So, here we go again! The crypto market is all in a dither as over $4.6 billion of Bitcoin and Ethereum options are expiring today. I mean, what could possibly go wrong? This delightful spectacle is destined to dictate the short-term price circus for our two favorites! 🎢

Analysts are waving their flags, cautioning that this September expiry is a historic heavyweight-known for its tragic performances and liquidity issues. Why, oh why, can’t we have a “normal” month? 🤦♂️

Bitcoin, Ethereum Options Expiry: $14.6 Billion Drama Unfolds

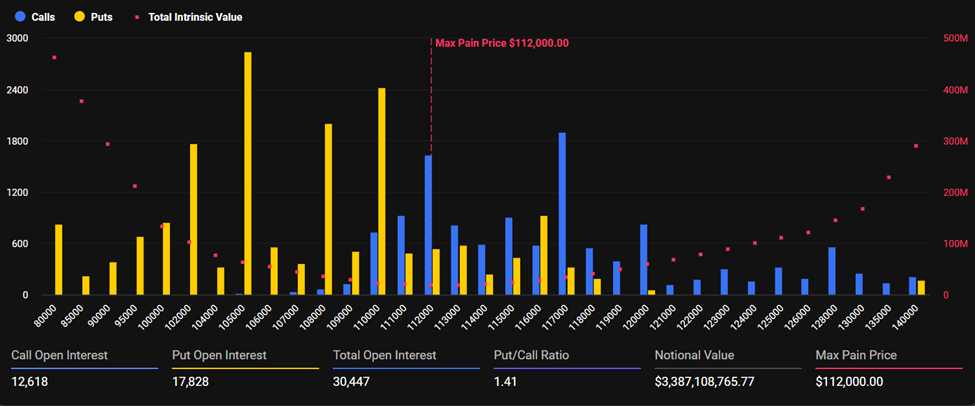

Bitcoin (BTC) is strutting around with a staggering notional value of $3.38 billion. According to Deribit (they’re like the referees of this game), we’re looking at 30,447 contracts in play. Talk about an overstuffed piñata just waiting for a good whack! 🎉

The max pain point-where all those poor options expire worthless-sits at $112,000. Meanwhile, the put-call ratio is 1.41. Sounds like bears are getting cozy, and we’re riding a wave of caution like a worn-out surfboard. 🌊

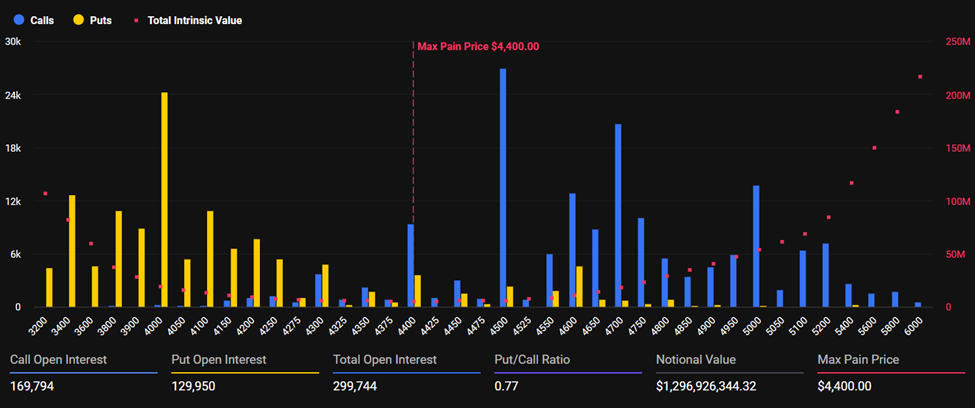

Ethereum, bless its digital heart, is facing its own existential crisis with $1.29 billion on the line. Open interest? Try 299,744 contracts! And here we are sitting on the edge of our seats! The max pain level for Ethereum is $4,400, which sounds like a weird party game. 🕺

With a put-call ratio of 0.77, it seems there’s more demand for calls, but analysts are pointing fingers at a big ol’ build-up above the $4,500 strike. Thanks for the heads up, Deribit! 🙄

“…flows lean more balanced, but calls build up above $4.5K, leaving upside optionality,” said Deribit. Sounds like a cryptic crossword puzzle no one asked for!

Now, if we dive into Ethereum’s implied volatility (IV), we see it’s had a bit of a freakout, surging toward 70%! 💥 Expectations for price swings are all the rage, especially after Ethereum decided to take a little dip of over 10% from its latest peak.

“Weakness in US equities and the WLFI index has intensified market skepticism,” they said. Yeah, understatement of the year, folks!

But wait, we’re not done! Bitcoin also had a tickle of excitement, bouncing back to about 40% IV after spending a month in a sulk. Did it drop more than 10% from its all-time high? Yes, yes it did. 🙃

Traders are sharpening their defensive playbooks, with block trading in puts rising to nearly 30% of today’s options volume. Defensive, offensive, whatever-we’re just trying to survive, right?

Analysts Warn: September is a Tough Month

Analysts at Greeks.live are practically screaming that September has always been a doozy for crypto. Capital flows tend to get stuck like an elevator in a bad movie. 🎭

“The options market, in general, lacks confidence in September’s performance,” they added. Gee, thanks for the optimism! 😅

Current trends in crypto equity are making it hard for anyone to feel like a superstar. As options expiry rolls around, Bitcoin and Ethereum’s prices might just be pulled toward their max pain like a moth to a flame. Right now, Bitcoin’s chilling at $111,391, a hair’s breadth from that $112,000 mark. Ethereum is fairing similarly at $4,326. Bold moves, my friends! 🎯

With today marking the third-quarter delivery month, the volatility could swing wildly. Traders might just be waiting for a miracle or hunkering down for the storm. The market usually stabilizes after 8:00 UTC, right when the options expire. 🎈

The burning question? Will this expiry bring Bitcoin and Ethereum closer to their current levels or ignite a bit of a spark for recovery? Stay tuned, folks. 💡

And there you have it-option dynamics bringing a touch of drama as we sit and watch the price pressure up close. If history tells us anything, September loves to poke at bulls with a stick. But with everyone on heightened alert, any surprise upside could face a swift kick to the curb. Buckle up! 🍿

Read More

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale December 2025: Events, Challenges, Tournaments, and Rewards

- Best Arena 9 Decks in Clast Royale

- Clash Royale Best Arena 14 Decks

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Decoding Judicial Reasoning: A New Dataset for Studying Legal Formalism

2025-09-05 08:52