Oh là là! Bitcoin Bonanza: Who Knew Mining Could Be So Profitable? 💰😄

Ah, mes amis! With a flourish of triumph, our dear Marathon has struck gold—well, Bitcoin, to be precise! With a staggering sum of over $5 billion in Bitcoin, they now prance about as the second-largest corporate holder of this digital treasure, trailing only behind the illustrious Strategy. What a delightful game of financial charades! 🎭

Corporate Bitcoin Holdings Continue to Grow

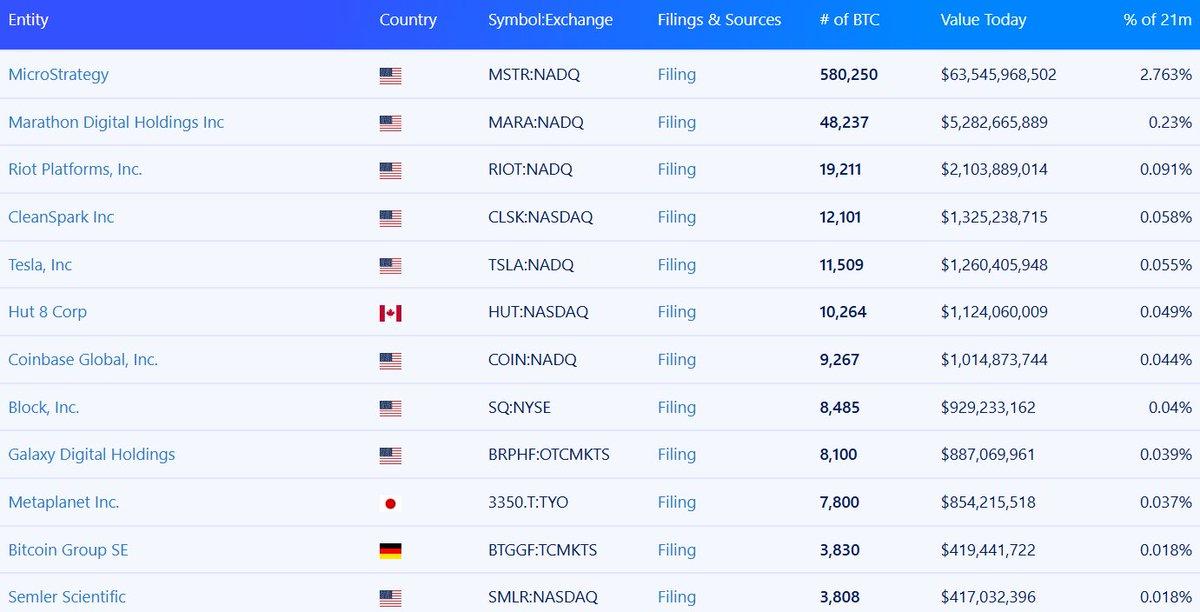

In the latest scrolls of financial wisdom, it appears that Strategy reigns supreme with a jaw-dropping 580,250 BTC, worth more than $63.5 billion! Meanwhile, our dear Marathon, with a mere 48,237 BTC, is like a sprightly young lad catching up to the elder statesman. Their rapid accumulation and rising mining profits are the talk of the town! 🏃♂️💨

With such strategic positioning, they have left behind other U.S.-based mining companies, such as Riot Platforms (19,211 BTC) and CleanSpark (12,101 BTC). One must wonder if they are all playing a game of “who can hoard the most Bitcoin?” 🤔

And let us not forget the other illustrious names in this grand Bitcoin ball: Tesla (11,509 BTC), Coinbase (9,267 BTC), and Block, Inc. (8,845 BTC). It seems the institutional confidence in this digital asset is as robust as a French wine! 🍷

Public Companies Signal Long-Term Confidence in Bitcoin

Ah, the data reveals a most intriguing trend! Public companies are not merely dipping their toes into the Bitcoin pool; they are diving in headfirst! From the mighty fintech giants to the energy-efficient mining firms, corporate treasuries are now treating Bitcoin as a strategic reserve rather than a mere speculative dalliance. How very sensible! 🧐

Strategy’s relentless accumulation strategy is akin to a long-term romance, while Marathon’s impressive mining revenue showcases how industrial-scale mining is becoming a formidable force in this digital ecosystem. Who would have thought that mining could be so chic? 💃

As Bitcoin evolves into a mainstream financial instrument, these holdings suggest that publicly traded firms are preparing for a future where digital assets play a critical role in corporate finance and balance sheet management. A future where every company might just be a Bitcoin aficionado! 🤑

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-05-28 04:15