Behold, MicroStrategy-now rebranded as “Strategy”-has conjured Bitcoin like a sorcerer’s spell, vanquishing the age-old woes of private equity with a flourish of digital alchemy. Or so claims Chaitanya Jain, who now speaks in riddles backed by $BTC.

In a world where private equity has spent decades fumbling with retail investors like a toddler with a Rubik’s cube, Jain proclaims Strategy has cracked the code: “Perpetual capital” and “Digital Equity” (a term as vague as a dachshund’s shadow). All thanks to Bitcoin, which now serves as both collateral and confidant. 🐕💰

MicroStrategy’s Bitcoin Overture: A Symphony of Leverage and Lunacy

Jain, with the gravitas of a man who’s never met a metaphor he couldn’t overuse, boasts that Strategy has “democratized” access to alternative investments. By which he means: “We’ve turned Nasdaq into a Bitcoin buffet for the masses.” 🍽️📈

“Since the last decade, Private Equity has been trying to (i) raise directly from retail and (ii) build continuation or perpetual funds,” Jain declared, as if reciting a grocery list. “Strategy has achieved both. Permanent capital via publicly listed securities on Nasdaq. Digital Equity and Digital Credit backed by $BTC.”

Indeed, Strategy’s “Digital Equity” allows investors to gamble on Bitcoin with a side of leverage, while “Digital Credit” offers BTC-backed loans. A financial duet only a mother could love. 🎵💸

2025 marked Year 0 for Digital Credit.

Innovating, launching, and scaling.

All in a tepid $BTC year.2026 is Year 1.

– Chaitanya Jain (@CJ_Bitcoin) January 3, 2026

In 2025, Strategy raised $21 billion through a cocktail of equity, preferred stock, and convertible debt. The pièce de résistance? A $2.5 billion perpetual preferred stock issuance, hailed as the “largest US IPO by gross proceeds” that year. One can only imagine the champagne showers. 🥂

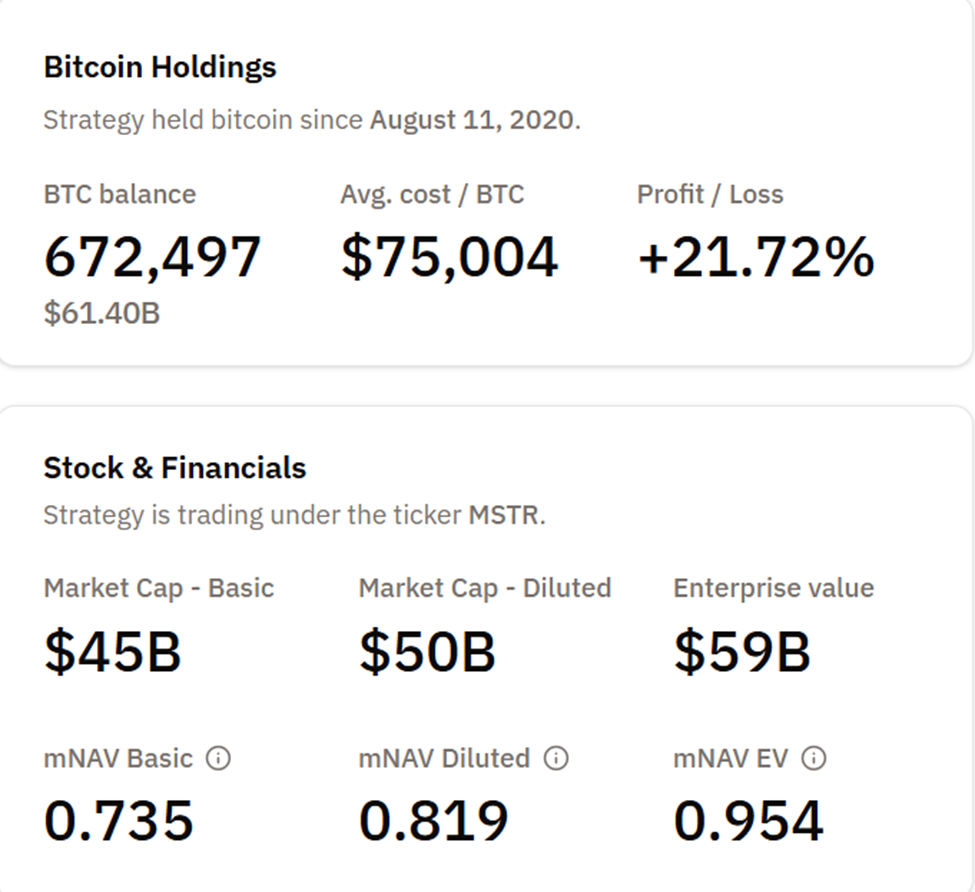

With 672,497 BTC in its vault (acquired for $50.4 billion, now worth $61.4 billion), Strategy’s balance sheet resembles a Russian nesting doll of leverage. $15-16 billion in debt and preferred stock? Why yes, because who needs sleep when you’re a leveraged Bitcoin investment vehicle? 🛏️🚀

Analysts whisper that this model could trigger crypto’s next “black swan” in 2026. A thrilling prospect, assuming one enjoys financial chaos with a side of existential dread. 🕊️💣

Yet, even as Strategy dances on the edge of a fiscal precipice, it remains a corporate Bitcoin treasury par excellence. Or as one might call it, “the world’s most over-leveraged software company with a crypto fetish.” 💅

Jain’s 2026, dubbed “Year 1,” promises to scale these BTC-backed products amid a market infrastructure that’s “stronger” than a toddler’s willpower. One can only hope the MSCI exclusion looming overhead isn’t the plot twist we’ve all been dreading. 🕵️♂️

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- Clash Royale Witch Evolution best decks guide

2026-01-05 01:42