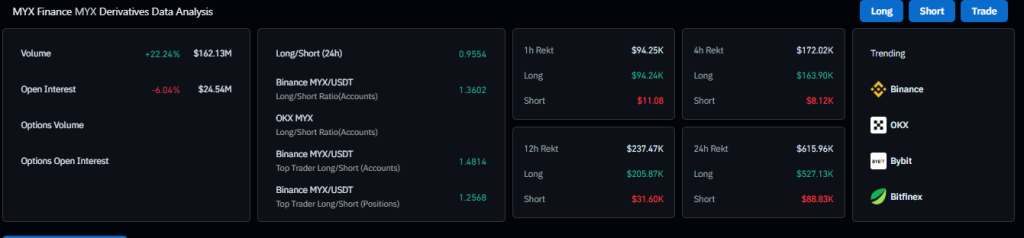

According to Coinglass, total liquidations rekt over the past 24 hours reached $615.96K. Longs took the bulk, $527.13K flushed, while shorts accounted for just $88.83K. That imbalance tells a clear story of a token dump. This wasn’t a balanced deleveraging; it seemed like a one‑sided unwind designed to squeeze every last bit of profit from people who forgot to put on their risk goggles.

Liquidations Tell the Story in MYX Price

When long liquidations outweigh shorts nearly five to one, it usually means someone bet the elevator would never stop and forgot there are stairs. I’m not saying they were wrong-just that the view from the top wasn’t as scenic as they imagined.

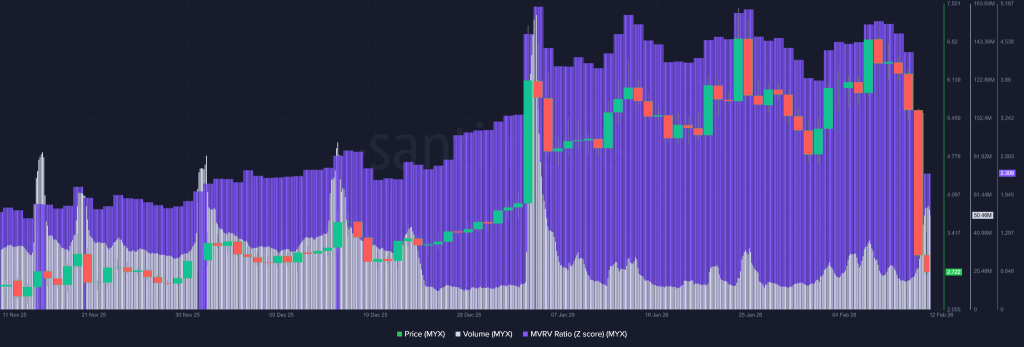

The onchain data confirms they leaned too bullishly. Per Santiment’s data, the MYX price had previously pushed the MVRV Z-Score to 4.731, a danger zone that looked like a speed trap for anyone driving a metaphorical sports car with a dented bumper. The metric had been climbing, but not much beyond 4.731-quite the ceiling for optimism, if you’re keeping score in a betting pool you call “the market.”

That reading suggests market value had detached sharply from holders’ cost basis. In plainer terms, there were too many paper profits, and the market tried to bridge that gap by lighting the fuse on a dump. Too much heat, not enough smoke detectors.

As a result, the Z-score collapsed to 2.309 alongside a 50% price drawdown and surging volume. That’s not random volatility; that’s a dramatic shift from speculative euphoria to something closer to fair value-where your hopes are smaller and your margin calls louder. Massive unrealized gains got flushed out. Weak hands exited under pressure. Supply changed hands with the efficiency of a used bookstore expanding into a disaster movie set.

Well, here’s the kicker: that kind of washout can either mark the end for crypto or the reset before a base forms. Based on what the MYX price chart displays, it seems it is more interested in developing a base around $2.50-$3.00, aligning with an ascending trendline that’s been present for months-the kind of stubborn line that won’t quit, like a mug that sticks to the countertop after you wash it three times.

