On this fateful day, February 5, 2026, U.S. equities found themselves in the clutches of despair, resembling a tragic opera as technology shares took center stage in a grand performance of decline.

Nasdaq Takes a Bow as Risk-off Sentiment Returns

The stock markets opened with a dramatic plunge, as if each index were an actor tumbling into a pit of despair, continuing a multi-session retreat that weighed heavily on growth-oriented sectors. The tech-heavy Nasdaq Composite, like a beleaguered hero, faced the brunt of the storm, setting the stage for its worst three-day performance since the spring of 2025, as investors sought refuge in the arms of safer havens, bidding adieu to high-valuation stocks.

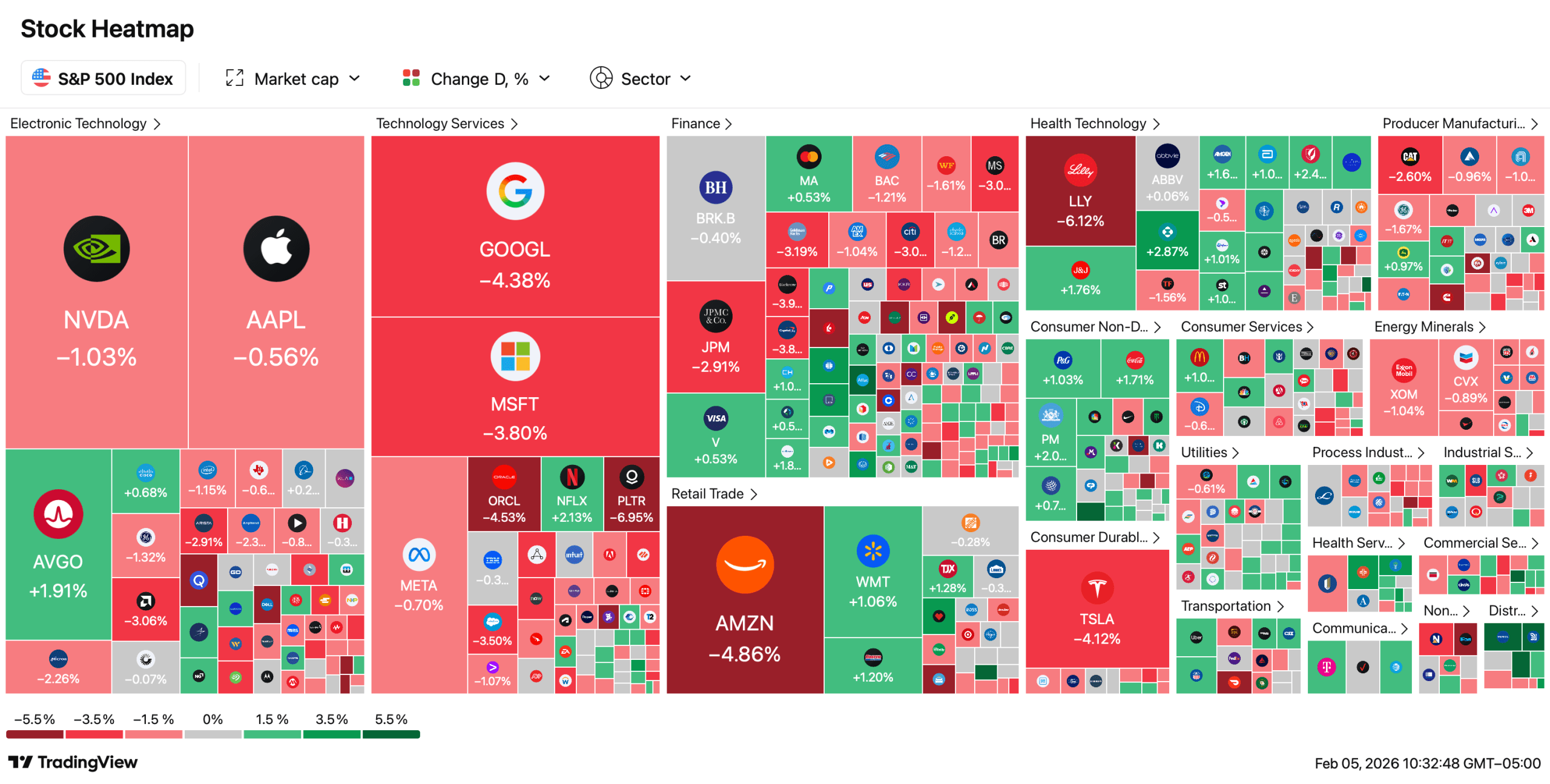

By mid-morning, the Nasdaq Composite teetered at 22,500.96, down 403.62 points-each tick a lamentation. The S&P 500 succumbed to gravity, falling 94.64 points to 6,788.08, while the Dow Jones Industrial Average slid 598.18 points to 48,903.12, the NYSE Composite joined the gloomy procession, echoing the broader weakness across sectors.

Technology shares bore the weight of the world as fears swirled around capital expenditures entwined with artificial intelligence initiatives, valuations stretched like a rubber band ready to snap. Software and semiconductor stocks embarked on a multi-day retreat, erasing hundreds of billions in market value since the dawn of the year, as chipmakers faced pressure akin to a bad dinner party conversation, even when some dared to beat earnings estimates.

