JTO, the governance token of the Jito Network, is today’s top-performing asset, climbing almost 15% over the past day. 🚀

The bullish momentum follows Jito Labs’ June 13 meeting with the US Securities and Exchange Commission’s Crypto Task Force. 🤝

JTO Eyes Breakout After SEC Talks Spark Investor Accumulation

JTO has witnessed a resurgence in new demand following Jito Labs’ June 13 meeting with the SEC’s Crypto Task Force. At this meeting, the parties discussed a proposed Token Transparency Framework and a blockchain-based securities trading initiative dubbed “Project Open.”

//beincrypto.com/wp-content/uploads/2025/06/JTOUSDT_2025-06-16_08-14-58.png”/>

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

JTO’s RSI readings indicate market participants prefer accumulation over distribution. If this trend continues, its price could continue to rise. 📈

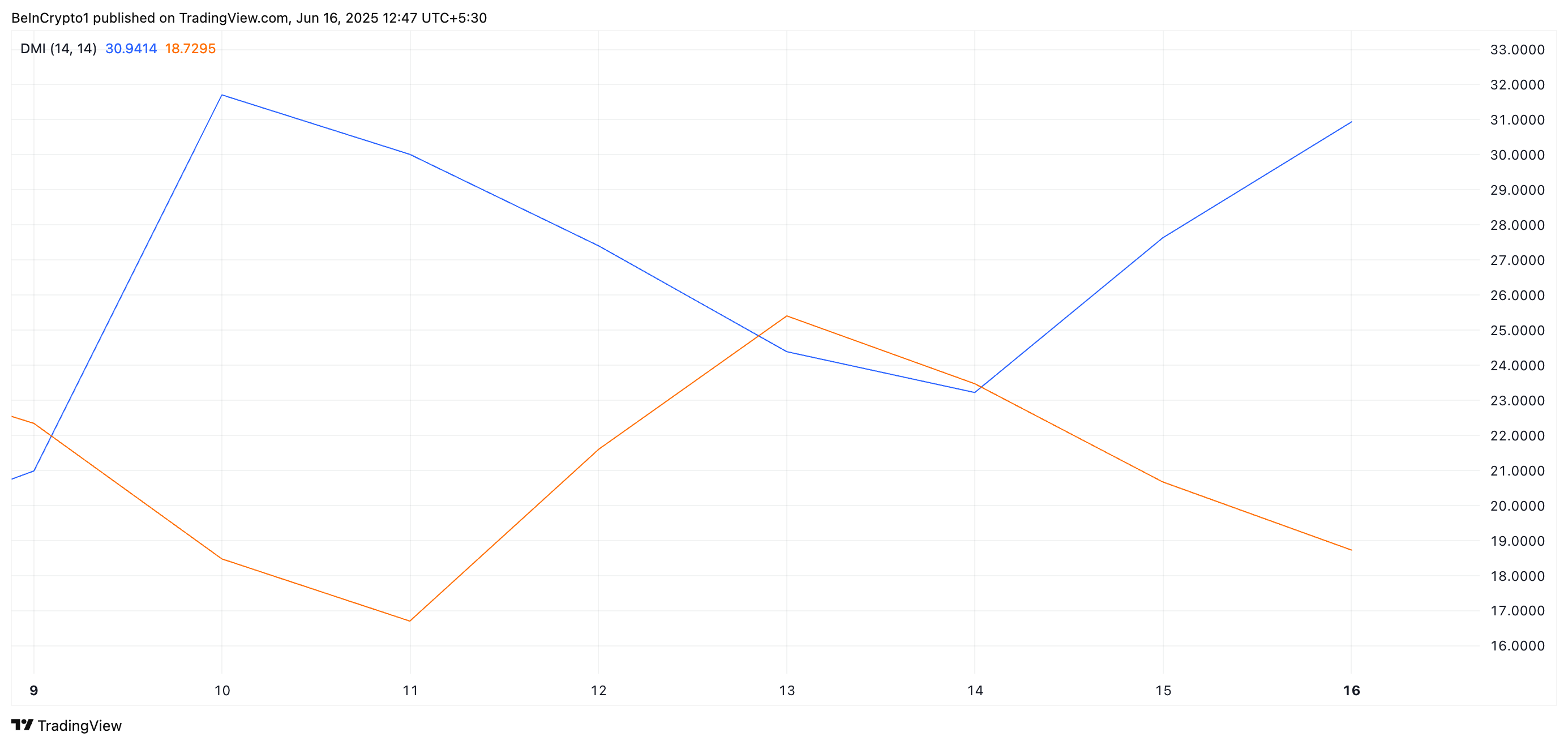

Furthermore, the token’s Directional Movement Index (DMI) highlights growing bullish dominance, with the positive directional indicator (DI+, blue) pulling ahead of the negative (DI–, orange).

The DMI indicator measures the strength of an asset’s price trend. It consists of two lines: the +DI, which represents upward price movement, and the -DI, which means downward price movement. 📈

When the +DI rests above the -DI, it signals that upward price movements are stronger than downward ones, indicating a bullish trend. The widening gap between the two lines on the JTO/USD one-day chart confirms the stronger directional momentum in favor of buyers.

JTO Surges Toward Key Resistance—Will Bulls Push Through?

At press time, JTO trades at a two-month high of $2.30. With strengthening buying pressure, the altcoin could break above the resistance at $2.39. 💥

A confirmed breakout and subsequent flip of this level into support could open the door for a move toward $2.53 in the short term. 📈

However, if profit-taking gains traction, JTO may face a temporary correction, with potential downside toward $2.01. 📉

Read More

- Clash Royale Best Boss Bandit Champion decks

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Best Hero Card Decks in Clash Royale

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Best Arena 9 Decks in Clast Royale

- All Brawl Stars Brawliday Rewards For 2025

- Clash Royale Furnace Evolution best decks guide

- Dawn Watch: Survival gift codes and how to use them (October 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Clash Royale Witch Evolution best decks guide

2025-06-16 13:21