What to know:

- In a plot twist worthy of a soap opera, Monero’s price has plummeted from a lofty $420 to a mere $325 in just three days. Talk about a dramatic fall from grace!

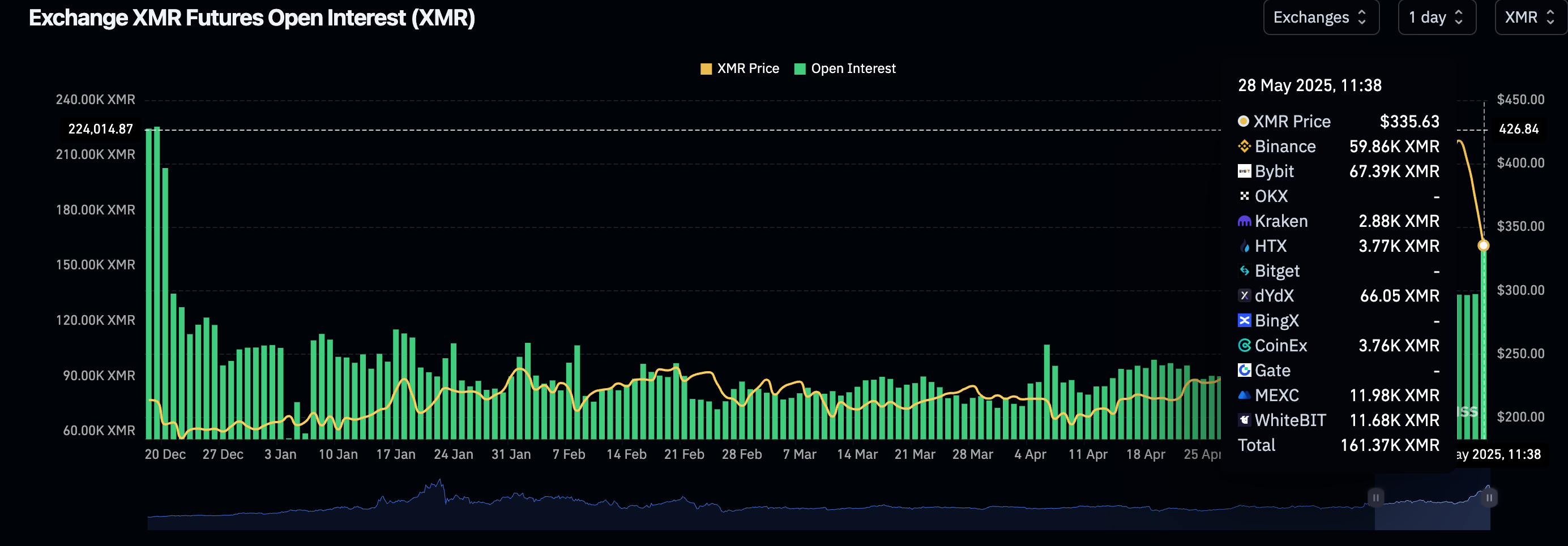

- Open interest in Monero futures has skyrocketed to levels not seen since December, suggesting that traders are either very brave or very foolish. 🤔

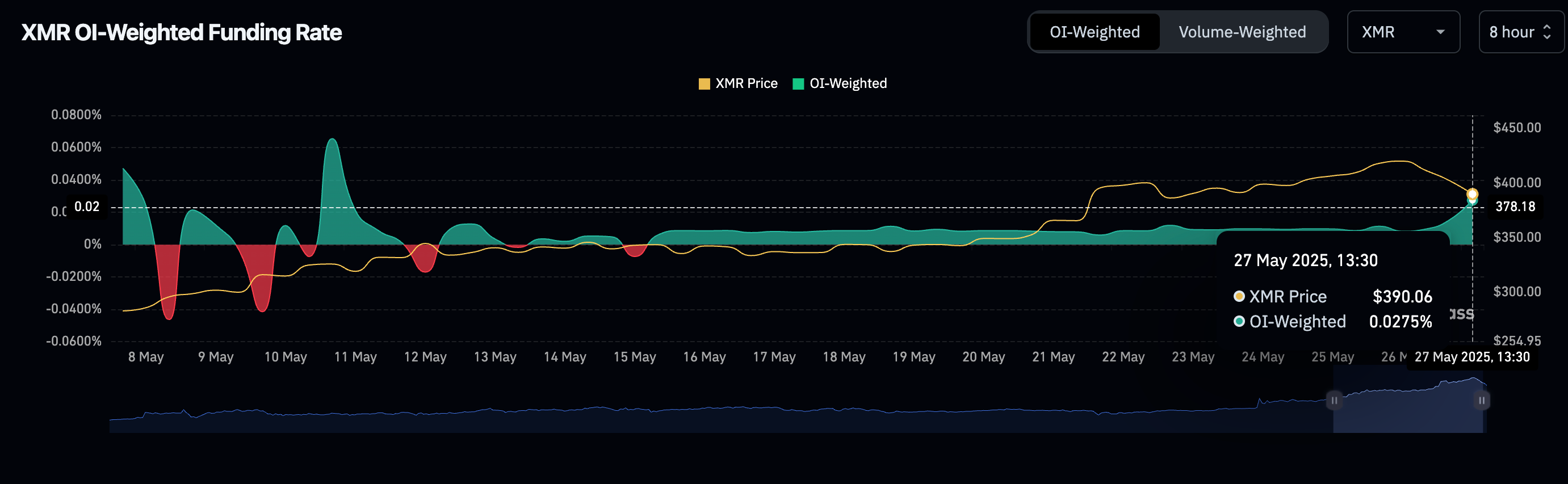

- Positive funding rates are waving a little flag for long positions, as if to say, “Hey, don’t panic!”

In the grand universe of cryptocurrencies, Monero (XMR) has decided to take a nosedive, leaving traders wondering if they should buy the dip or just buy a ticket to the next space adventure. 🚀

On this fine Wednesday, the largest privacy coin by market capitalization has plummeted to $325 on Kraken, after peaking at a dizzying $420 on Monday. Who knew the crypto world could be so volatile? 📉

This sell-off follows a meteoric rise from $165 to $420 over seven weeks, all thanks to a favorable U.S. regulatory outlook and the impending FCMP++ upgrade, which promises to make Monero as secure as a vault guarded by a dragon. 🐉

Open interest rises

As the price tumbles, the futures market is buzzing with activity, with open contracts jumping to a staggering 161.37K XMR—the highest since December 20. It’s like a party where everyone shows up just as the cake falls off the table! 🎂

Now, typically, an increase in open interest during a price drop is seen as a sign of bearish sentiment. It’s like watching a group of traders don their raincoats just as the sun comes out. ☔️

Funding rates hold positive

But wait! Not all is doom and gloom for XMR. The perpetual funding rates are still positive, suggesting that traders are feeling a bit more optimistic than a cat in a room full of laser pointers. 🐱

This uptick in open interest likely reflects a “buy the dip” mentality—traders are jumping in, hoping for a quick recovery, like a kid diving into a pool of jelly. 🍮

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Witch Evolution best decks guide

- Best Hero Card Decks in Clash Royale

2025-05-28 10:30