In the face of today’s uncertain and fluctuating market conditions, Mantra has garnered significant interest among cryptocurrency aficionados and digital asset dealers. Unfortunately, negative news has impacted its popularity.

The massive decrease in the token’s value occurred rapidly, causing a significant plunge in its price and recalling the dramatic event known as the LUNA crash of 2022, which was marked by a sharp decline in its chart.

The sudden drop in the value of Mantra tokens ignited a flurry of allegations among the project team members and centralized trading platforms, causing uncertainty among investors and token owners as to the cause of the incident and its potential future implications.

Let’s analyze the reasons for this drop and what the on-chain analysis tells us.

Mantra Token Price Collapse: What Happened?

On the 14th of April, the value of Mantra, the digital currency associated with the Mantra blockchain, plummeted by a staggering 90%, suggesting a potential record-breaking cryptocurrency crash akin to TerraLuna’s since then.

On April 13th, the OM token was priced at $6.30, but by 17:00 UTC that day, it began a sharp decline. Within an hour, the cryptocurrency plummeted 75%, dropping to nearly $0.50 by 19:00 UTC.

The sudden drop wiped out over $5.2 billion from the company’s total value, causing concern about potential internal deceit and inadequate supervision on the trading platform.

The significant drop occurred particularly in periods with less trading activity, making the effects of widespread selling more pronounced. This occurrence at odd hours has sparked debate among many about whether the market collapse was a spontaneous event or an intentional one.

Swift Management’s Reaction

John Patrick Mullin, one of the co-founders, swiftly addressed concerns, confirming that the platform remains operational and its Telegram communities continue to operate smoothly. He emphasized that users’ assets and funds are secure, and there is no instance of a ‘Mantra exit scam’ associated with this event.

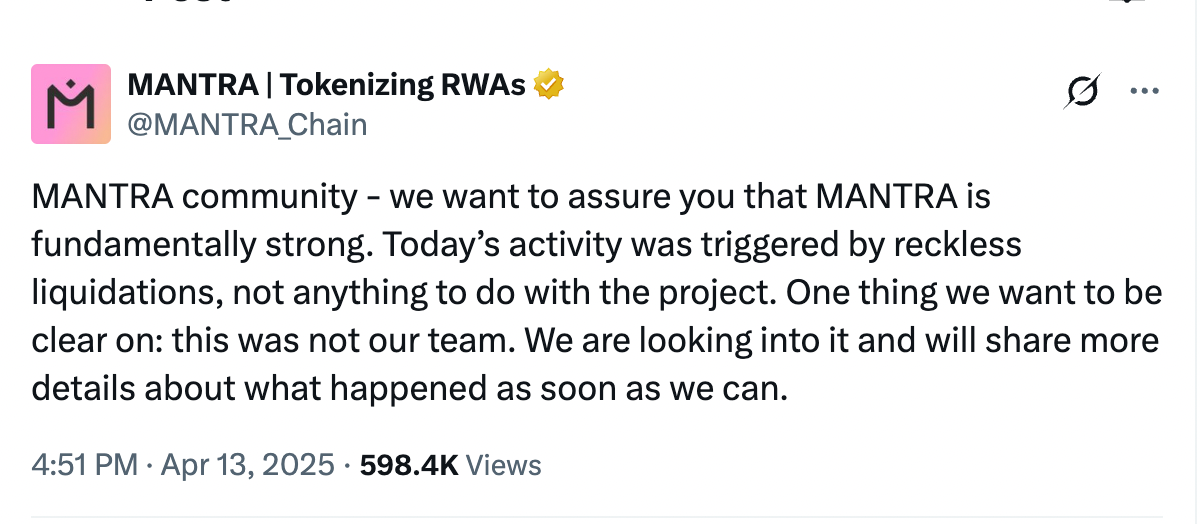

As a researcher, I’ve noted an intriguing point raised by Mullin in a recent post: abrupt liquidations occurred predominantly during illiquid phases of the market. This situation, in turn, intensified the downward trend of the Mantra, leading to a significant decrease in its price.

He underscored that the main group remains in possession of their token distribution and plans to carry on developing, notwithstanding the obstacle.

Mantra’s Roadmap

As an analyst, I’ve been observing Mantra’s progression as a potential powerhouse for Real-World Asset (RWA) tokenization. In the month of January 2025, Mantra sealed a significant $1 billion partnership with the UAE-based DAMAC Group, marking a pivotal step towards tokenizing real estate and digital infrastructure.

In February, it became the initial DeFi project to acquire a Virtual Asset Service Provider (VASP) license from the Virtual Assets Regulatory Authority (VARA), located in Dubai.

Achieving this milestone enables Mantra to legally conduct business in the UAE as a digital asset company, thereby establishing itself as an emerging force within the world of tokenized financial systems.

The project’s future is uncertain as the community is seeking explanations to determine if they will or won’t have faith in the platform.

Insider Trading or CEX Liquidations

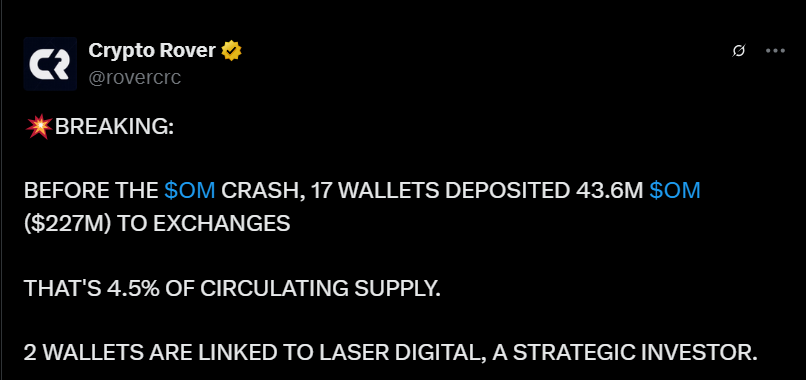

According to blockchain analysis firm Arkham, approximately 17 digital wallets moved about 43.6 million OM tokens (worth around $227 million) to exchanges prior to the market downturn. This transfer represented around 4.5% of the total supply in circulation, adding fuel to suspicions regarding these transactions.

A troubling aspect is that among these wallets, two are connected to Laser Digital, a key initial backer of Mantra Chain. This discovery has fueled further conjecture regarding potential internal manipulation, casting doubt on the effectiveness of Mantra’s management structure and economic model.

Nevertheless, the co-founder argued that centralized exchanges had caused the crash. He condemned these platforms for carrying out hasty, compulsory liquidations of significant OM positions without adequate warning or collaboration, labeling their behavior as a betrayal of trust.

It seems that the specific reason behind it remains uncertain, but prominent digital asset trading platforms such as OKX and Binance are currently scrutinizing an apparent instance of collusive selling by insiders.

Final Takeaways

The sudden drop in value of the OM token sparked widespread fear in the cryptocurrency sector. Although the market’s general prices weren’t at their peak, this steep decline came as quite an unwelcome surprise.

In just a few short hours, the price of the Mantra token plummeted by more than 90%, casting uncertainty on the company’s previously promising future prospects.

Given the internal disagreements among key personnel and centralized platforms casting blame, can Mantra bounce back from this challenge, as the co-founder proposes?

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Best Hero Card Decks in Clash Royale

- FC Mobile 26: EA opens voting for its official Team of the Year (TOTY)

2025-04-14 21:25