As I sit here, sipping my tea and pondering the vicissitudes of the cryptocurrency market, I find myself drawn to the curious case of Litecoin. This erstwhile darling of the altcoin world has, of late, experienced a bit of a pullback, rather like a nervous debutante at her first ball. 💃

Litecoin, or LTC, as it is affectionately known, was trading at a rather anemic $85.98 on Sunday, a far cry from its heady heights of May, when it seemed as though the sky was the limit. This decline, I dare say, has been mirrored by other altcoins, such as Cardano (ADA) and Chainlink (LINK), rather like a trio of synchronized swimmers executing a flawless dive into the depths of despair. 🏊♀️

And yet, despite this seeming downturn, the odds of the Securities and Exchange Commission (SEC) approving a Litecoin ETF have jumped to a rather impressive 76%. Ah, but what does this portend, dear reader? 🤔

Well, it seems that Litecoin’s status as a proof-of-work cryptocurrency, rather like Bitcoin (BTC), has earned it a certain… let’s say, ” cache” in the eyes of the SEC. Its main difference from Bitcoin, of course, being its rather more generous supply limit of 84 million coins, compared to Bitcoin’s rather parsimonious 21 million. 🤑

Thus, it would seem that the SEC’s approval of Bitcoin ETFs has set a rather… shall we say, “precedent” for Litecoin. And should an LTC ETF be approved, well, it would likely lead to a veritable flood of American investors clamoring to get in on the action. 🚀

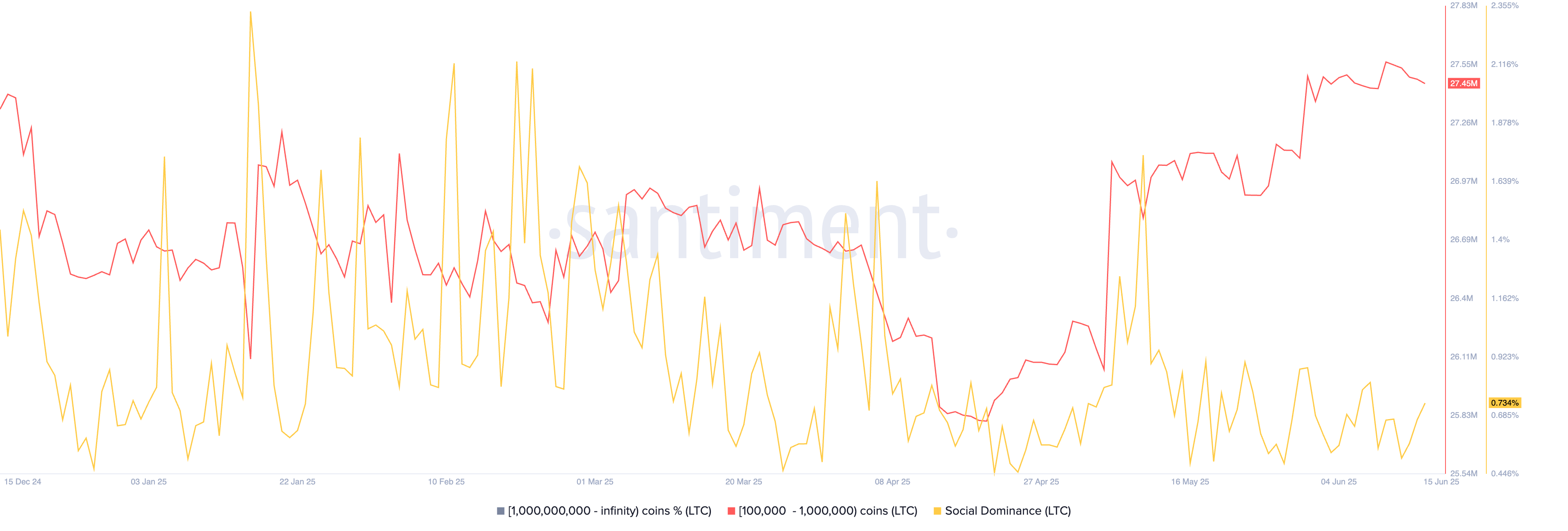

But wait, dear reader, there’s more! It seems that those wily whales have been accumulating Litecoin with all the fervor of a latter-day Captain Ahab. Santiment data shows that accounts holding between 100,000 and 1 million tokens have increased their holdings from 25.8 million on April 15 to 27.8 million today. Ah, but what does this mean, you ask? 🤔

Why, it means that Litecoin’s social dominance has pointed upwards in the past few days, a sign that it is attracting attention from social media users like a latter-day siren luring sailors to their doom. It rose to 0.734% from 0.512%, a rather impressive feat, if I do say so myself. 📈

And now, dear reader, let us turn our attention to the rather more esoteric realm of technical analysis. 📊

The daily chart, you see, shows that the LTC price dropped to $63.30 in April and then bounced back to $106.72 as the crypto market rally happened. Ah, but what a wild ride it’s been, rather like a latter-day rollercoaster careening out of control through the streets of Tokyo. 🎠

Recently, however, it has pulled back and moved below the 50-day and 200-day Exponential Moving Averages. Ah, but fear not, dear reader, for this is merely a sign that the bears have prevailed, rather like a latter-day Napoleon at the Battle of Waterloo. 🐻

Litecoin price, you see, has formed a rather… shall we say, “bullish flag chart pattern”, a popular continuation sign, rather like a latter-day semaphore signaling the approach of a rather more auspicious era. This pattern comprises of a vertical line, which in this case starts at $63.29 and ends at $106.72. It is now forming the flag section in the form of a descending channel, rather like a latter-day Ariadne’s thread leading us out of the labyrinth. 🧵

Therefore, Litecoin price will likely rebound, and initially target the resistance at $106.7, which is up by 25% from the current level. Ah, but what a wondrous prospect, rather like a latter-day sunrise breaking over the horizon. ☀️ A climb above that resistance will point to more gains, potentially to $140, the highest swing in January and February this year. 🚀

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- World Eternal Online promo codes and how to use them (September 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- ATHENA: Blood Twins Hero Tier List

- Clash Royale Furnace Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

2025-06-15 18:07