Japan-based investment firm Metaplanet, in a move that could either be seen as a stroke of genius or a mad dash towards the digital gold rush, is planning to raise a whopping 555 billion yen ($3.7 billion). This, dear readers, is not just any ordinary fundraising; it’s part of their grand “Bitcoin Strategy,” aiming to hoard a staggering 210,000 Bitcoin (BTC) by the end of 2027. 🚀💰

Metaplanet Seeks $3.7 Billion Raise To Buy More BTC

As per the official announcement, Metaplanet intends to raise this colossal sum through a stock offering. The funds will be directed towards their ambitious Bitcoin Strategy, with the goal of accumulating 210,000 BTC by the end of 2027. If you’re wondering why they need so much money for a digital currency, well, welcome to the 21st century! 🌐💸

Interestingly, the company will issue perpetual preference shares to finance this strategy. These shares promise an annual dividend of up to 6%, but only if the market conditions, interest rates, and investor demand align perfectly. It’s like a magic trick, where everyone hopes something valuable appears out of thin air. 🎩🪄

Some critics argue that issuing new shares might dilute the value for existing shareholders. But Metaplanet assures us that the projected increase in BTC Yield will create enough corporate value to counteract any negative effects. For those who don’t speak financial gibberish, BTC Yield is a fancy way of saying how much the company’s Bitcoin stash grows relative to the number of shares floating around. 📊✨

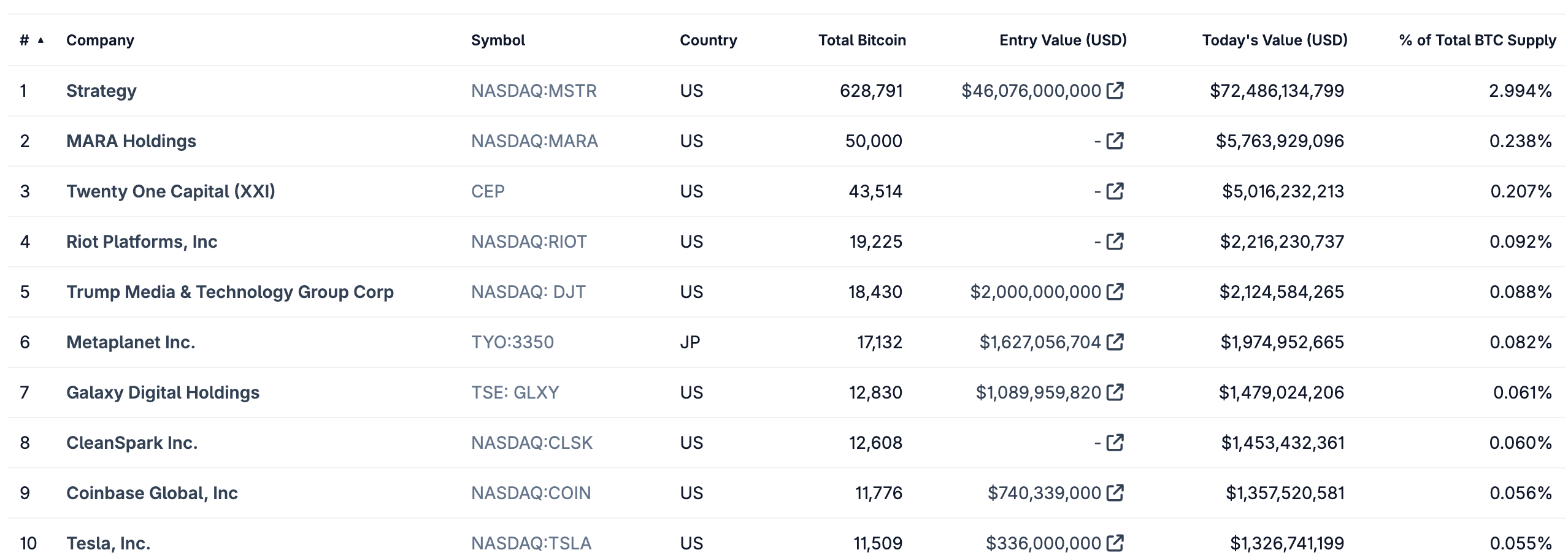

Just over two weeks ago, Metaplanet added 800 BTC to its balance sheet, bringing its total holdings to 17,132 BTC. According to CoinGecko, this makes them the sixth-largest corporate Bitcoin holder. Not bad for a company that’s betting big on the future of digital currencies. 🏆🔥

Despite the grand plans, Metaplanet’s stock took a tumble today, closing down 7.65% at 1,063 yen ($7.18). However, the stock is still up more than 200% year-to-date, which is like saying they’ve had a rollercoaster ride with a few unexpected dips. 📉🎢

Companies Anticipating Further Bitcoin Upside?

Since Donald Trump’s surprising victory in the 2024 US presidential election, there’s been a wave of optimism regarding crypto-friendly regulatory reforms. This has encouraged several global corporations to dip their toes into the digital asset pool. 🏃♂️🌊

For instance, NYSE-listed Marti Technologies has announced plans to convert 20% of its cash reserves into BTC. Meanwhile, MARA Holdings successfully raised $950 million to expand its Bitcoin exposure. Even in the UK, companies like Satsuma Technology and The Smarter Web Company are beefing up their BTC reserves. 🇬🇧💼

This renewed institutional interest is further fueled by positive macroeconomic signals. The CME’s FedWatch tool suggests a 78.8% chance that the US Federal Reserve will cut interest rates at its September 17 meeting. Such a move could be a boon for risk-on assets like Bitcoin. At the time of writing, BTC is trading at $115,189, down 2.8% in the past 24 hours. 📈📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-08-02 11:14