MVRV Reset in Motion

A drop from 4.731 to 2.309 doesn’t scream bullish continuation, but it doesn’t scream structural death either. Historically, extreme Z-scores leave little room for sustainability. Pullbacks are common, and around here, they’re practically a tradition with a tuxedo and a disclaimer.

Now the market sits in a more neutral-bullish range, at least statistically speaking. And that spike in volume during the drawdown? Classic capitulation behavior. It often accompanies panic-driven exits. But let’s be honest, it also signals the market has aggressively repriced risk, which is the grown-up way of saying “we all learned a hard lesson about leverage and pride.”

$3 Support Under Pressure

Technically, the MYX price chart shows the collapse reaching an ascending trendline support near $2.50-$3.0. That level matters. So far, it’s holding at CMP at $2.65, as I write this, which sounds like a college freshman’s GPA but for a crypto chart.

But, if $3.0 breaks decisively, downside toward $1.0 becomes a realistic extension of the bearish outlook. No sugarcoating that. However, if consolidation builds around current levels and demand gradually returns, the foundation for recovery could form-a little like shelving a dream of villa in the hills and settling for a studio with decent sunlight.

The MYX price prediction now hinges on whether this support becomes accumulation or surrender.

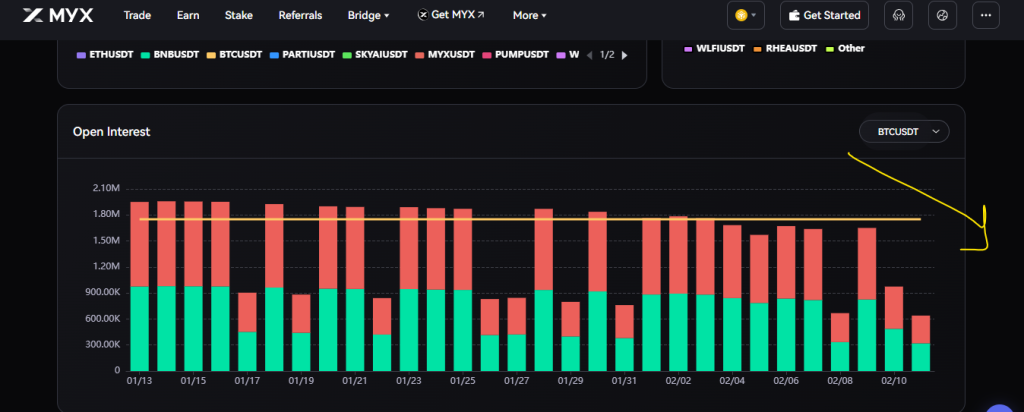

Utility Concerns Emerge

And then there’s the uncomfortable detail. Lower daily exchange activity appears to have played a role too in a recent dump. Because MYX’s utility is driven by trading activity on its platform, recent dashboard data shows declining open interest across key pairs like BTC/USDT and ETH/USDT. It’s the crypto version of a suddenly quiet gym-you notice the difference when the weights stay on the rack.

Less activity. Less utility demand. Investors noticed and they basically dumped. The moral of the story, if there is one, is that a platform without people trading on it tends to become a museum, albeit a very expensive one with a humming discount sign.

So while the long squeeze triggered the collapse, slowing exchange momentum may have lit the fuse. Whether that trend stabilizes could determine what happens next for MYX price.

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Gold Rate Forecast

- Star Wars Fans Should Have “Total Faith” In Tradition-Breaking 2027 Movie, Says Star

- KAS PREDICTION. KAS cryptocurrency

- eFootball 2026 Jürgen Klopp Manager Guide: Best formations, instructions, and tactics

- Christopher Nolan’s Highest-Grossing Movies, Ranked by Box Office Earnings

- Jason Statham’s Action Movie Flop Becomes Instant Netflix Hit In The United States

- Jujutsu Kaisen Season 3 Episode 8 Release Date, Time, Where to Watch

- Jessie Buckley unveils new blonde bombshell look for latest shoot with W Magazine as she reveals Hamnet role has made her ‘braver’

- How to watch Marty Supreme right now – is Marty Supreme streaming?

2026-02-12 20:32