In the gray shadowed corridors of finance, as if in a Chekhovian salon after one vodka too many, Metaplanet—a Japanese investment firm flavored with all the vigor of impatient youth—has snapped up 1,241 Bitcoin (BTC) for a sum so perfectly modern it makes Dostoevsky’s pockets tremble: $126.7 million.

And so it came to pass: Metaplanet, fueled more by spreadsheets than poetry, now boasts grander Bitcoin coffers than the whole nation of El Salvador—lending new drama to the spectacle that is institutional asset holding.

Metaplanet: Vanquishing El Salvador with the Casual Flick of a Wallet 🥷

A company missive—perhaps written on the finest, most melancholic stationery—declares: they bought their latest Bitcoins at an average of $102,119 per coin (or, in more dignified yen, 14,848,061) and the entire hoard now tallies up at 6,796 BTC. Just last week it was 5,555 BTC. One imagines their accountants, pale in the candlelight, updating the ledger with trembling hands.

Their affair with Bitcoin began as recently as April 2024, but love has a way of accelerating: they now best El Salvador’s modest national reserve, which stands at a shy 6,174 BTC. The difference? 622 BTC—a number enough to arouse envy in every Central American café.

“We have more Bitcoin than El Salvador. From humble beginnings to rivaling nation-states, we’re just getting started,” boasted CEO Simon Gerovich—though perhaps a little Dostoevskian self-doubt is in order.

The air grows thick with numbers. On X (which your father remembers as Twitter), Gerovich trumpeted their dogged devotion: a cumulative $608.2 million invested. At today’s price of $104,003 per Bitcoin, their stash is worth $706.8 million—a delicious 16.2% profit that neither Pushkin nor the tax authorities could ignore.

In a turn that would make even the most jaded nihilist raise an eyebrow: BTC Yield for 2025 has strummed a balalaika at 170.0%. And for those keeping count since April Fool’s Day till May 12, it sits at 38.0%. All in the name of “shareholder value.” How the word sings!

Meanwhile, the company’s stock leaped like Turgenev’s youthful heroes—up 3.8% in a single Monday after the news. One almost expects troikas to race through Tokyo’s business district.

And what do poets say of growth? BeInCrypto whispers that Metaplanet’s stock has multiplied fifteenfold since the Bitcoin adventure began. Has optimism ever looked so enticing—at least to investors if not to the lovesick?

Metaplanet vs. Strategy: In the Duelling Salons of Bitcoin Speculation 🎩

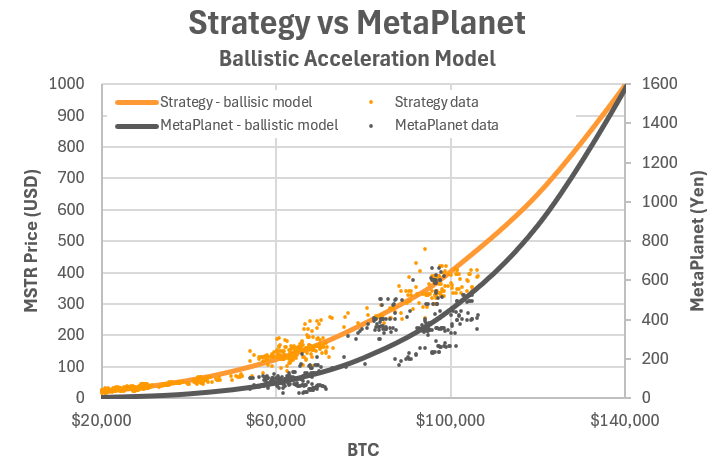

Some, sharpened by the bitterness of Moscow tearoom debates, compare Metaplanet to Strategy (née MicroStrategy of the United States)—that old warhorse of Bitcoin collecting. Yet one analyst, emboldened with the glee of a provincial wit at a St. Petersburg soirée, claims Metaplanet might outshine its rival when Bitcoin’s price mounts the barricades.

If Bitcoin were to tease the heavens at $120,000, the soothsayer expects Metaplanet stock to double, while Strategy might muster a 1.6x rise. At $150,000, Metaplanet would leap to 4.5x, Strategy to a mere 3.0x. It is as if the two duelists have found themselves on different paces—one tipsy, the other inspired.

The prophecy continues: in this wind-whipped market, Metaplanet’s “asymmetric upside” (a phrase calculated to bewilder even the most cynical pensioner) might mean wilder fortunes—larger wins, sharper heartbreaks. They are, in short, the high-beta, high-falutin’ proxy for those who like their Bitcoin exposure the way they like their novels: dramatic, long, and possibly ending in existential crisis.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- World Eternal Online promo codes and how to use them (September 2025)

- How to find the Roaming Oak Tree in Heartopia

- Best Arena 9 Decks in Clast Royale

- Clash Royale Furnace Evolution best decks guide

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- Clash Royale Witch Evolution best decks guide

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

2025-05-12 09:03