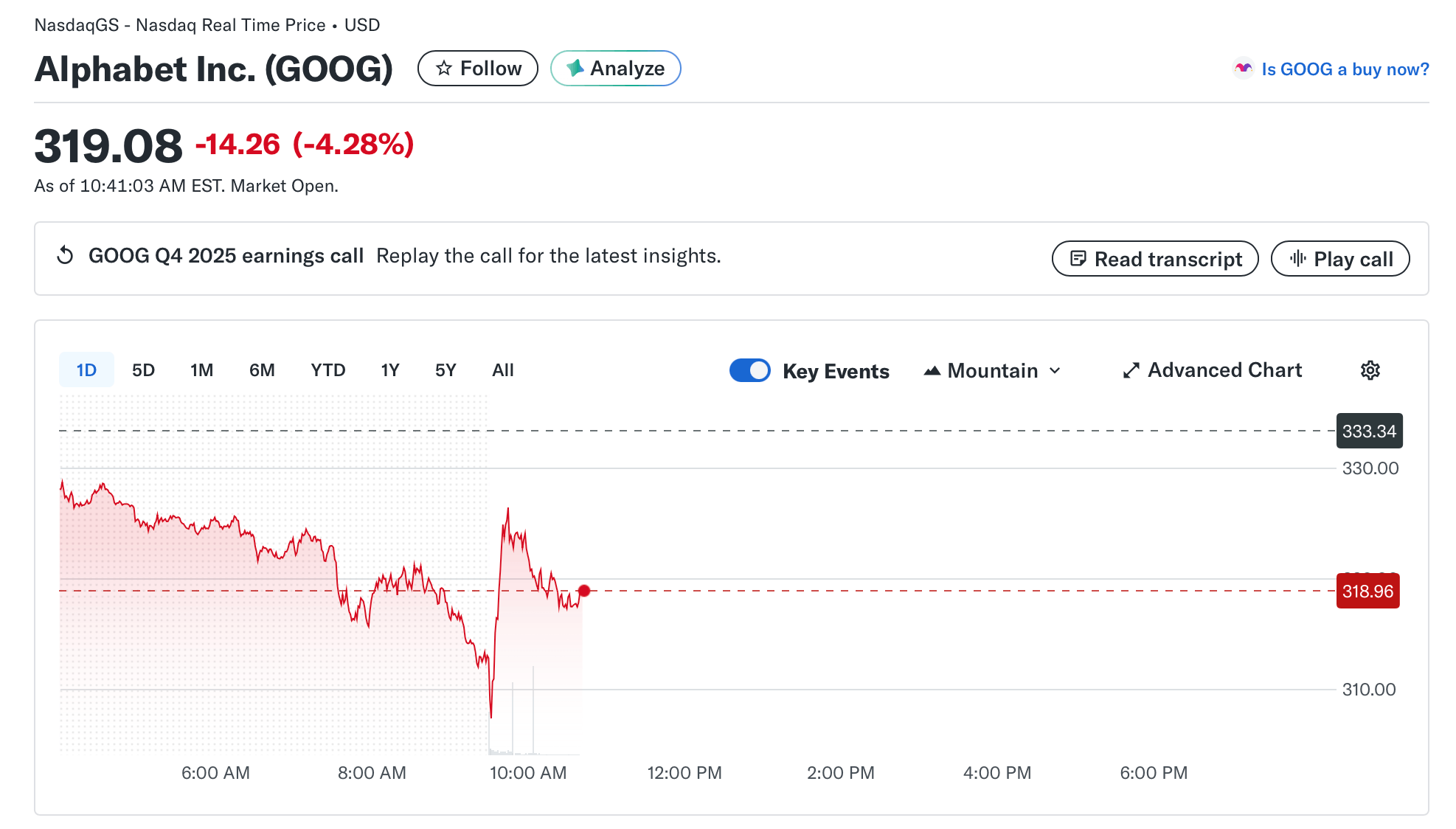

Communication services also fell victim, as Alphabet (Google) shares plummeted after revealing ambitious AI spending plans, proving that sometimes the more you spend, the less you earn. Health care stocks added to the malaise, while other defensive sectors offered support so limited it could barely prop up a paper cup. The Cboe Volatility Index hovered near 21, signaling elevated uncertainty-a feeling familiar to anyone who’s ever tried to assemble IKEA furniture without instructions.

Economic data clouded the scene further, as a rise in unemployment claims and lackluster private hiring figures echoed back to the days of yore, reviving fears of a slowing growth, thus prompting a collective retreat from risk assets. Futures markets mirrored this unease, with S&P 500 and Nasdaq futures pointing downward like a forlorn compass before the opening bell.

Investor sentiment turned cautious as portfolios were restructured amidst a broader sector rotation. Value-oriented stocks began to bask in the limelight, outperforming their growth counterparts since the year’s inception-ah, the irony! The small-cap shares had their moments of fame earlier in 2026, suggesting that investors were reassessing exposure after last year’s jubilant rally, which now seemed like a distant memory.

Global markets echoed this dissonance, as major indexes in Europe and Asia followed suit, sinking lower into the abyss. A stronger U.S. dollar and ongoing geopolitical tensions played the role of the villain, adding to the pressure, resulting in a synchronized retreat across asset classes, reminiscent of a Shakespearean tragedy.

In a twist of fate, bitcoin succumbed to gravity, falling below the $67,000 threshold for the first time since November 2024, extending a dramatic decline from its October 2025 peak of over $126,000. Precious metals, too, waded into the waters of retreat, with gold and silver posting losses that would make even the most stoic investor weep, as they reduced leveraged positions amid the heightened volatility.

As we cast our gaze forward, analysts foretell choppier trading conditions throughout the year, citing inflated equity valuations, the uncertainty of election year antics, and queries about the sustainability of AI-driven spending. While some strategists point to glimmers of opportunity in undervalued sectors, the near-term sentiment remains cautious, as markets adjust to the fickle whims of macroeconomic signals.

FAQ ❓

- Why are U.S. stocks falling on Feb. 5, 2026?

Equities declined as investors sold off technology shares amid valuation concerns and softer economic data-because who needs stability, right? - Which indexes were hit the hardest?

The Nasdaq Composite led losses, followed by the S&P 500 and Dow Jones Industrial Average-the usual suspects! - What sectors drove the selloff?

Technology, software, semiconductors, and communication services were the biggest laggards, leaving us to wonder if they ever had a good day. - Is market volatility increasing?

Yes, with the VIX near 21, signaling heightened uncertainty across markets-time to hold onto your hats!

Read More

- Clash of Clans Unleash the Duke Community Event for March 2026: Details, How to Progress, Rewards and more

- Brawl Stars February 2026 Brawl Talk: 100th Brawler, New Game Modes, Buffies, Trophy System, Skins, and more

- Gold Rate Forecast

- MLBB x KOF Encore 2026: List of bingo patterns

- eFootball 2026 Show Time Worldwide Selection Contract: Best player to choose and Tier List

- Free Fire Beat Carnival event goes live with DJ Alok collab, rewards, themed battlefield changes, and more

- Brent Oil Forecast

- Magic Chess: Go Go Season 5 introduces new GOGO MOBA and Go Go Plaza modes, a cooking mini-game, synergies, and more

- eFootball 2026 Starter Set Gabriel Batistuta pack review

- Overwatch Domina counters

2026-02-05 20:43